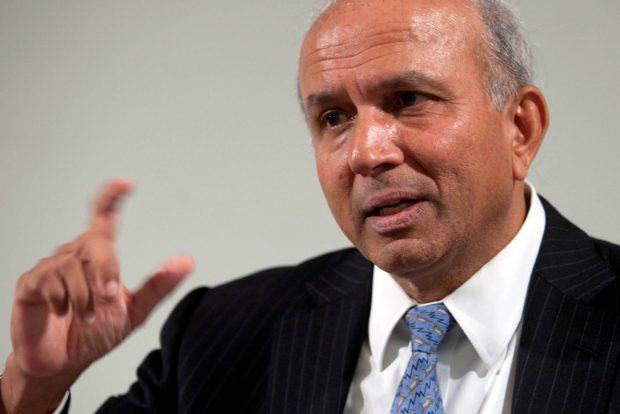

Ontario Municipal Employees Retirement System agreed to invest $1 billion to back the $4.8 billion acquisition by Prem Watsa’s Fairfax Financial Holdings Ltd. of insurer Allied World Assurance Co.

The investment will give OMERS a 21 percent stake in Allied World, according to a statement Friday from Toronto-based Fairfax. Watsa’s company is also in talks with “several additional third parties to participate in the Allied World investment,” according to the statement.

Fairfax agreed in December to buy Zug, Switzerland-based Allied in a cash-and-stock deal to expand in the commercial insurance market and add more assets that Watsa can invest as he bets on economic growth after Donald Trump won the U.S. presidential election. Fairfax said at the time that bringing on equity partners would limit dilution for its investors.

“OMERS is a proven, long-term investor and the commitment by it will allow us to increase the cash component” of the Allied transaction, Watsa said in the statement. The deal “gives us the flexibility to potentially buy back their interest over five to seven years’ time.”

OMERS previously joined with Watsa in his deals for Brit Plc and a controlling stake in Eurolife ERB Insurance.

Fairfax originally committed $4 billion toward the purchase price with its own shares. Watsa’s company said it could limit dilution by bringing in partners for as much as $2.7 billion of the purchase price.

Increase Portfolio

Without Watsa bringing on the partners, Allied’s investors would have received a 27 percent stake in his insurance and investing firm. If the full $2.7 billion is contributed in cash, that would be reduced to 10 percent, under the terms of the agreement.

Fairfax has the lowest of 10 investment grade scores by S&P Global ratings, which limits Watsa’s ability to take on more debt without risking a cut to junk status.

The purchase will boost the company’s investment portfolio to $39 billion from about $30 billion.

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies  Is Risk the Main Ingredient in Ultra-Processed Food?

Is Risk the Main Ingredient in Ultra-Processed Food?  10 Do’s and Don’ts of a Smart ORSA Report

10 Do’s and Don’ts of a Smart ORSA Report  Why Claims AI Build vs. Buy Decisions So Often Miss the Mark

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark