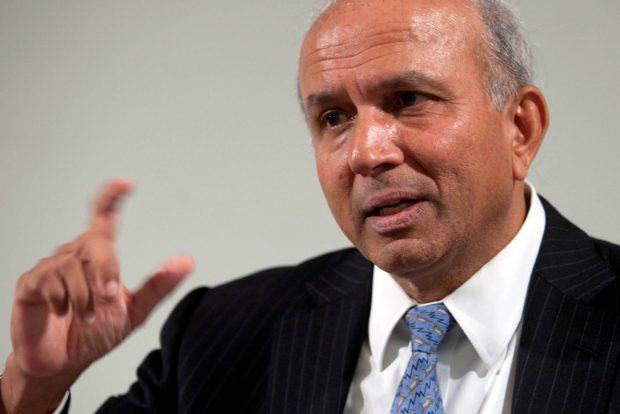

Prem Watsa’s Fairfax Financial Holdings Ltd. is in talks with the Ontario Municipal Employees Retirement System to see if the pension fund will help finance his $4.9 billion takeover of Allied World Assurance Co., according to a person familiar with the discussions.

OMERS could take a minority stake in Zug, Switzerland-based Allied, and there have also been talks with other potential backers, said the person, who asked not to be identified discussing a confidential matter.

A partnership could reduce the amount of Fairfax stock that Watsa needs to fund the transaction, limiting dilution for his shareholders. Under terms of the deal, announced Dec. 18, his Toronto-based company would pay about $900 million in cash and $4 billion in Fairfax stock. Fairfax has the lowest of 10 investment grade scores by S&P Global ratings, which limits Watsa’s ability to take on more debt without risking a cut to junk status.

“Doing it from an equity perspective ensures that we meet the rating agency requirement, so we wanted to be sure it was fully funded with equity,” Fairfax President Paul Rivett said in a Dec. 19 conference call with investors. “But that said, we want to also do the best we can for our Fairfax shareholders. So, that is why we will be looking for these third-party equity providers like we did find for Brit and Eurolife, to reduce the dilution to our shareholders.”

An OMERS spokesman declined to comment, and a representative for Fairfax didn’t immediately respond to a message.

After announcing a deal in February 2015 to buy Brit Plc, Watsa turned to OMERS two months later to take a 30 percent stake in the Lloyd’s of London insurer, reducing his financing costs. S&P restored Fairfax’s outlook to stable from negative in May 2015.

OMERS also joined Fairfax in August in the purchase of a controlling stake in Eurolife ERB Insurance.

Beyond Automation: The Emerging Role for Contextual AI in Insurance

Beyond Automation: The Emerging Role for Contextual AI in Insurance  The Future of HR Is AI

The Future of HR Is AI  New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies  Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next