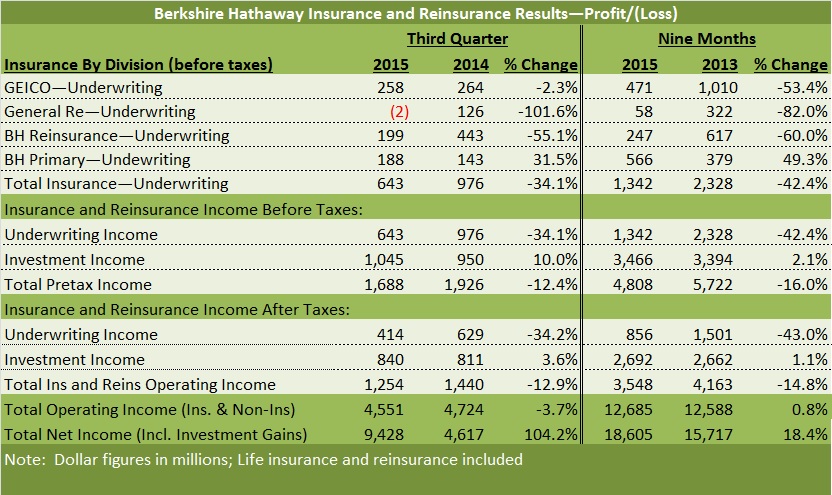

While overall net income for Berkshire Hathaway more than doubled in the third quarter on the strength of more than $5 billion in investment gains, operating earnings from insurance businesses fell nearly 13 percent, the conglomerate reported Friday.

And while investment income (interest and dividends) for insurance and reinsurance businesses came in at $840 million for the quarter—up 3.6 percent from last year’s third quarter—underwriting income dropped more than 34 percent to $414 million.

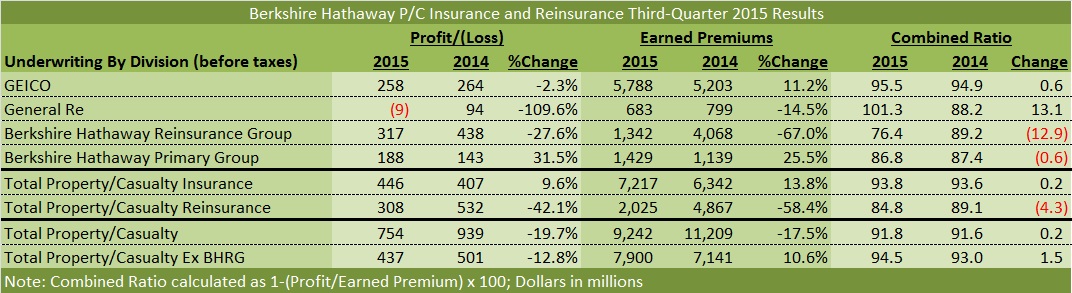

Among the property/casualty businesses, only Berkshire Hathaway Primary Group posted a bigger underwriting profit in the third quarter of 2015 than in third-quarter 2014—a 31.5 percent increase to $188 million before taxes.

While Berkshire Hathaway Reinsurance Group posted the biggest underwriting profit of the four property/casualty reporting segments included in the earnings report, the $317 million pretax profit figure was nearly 28 percent lower than last year’s third-quarter result. Berkshire’s other reinsurance unit—General Re—posted an underwriting loss of $9 million. The results for both reinsurance businesses reflect the impact of incurred property losses from an explosion in Tianjin, China—$44 million going on Gen Re’s books and $86 million for Berkshire Hathaway Reinsurance.

In terms of premium, Berkshire Hathaway Reinsurance Group also showed the biggest dip in the quarter—a 67 percent decline, largely attributable to the fact the group booked $3 billion related to a retroactive reinsurance cover for Liberty Mutual in third-quarter 2014, with no comparable high-volume deal recorded in this year’s third quarter. Meanwhile, a 10-year, 20 percent quota share contract with Insurance Australia Group (effective July 1, 2015), did push other P/C reinsurance business totals for reinsurance group led to Ajit Jain up 31 percent. The double-digit increase came in spite of volume limitations referred to the financial report.

“Our premium volume is generally constrained for most property/casualty [reinsurance] coverages, and for property catastrophe coverages in particular, as rates, in our view, are generally inadequate. However, we have the capacity and desire to write substantially more business when appropriate pricing can be obtained,” the report says.

Both primary insurance divisions—GEICO and Berkshire Hathaway Primary Group—reported increased overall earned premium for the quarter and the first nine months. Berkshire Hathaway Primary Group’s premium topped $1.4 billion in the quarter, up 25.5 percent from last year’s third quarter, with the increase primarily attributable to Berkshire Hathaway Specialty Insurance, National Indemnity primary group, Berkshire Hathaway Homestate Companies and GUARD Insurance Companies, according to the financial disclosure.

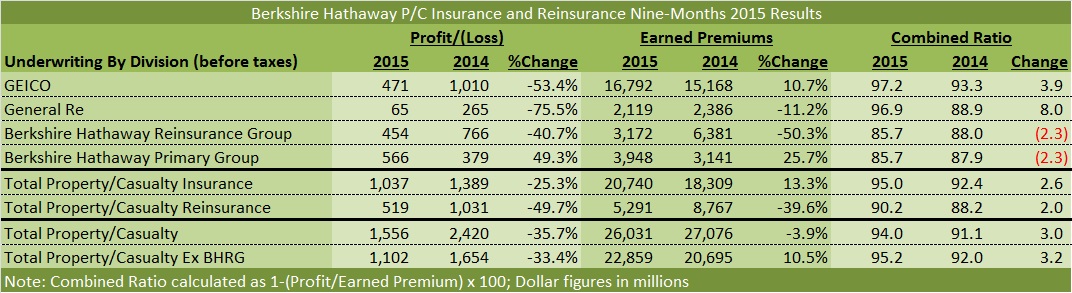

Results for all four P/C insurance and reinsurance units for the first nine months are summarized in the chart below.

Putting insurance and noninsurance results together, Berkshire explained the bottom line increase in net income in a footnote stating that $5.4 billion in investment gains for the third quarter included an after-tax non-cash holding gain of $4.4 billion related to an investment in Kraft Heinz (recognized on July 2, 2015, in connection with the merger of Kraft Foods and H.J. Heinz).

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  Why Claims AI Build vs. Buy Decisions So Often Miss the Mark

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark  Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec