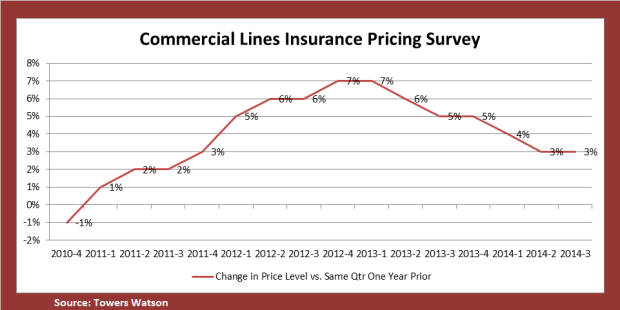

Commercial insurance prices grew on average about 3 percent in the 2014 third quarter compared to the previous year. It matched last quarter’s uptick and halted more than a year of consecutively falling quarterly price hikes, Towers Watson noted in its latest pricing survey.

As before, however, some lines performed much better than others.

Employment practice liability and then commercial auto produced the biggest price increases, Towers Watson said. Commercial property stayed static after facing a slight price decrease in the previous quarter. Most other lines saw price dips.

Also of note: workers compensation and some specialty lines experienced slower price hikes than in previous quarters. Property price stabilization helped offset some of this, according to Towers Watson.

As well, the results pointed to more moderate price jumps for large and specialty accounts versus small and mid-market accounts. Also, as Towers Watson noted, price increases mirrored the slight uptick experienced in the 2014 second-quarter.

The results come after price increases of between 6 percent and 7 percent in the second part of 2012 and the first half of 2013, Towers Watson noted.

Alejandra Nolibos, director in Towers Watson’s Americas PC practice, interpreted the Q3 results as a pricing lull.

“After many quarters of moderation in price increases, we are seeing a lull,” Nolibos said.

Nolibos said that property was a standout in this regard, after price changes for the sector “had reached negative territory.”

Source: Towers Watson

The Future of HR Is AI

The Future of HR Is AI  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec