Travelers Cos., which acquired Dominion of Canada General Insurance in 2013 and increased its ownership stake in its joint venture in Brazil in 2012, is likely to continue expanding internationally.

In his annual letter to shareholders, Travelers CEO Jay Fishman said the insurer will “continue to look at attractive opportunities outside the United States.”

He said the acquisition of Dominion last year “was one such opportunity, and one that has given us an exceptional platform from which to expand our commercial lines business in Canada.”

In the letter, Fishman said the insurer made a commitment in 2010 to increase the profitability of its products through “thoughtful, appropriate rate gains and improved terms and conditions.”

“The returns on many of our products had deteriorated over time due to generally declining pricing, higher losses arising from more volatile weather patterns and the impact of historically low interest rates. We leveraged our industry-leading data and analytics to improve the price and the terms and conditions of our products on a granular account-by-account or class-by-class basis and, importantly, we did so with the express intention of not disrupting our agents, brokers or customers,” he wrote.

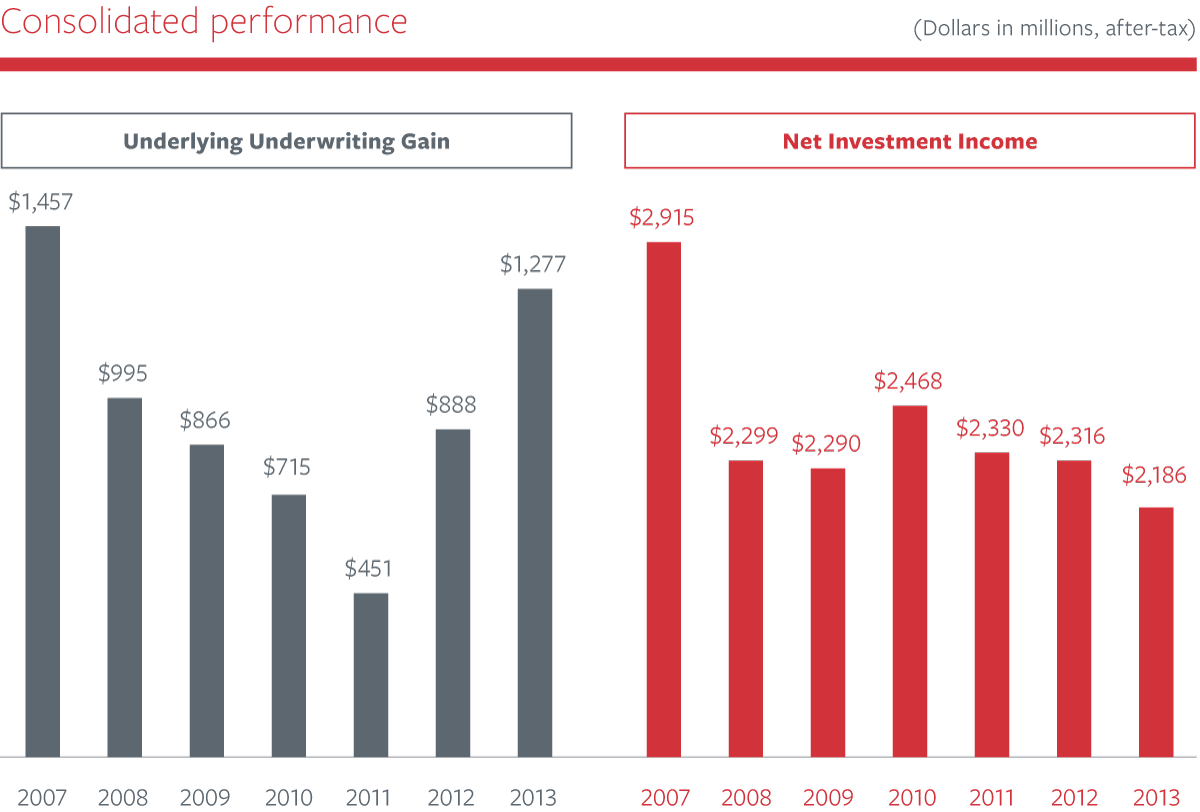

Fishman said that underlying underwriting gain (which excludes the impact of prior-year reserve development and catastrophe losses) was approximately $1.3 billion in 2013—almost three times higher than in 2011. This rise more than offset the decline in net investment income resulting from lower yields.

“I don’t think we could be more pleased than we are with these results—particularly given the challenges that our industry has been facing over the last several years, including historically low interest rates and more volatile weather patterns,” Fishman said in his letter.

He said while it is a challenge to grow the company in a low-growth economy, Travelers would not change its approach to balancing risk and reward. “Instead, we will continue to develop better products for our agents and customers, enhance services and capabilities, and invest in technology to increase efficiency and improve our customers’ experience,” he wrote.

Change can be “rapid and dramatic,” he said, citing technology affecting the auto insurance and the influx of new capital into traditional reinsurance markets.

“To remain competitive in the face of change, we are constantly recalibrating,” he wrote. He cited the adoption of comparative rating technology by independent agents, customers’ changing expectations and his company’s efforts to raise rates—all of which “meaningfully” affected Travelers’ new auto business volume.

In response to changes in the personal auto market, in 2013 Travelers introduced Quantum Auto 2.0, a more competitively priced product supported by significant expense reductions (including lower commissions) that he said were developed with input from agents to meet the needs of customers increasingly focused on value.

“We are very encouraged by initial market response,” Fishman said of Quantum Auto.

In January, Travelers President and Chief Operating Officer Brian MacLean said that in the auto line, retention was 81 percent in the fourth quarter, with a 7 percent renewal premium change. New business volume was up compared to recent periods, and net written premium was down year over year.

MacLean said the rise in the new business volume was mostly the result of the Quantum 2.0 rollout. By the end of 2013, Travelers had launched the product in 18 states.

Travelers is also becoming a partner in ProjectCAP, a program of the Independent Insurance Agents and Brokers of America (IIABA), and the TrustedChoice.com consumer portal website where insureds can shop for personal insurance and obtain comparative quotes. The addition of Travelers was announced last week by IIABA Chairman Tom Minkler, who said Motorists Insurance is also joining.

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next  Is Risk the Main Ingredient in Ultra-Processed Food?

Is Risk the Main Ingredient in Ultra-Processed Food?  Why Claims AI Build vs. Buy Decisions So Often Miss the Mark

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered