The use of predictive modeling continues to increase in nearly every business line, according to Towers Watson’s fifth annual Predictive Modeling Benchmarking Survey.

The survey examined how North American property/casualty insurers are embracing predictive modeling as a means to enhance performance improvement efforts in underwriting, pricing, claim management and other core functions.

All personal lines respondents attached some degree of importance to sophisticated underwriting and risk selection techniques for rating and pricing, and 83 percent identified predictive modeling as essential. This compared to 79 percent of small to midsize commercial lines respondents and 56 percent of large account and specialty lines carriers that said predictive modeling was essential or very important.

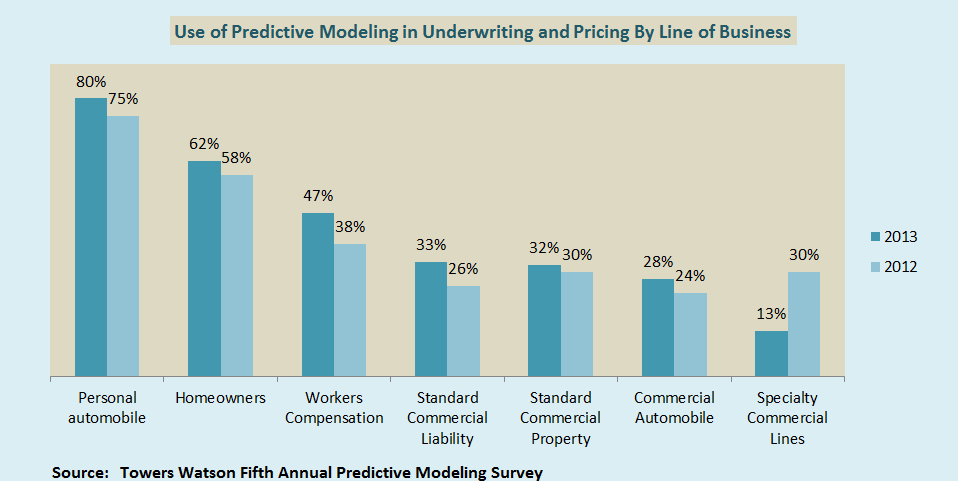

Predictive modeling increased for virtually all lines of business in 2013. Personal auto increased five percentage points from 2012 to 80 percent, while homeowners increased four percentage points to 62 percent. Workers compensation increased nine percentage points to 47 percent, while general liability, commercial multiple peril and business owners policy increased seven percentage points to 33 percent.

Specialty lines carriers saw the only decrease, with 13 percent of respondents currently using predictive modeling compared to 30 percent in 2012, but 45 percent said they plan to use modeling in the future.

The majority (85 percent) of small and midsize personal lines carriers surveyed said predictive modeling applications are required to compete in their main line of business, compared to 48 percent of commercial lines respondents.

Sixty-nine percent of small and midsize personal lines carriers said they implement predictive models when necessary but also focus on differentiating themselves in other aspects of their value proposition, such as superior customer service and claim processing, compared to 57 percent of commercial lines carriers.

Other key findings of the survey include:

- Carriers using captive agents believe there is greater agent understanding and approval of models than among carriers using independents, but there is still a broad lack of communication about predictive modeling between carriers and their agents.

- 48 percent of large carriers are either using or are nearly ready to roll out predictive analytics for fraud detection, compared with 26 percent of midsize carriers. No small carriers have implemented or are in the process of implementing fraud applications, and only 23 percent of small carriers are exploration such an application.

- 45 percent of respondents that write personal lines auto now have formal usage-based insurance (UBI) plans (a 10-percentage-point increase from last year), while 12 percent of commercial auto carriers have either launched UBI products or plan to do so in the next year.

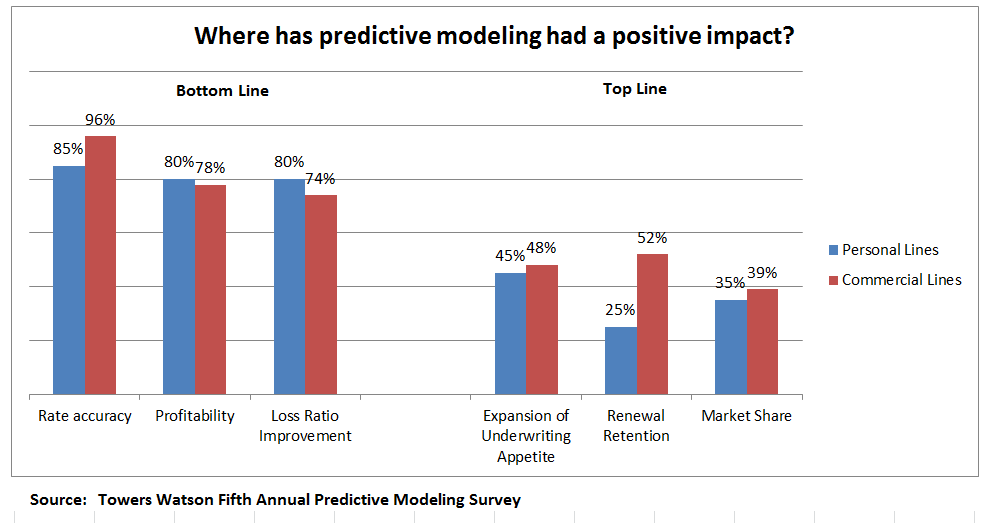

The Towers Watson benchmark survey also sought carrier views on the impacts of predictive modeling to top-and bottom-line results, finding more positive views of bottom-line impacts in both personal and commercial lines.

The survey included 59 U.S. P/C insurance executives. Respondents were relatively evenly divided between midsize and large P/C insurers, each at 39 percent, with smaller insurers representing the remaining 22 percent.

The Future of HR Is AI

The Future of HR Is AI  From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation  Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  Why Claims AI Build vs. Buy Decisions So Often Miss the Mark

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark