McGraw Hill Financial Inc.’s Standard & Poor’s unit seeks information from the board of governors of the Federal Reserve to bolster its defense against U.S. claims it misled investors in mortgage-backed securities.

The credit rating company said it served subpoenas on the Federal Reserve board as well as the Federal Open Market Committee and the Federal Reserve Bank of New York, according to a filing Monday in federal court in Santa Ana, California.

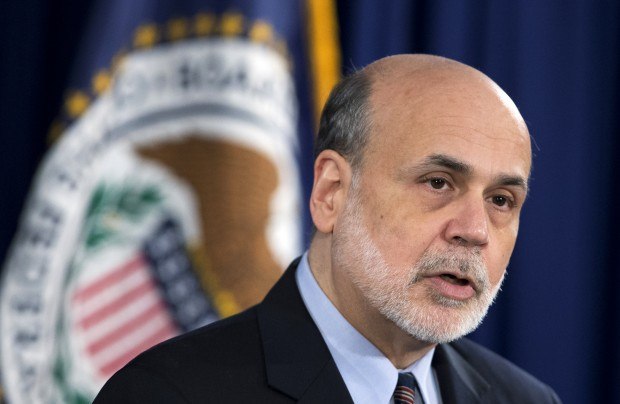

S&P is “seeking, among other things, information and analyses supporting or relating to specifically identified statements from high ranking government officials such as Ben Bernanke and Timothy Geithner about the housing market in 2006 and 2007,” it said in the filing, referring to the then-Fed chairman and the former head of the New York Fed. “S&P seeks to identify the data upon which the assessments, similar to those made by S&P, were made.”

S&P, based in New York, and the Justice Department are exchanging pre-trial evidence in the U.S. lawsuit that accuses the company of knowingly downplaying the credit risks of residential mortgage-backed securities, as well as that of collateralized-debt obligations that contained those securities, in order to win more business from investment banks.

S&P has denied the allegations and is seeking evidence that the lawsuit was brought in retaliation for its downgrade of the U.S. debt two years ago.

Information Request

The U.S. hasn’t agreed to obtain documents from the Federal Reserve and the Federal Open Market Committee, saying they are independent regulatory offices and that S&P has to submit its information request to them directly, according to a separate Justice Department filing.

The government also hasn’t agreed to provide certain documents regarding its decision to sue because it wants S&P to make an “as yet unspecified” showing to support its retaliation defense, according to the company.

The government doesn’t think S&P can show that its allegations that it was singled out warrant releasing documents that would otherwise remain legally protected as confidential internal communications, the Justice Department said.

S&P and the Justice Department both filed a status report in response to a request from U.S. District Judge David Carter, who is presiding over the lawsuit.

The Justice Department said in its filing that it has been collecting information from federally insured financial institutions, foreign banks, collateral managers, investment banks and trustees. The U.S. said at a July 29 hearing it wants to identify those securities rated by S&P that best support its fraud claim when the case goes to trial.

The case is U.S. v. McGraw-Hill Cos., 13-cv-00779 U.S. District Court, Central District of California (Santa Ana).

–Editors: Peter Blumberg, Michael Hytha

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered  State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists  Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly