Chief financial officers of non-bank financial services firms saw lower percentage increases in compensation than chief executives in 2012, although the pay hikes for both C-suite positions were lower than those for most other industries, an analysis revealed last week.

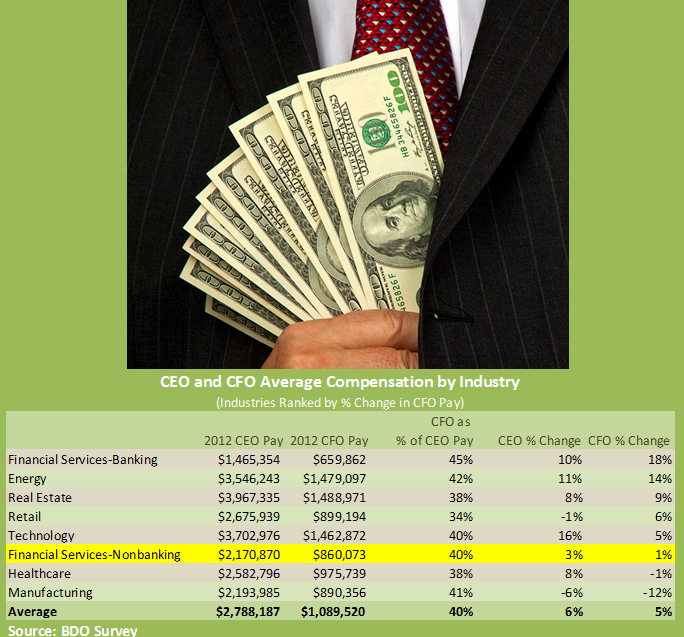

Although the analysis of 600 mid-market public companies across eight sectors by BDO USA, LLP, a leading accounting and consulting organization, reveals that CFOs had bigger compensation increases than CEOs for four of the eight, CFOs of non-bank financial firms only saw their pay rise 1 percent.

CEOs for these firms commanded a 3 percent increase.

Only CFOs in health care and manufacturing did worse in terms of percentage change in compensation, the analysis showed, with pay declining for CFOs in those two sectors.

While average pay for CFOs in the 600 companies was $1.1 million across the eight sectors studied, for CFOs in the non-bank financial sector, the figure was only $860,000.

The $860,000 was roughly 40 percent of the $2.2 million that CEOs in the same sector took home.

CFOs in the banking sector did the best both in terms of change in pay and pay relative to the top spot in the C-suite. For banks, average CFO compensation was about $660,000—up 18 percent from 2011, and roughly 45 percent of CEO pay.

“The CFO role is undergoing a period of notable change, as even more is expected of today’s CFOs. CFOs are no longer just the keeper of the numbers, but instrumental to executing the broad business strategy, from growth through acquisitions and maximizing existing assets, to navigating an increased financial and industry-specific regulatory environment,” said Randy Ramirez, a senior director in the Global Employer Services Practice at BDO, in a statement about the analysis.

“As the position evolves, pay rates across some industries are starting to meet those new demands,” Ramirez added.

According to the study, real estate CEOs continued to receive the highest compensation out of all surveyed industries at nearly $4.0 million in 2012. For CFOs, the highest earners for 2012 were also in the real estate industry ($1.5 million), while technology CFOs outpaced all others in 2011. BDO suggests that the overall turnaround in the real estate sector this past year may be contributing to this positive increase in both CEO and CFO pay.

Following real estate and technology, energy executives are also among the most highly compensated CEOs and CFOs, with overall compensation at $3,546,243 and $1,479,097, respectively.

CEO pay in banking and financial services, on the other hand, continues to be sluggish and remains solidly at the bottom of all surveyed industries across both categories. This remains consistent with last year’s study findings, indicating that there has been little bounce back from the increased regulatory environment, perceived personal risk, and continued reputational damage that the industry overall still endures.

About the Study

These findings are from the third edition of The BDO 600 CEO and CFO Pay Study, which examines the CEO and CFO compensation trends in publicly traded companies with annual revenues from $25 million to $1 billion in the energy, health care, manufacturing, real estate, retail and technology industries; and publicly traded companies with assets between $50 million to $2 billion in the banking and financial services industries.

The study included proxy statements that were filed between May 15, 2012 and May 15, 2013.

Source: BDO USA, LLP

Is Risk the Main Ingredient in Ultra-Processed Food?

Is Risk the Main Ingredient in Ultra-Processed Food?  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  The Future of HR Is AI

The Future of HR Is AI  New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies