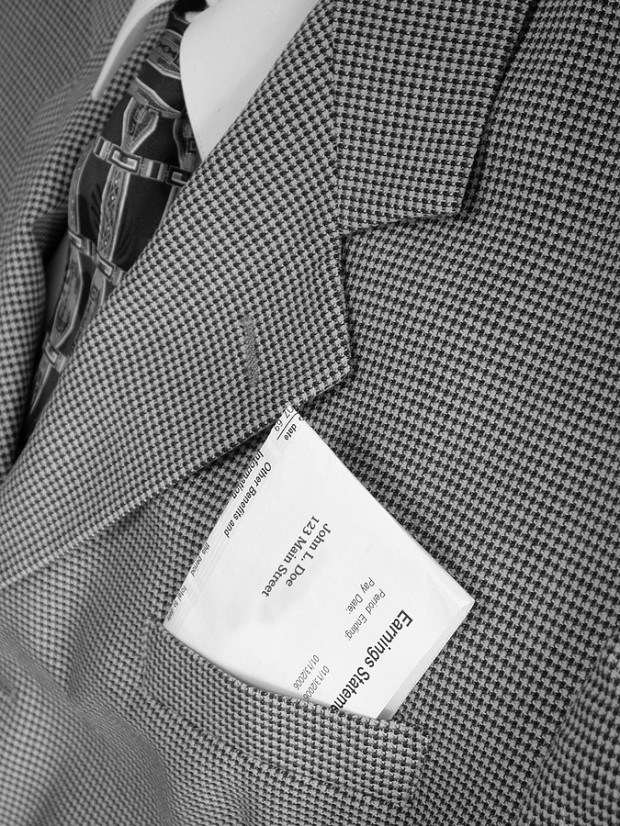

Almost two-thirds of U.K. financial services firms have boosted salaries to retain employees before the introduction of European Union limits on bonuses, according to a survey.

Companies increased salaries by an average of 20 percent, according to the report, published by recruitment firm Robert Half today. More than half the survey participants expressed concern the limits will create an “unstable” cost structure.

The EU brokered a deal in February to ban banker bonuses that are more than twice fixed pay, a move lawmakers said would prevent excessive payouts and curb risk-taking that sparked the financial crisis. U.K. Chancellor of the Exchequer George Osborne opposed the curbs, saying they would harm the competitiveness of the nation’s finance industry.

“With the U.K. competing with other international centers for the world’s top financial-services talent, firms will need to strike the balance between risk and reward, with additional employee remuneration potentially creating an unstable cost structure,” Neil Owen, global practice director at Robert Half Financial Services, said in the statement.

Thirty-eight percent of participants said they were “very concerned” about losing staff because of the bonus caps, while 55 percent were “somewhat concerned.”

HSBC Holdings Plc, a London-based bank that makes most of its profit in Asia, said this month it would consider raising salaries to ensure its remuneration remains competitive.

Robert Half said it surveyed 100 U.K. chief financial officers and chief operations officers in June and July.

Jury Orders PacifiCorp to Pay $305M in Latest Oregon Wildfire Class Action Verdict

Jury Orders PacifiCorp to Pay $305M in Latest Oregon Wildfire Class Action Verdict  What Berkshire’s CEO Abel Said About Insurance

What Berkshire’s CEO Abel Said About Insurance  Why Claims AI Build vs. Buy Decisions So Often Miss the Mark

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark  NYC to Install Red Light Cameras at 600 Intersections by Year End

NYC to Install Red Light Cameras at 600 Intersections by Year End