There are now clear signs that the low interest rate environment is forcing underwriting discipline in the casualty market, carrier executives said during earnings calls last week, but one glaring exception is the global reinsurance market, ACE Limited’s Evan Greenberg said.

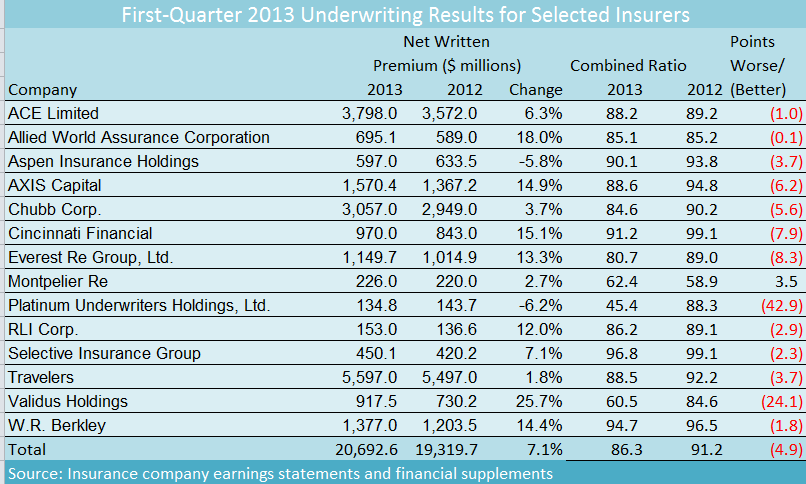

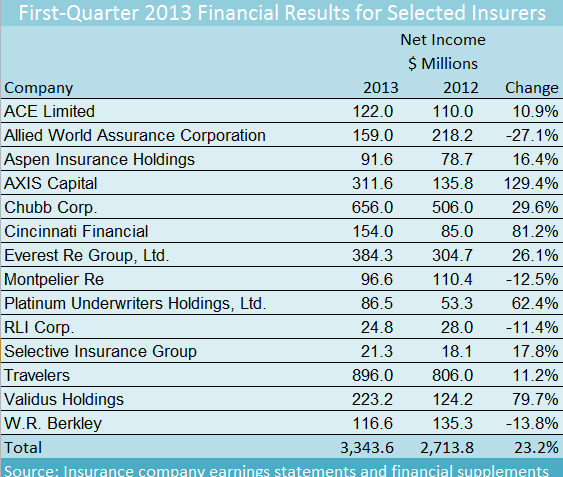

Kicking off the second week of earnings conference calls—with more than a dozen publicly traded insurers and reinsurers reporting their first-quarter results (summarized on the accompanying tables)—Greenberg reinforced some comments he made in ACE’s 2012 Annual Report about outliers in the international insurance and global reinsurance markets.

Note: Combined ratio average for total line is weighted average based on written premiums.

Meanwhile, at W.R. Berkley, President & Chief Operating Officer Rob Berkley, delivered some of the strongest comments of the week about the tightening U.S. commercial insurance market, attributing the ongoing trend to a combination of concerns over prior-year reserve development and low interest rates.

“The low interest rate environment is beginning to have a real impact on investment income, and consequently, overall profitability for the industry. And people are beginning to recognize the issue and react,” he said.

“There has been talk about this over the past couple of years, but we’re now beginning to see it translate into action in the form of greater discipline on the underwriting side,” Berkley said.

Like Greenberg, however, he sees a segment of the market swimming against the current. In his mind, it’s the domestic excess workers’ compensation segment.

Going Against The Flow

“I have never seen a global market behave this way before,” Greenberg said, when asked by an analyst to explain why he believes the internationally pricing environment is lagging. In the United States, “insurers respond to ROE pressure with greater underwriting discipline.” Internationally, however, “there is a tremendous amount of surplus capital,” he said, suggesting that the excess and growing supply of industry capital outweighs ROE pressures.

“The reinsurance market, by the way, is not following the insurance market,” he continued. “The reinsurance market is more competitive in my judgment.”

“There is a tremendous amount of capital internationally and [there is] more capital that enters—whether it’s in London or it is in the emerging markets as they grow wealth, more local companies are being formed that compete. And you’re not seeing the same reaction to a lower interest rate environment of greater underwriting discipline.”

“It’s as simple as that,” he said. “They’re more market-share driven.”

On the W.R. Berkley call, Rob Berkley dismissed an analyst’s suggestions that pricing is better in the United States than outside of it, saying that he was painting the competitive landscape with too broad a brush. The analyst was essentially asking why W.R. Berkley has launched many startups outside the United States given the dichotomy that Greenberg suggested.

“Certainly, there are markets outside the United States that remain more competitive than our domestic market here, perhaps Europe being one example of that, or parts of Asia. But ultimately, when we look at opportunities,” wherever they are, “we’re looking at [them] from a risk-adjusted return perspective,” Berkley said.

Within the United States, Berkley highlighted the workers’ comp market as “an anomaly” in the overall flow of returning discipline. “The excess space remains surprisingly competitive,” as the primary workers comp market firms. “One can only assume the explanation is the difference in the duration of the tail—and that companies are just not recognizing their business is underpriced,” he said.

“We can’t specifically pinpoint what is driving others’ behavior, but we are noticing a great difference as to the tone and the attitude when it comes to pricing of primary versus excess in a couple of parts of the overall marketplace. Our theory is that the excess tends to take a little more time for the results to come through—and for people to recognize the issues that they may be facing,” he said.

Later, Berkley clarified that the level of competition in the excess comp market had abated from levels apparent in recent years. “It’s not the free-fall that it was in maybe last year and prior. At the same time, certainly, we are not seeing the excess comp market react the way we have seen the primary comp market over the past quarter or two,” he said.

William R. Berkley, chairman and CEO of the specialty insurance group, noted that the long tail of excess workers comp—which could extend for 17 or 18 years—fuels huge potential differences in pricing among competitors. “If you’re not cautious, you choose an optimistic interest rate.… The combination of optimism as to low inflation [and] higher interest rates than we currently have [available] can create differentials in price of 50 percent—and you can justify it. You just have to worry about retiring before you have to pay the piper,” he said.

Sustained Improvement Elsewhere

Before the question-and-answer session of the call, Rob Berkley summed up better overall market conditions outside the excess comp arena, concluding that low interest rates and concerns over reserving issues “will sustain the market improvement.”

“While on the surface, market conditions during the first quarter appeared consistent with the second half of 2012, there were a number of signs that a sense of urgency is on the rise.” Two such signs, he said, were:

- Continued strong growth in assigned risk plans,

- Less competition for certain large accounts

- A noticeable spike in submissions coming into the specialty market from the standard market

These are evidence that “we are likely to see further tightening as the year progresses,” he said.

An analyst asked that shift from standard to specialty markets could fuel double-digit rates by end of 2013.

Prefacing his response by saying that any answer “would just be speculation,” the COO said that “there are lots of data points that would suggest that pricing leverage in favor of the carriers could potentially build from here. At the same time, I’m not sure if it’s such a perfect science that we can call it within any 90- or 180-day period.”

“Are the fundamentals there? Does the pressure continue to build that would drive further change in behavior and looking to achieve as far as rate? Absolutely, that is the case. But our ability to answer your question with a level of precision that you’re looking for, I think is a stretch.”

“Having said that, it certainly is a distinct possibility” that double-digit price hikes could occur, he said.

In his prepared remarks, Berkley also discussed other segments of the casualty insurance market, beyond primary and excess comp. He said:

- While the professional market lagged the broader market, it is also now showing signs of improvement.

- The commercial auto, aviation and marine markets all continue to remain quite competitive, [but] given the industry results, he anticipates a noticeable shift over the balance of the year.

- Property rates are improving, but “are less robust than one might expect, given the global cat activity over the past two years.”

Berkshire Hathaway Profit Falls; Insurance Income Lower for GEICO, Other Ops

Berkshire Hathaway Profit Falls; Insurance Income Lower for GEICO, Other Ops  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec  Four Practical, Data-Backed Steps for Preventing Nuclear Verdicts®

Four Practical, Data-Backed Steps for Preventing Nuclear Verdicts®  NYC to Install Red Light Cameras at 600 Intersections by Year End

NYC to Install Red Light Cameras at 600 Intersections by Year End