Despite devastating California fires causing upward of $40 billion in losses for U.S. property/casualty insurers, the industry still managed an underwriting profit of $11.6 billion in the first half of the year.

Every penny of it came from beneficial adjustments of loss reserves for business written in prior years, and 40 percent of those adjustments came from a single company: State Farm Mutual Automobile Insurance Company (SFMA).

Each quarter, insurance company actuaries and executives examine the latest claims patterns and other factors to reassess reserves previously set aside to pay future claims. If losses are projected to exceed original forecasts, known as being in a “deficient” position, they will increase reserves. If recent trends suggest lower-than-expected future losses, known as “redundancy,” reserves will be reduced. Reserve adjustments flow directly to the bottom line as net losses (for reserve additions to repair deficiencies) or net profit (for reserve reductions to shrink redundancy).

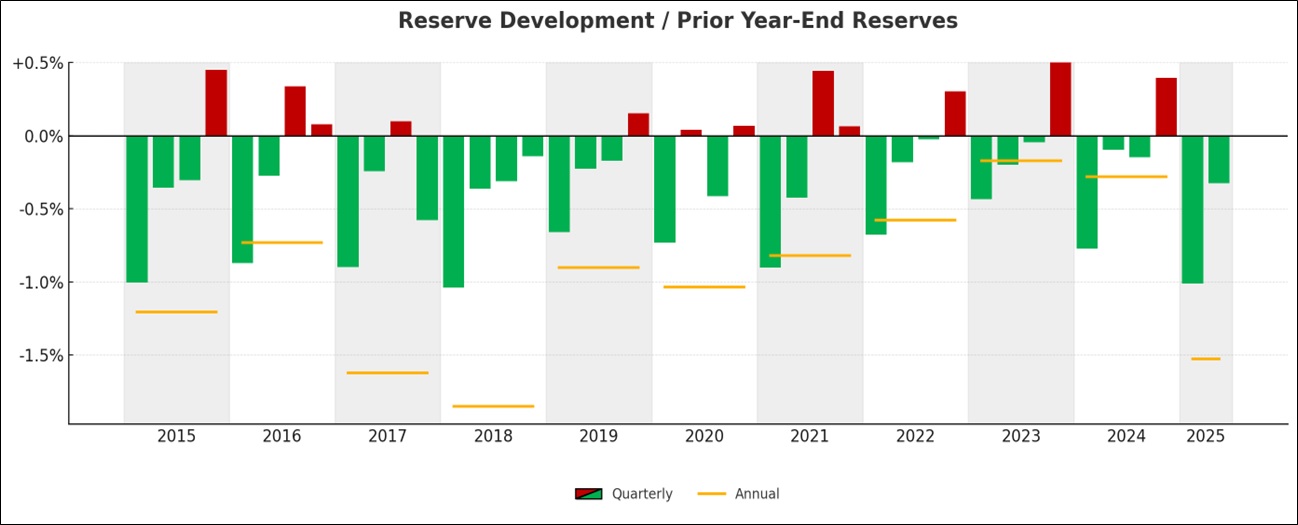

In general, the industry exhibits a highly predictable pattern of recognizing large redundancies in the first half of the year and much smaller redundancies or (more often) deficiencies in the second half of the year, as shown in the chart below. In each of the last 10 years, companies reported their largest quarterly reserve redundancies in the first quarter, and in seven of the last 10 years, showed much smaller redundancies or outright deficiencies in the fourth quarter. On a full-year basis, the industry has released reserves for 19 years in a row.

Why do insurers inflate underwriting profits early in the year, only to shave them down to size at the end of the year?

There are myriad reasons that vary by company and circumstance. For many, early-year optimism is replaced by post-catastrophe season pessimism. Others want to shine up results ahead of mid-year reinsurance renewals. There is scant loss experience data for the most recent accident year at the start of the new calendar year. And for virtually all companies, a more rigorous annual actuarial review is undertaken at the end of the year, requiring a “true up” before filing the all-important full-year annual financial statements.

It is unclear which, if any, of these conditions prompted the reserving actions of SFMA. The company is by far the largest single personal auto insurer in the U.S. GEICO General Insurance Co. is No. 2, but one-fifth of its size by direct premium earned. SFMA reported a whopping $5.3 billion reserve release for the first half of the year, 14.6 percent of its direct earned premium. The next largest net reserve release was $0.8 billion by American Family Mutual, which represented 8.3 percent of its direct earned premium.

SFMA’s reserve release in the first half reduced the total industry’s combined ratio by 3 points and contributed to the largest industry-wide first-half net reserve reduction since 2010. (Using “as-reported” dollars rather than constant dollars, it was the largest first-half reduction for the industry in at least 20 years—and probably ever.)

For SFMA alone, it was the largest first-half reserve reduction in the company’s history, and nearly double the amount reported for the first half of 2024.

While we don’t know specifically what SFMA’s claims experience has been, national claims trends don’t appear to be dramatically improving. Frequency of auto claims has moderated in recent quarters, according to data from the Independent Statistical Service Inc., Insurance Service Office Inc., and National Independent Statistical Service’s Fast Track Report, showing mild reductions since mid-2023 in all classes other than bodily injury, which has steadily risen.

Average claims costs (“severity” in actuary-speak) flattened out for collision and comprehensive coverages but ticked upward in 2025’s first quarter for property damage and bodily injury (the latest quarter available at this writing).

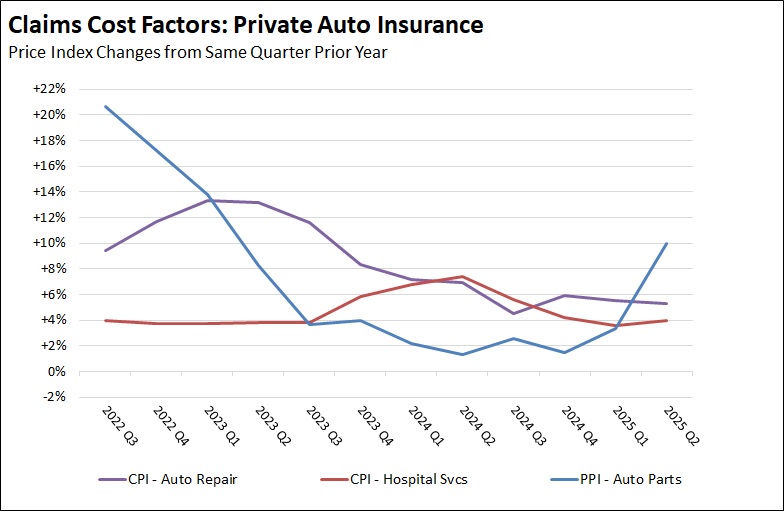

Auto insurance claims cost factors improved in recent quarters, but auto parts prices are rising again, perhaps a result of tariffs. Inflation in auto repair and hospital services costs has moderated but remain slightly above general consumer price inflation.

With little reason to expect that SMFA’s reserve reduction reflects an overly optimistic view of future claims trends, the next most likely explanation is the need to generate funds to support its California-based home insurer subsidiary, State Farm General Insurance Company (SFG). SFG took the brunt of losses from the Eaton and Palisades fires earlier this year, incurring $7.6 billion and a ratings downgrade. The company expects a much smaller net loss of $212 million after reinsurance, although its primary reinsurer is reported to be its parent, SFMA.

Related articles: Is State Farm General a Sinking Ship? California Emergency Rate Request Dropped to 17% ; Too Late? S&P Downgrades State Farm General (Updated); Another Downgrade for State Farm General: S&P Lowers Rating to A-

At the same time that SFMA reported the industry’s largest favorable reserve development for the first half, SFG reported the largest unfavorable development: $459 million, equating to 29.8 percent of direct earned premium and 10.5 percent of the total of all insurers reporting net reserve additions in the first half.

The Future of HR Is AI

The Future of HR Is AI  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers  Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard