“Verdicts on trial: The behavioral science behind America’s skyrocketing legal payouts.”

Our international editor, Lisa Howard, captured some of the highlights of a recent report from Swiss Re with that intriguing title, and an equally interesting subheading: “The hidden forces behind rising verdicts.”

As Lisa reported in her article, exponential growth in liability claims severity in the United States in recent years, is partially driven by changing juror sentiment and behaviors—not just the actions of an aggressive plaintiffs bar.

I was personally most captivated by this section of Lisa’s article:

“To understand how attitudes toward litigation translate into actual monetary outcomes, survey participants were asked to weigh in on a series of real-world [claims] scenarios….

Swiss Re found that a clear pattern emerged: Injury severity, not company size, is the strongest driver of verdict behavior.”

Related article: “Swiss Re Takes a Look at Hidden Behavioral Forces Behind Skyrocketing Jury Awards“

This new evidence eroding the “deep pockets” theory of escalating liability costs prompted me to look back at the report to read the real-world scenarios, which included a slip-and-fall resulting in minor or severe injuries at either a local retailer or a big box store, a truck accident that caused a pedestrian to become a paraplegic, and an exploding e-cigarette resulting in light or severe burns.

Test yourself. What would you award for the following scenario?

Your friend was visiting a big box store. She slipped near the produce section because the floor was wet and she suffered a hairline fracture. She also had significant pain and was out of work for three weeks.

What do you think the cost of being in pain and three weeks lost wages might be?

Hmmm… I guess we need to know more about your friend’s occupation. Let’s say she’s an actuary. $20,000? $2 million?

Should she get anything at all? The Swiss Re scenario also assumes that there was a warning sign present next to the wet area.

Now, what if she suffered a broken hip which required surgery and was out of work for six months? How would that change your answer?

Let’s try again. What if the store was a local business instead of a big box retailer?

The Swiss Re summary doesn’t share all the survey answers. But it does say that “when the injury was serious—such as a broken hip or spinal damage—participants were much more likely to assign blame and recommend high compensation, regardless of whether the defendant was a global brand or a local business.

“In one product liability scenario, where the injury resulted from user error, 40 percent of respondents still believed compensation was warranted for a severe injury, compared to only 24 percent for a minor one,” the report says.

Related article: Why Do I Need a Lawyer? I Was Just Out for a Walk

Anchors Away

It turns out there was another wrinkle presented in some of the scenarios beyond the size of the defendant company and the degree of injury. Swiss Re also tested how expectations would change when each of the cases included a plaintiff demand—an anchor.

It turns out there was another wrinkle presented in some of the scenarios beyond the size of the defendant company and the degree of injury. Swiss Re also tested how expectations would change when each of the cases included a plaintiff demand—an anchor.

Going back to our friend who slipped in the store, Swiss Re noted that when the plaintiff didn’t introduce a monetary anchor, award expectations often fell below $1 million, regardless of whether the store was a big box retailer or a local shop. But high plaintiff demands could inflate those expectations into nuclear verdict territory ($10 million plus), the report says, without giving specific dollar amounts.

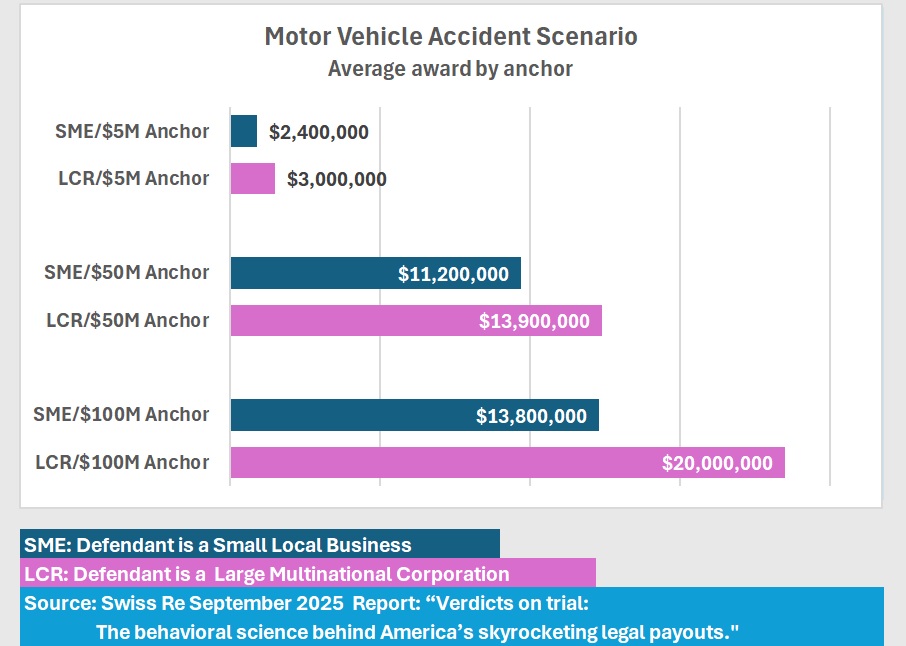

For a second scenario, the report does reveal the dollar-impact of a plaintiff anchor. The graphic below tells the story of how the results changed if survey takers were asked about a friend who crossed the street against the light and suffered a severe spinal injury when a delivery truck driver sped through the yellow light—and also advised that the friend’s lawyer was asking for $5 million, $50 million or $100 million to compensate her for her injuries, lost income and suffering.

Whether the truck driver was delivering for a local business or driving for a large retailer mattered to the respondents. They would award 25 percent more against large retailers when the plaintiff’s lawyer anchored with $5 million or $50 million demand, Swiss Re reports.

But a change in anchor mattered more.

Even when defendants were assumed to be small local businesses, the average award soared nearly sixfold to $13.8 million for a $100 million anchor vs. $2.4 million for a $5 million anchor.

Swiss Re went one step further to see if defense counter-anchors would change results. In the particular scenario detailed in the report, our imaginary friend didn’t read the instruction manual to install an e-cigarette cartridge and suffered a severe injury when the cigarette exploded (severe burns, an amputated finger and chronic pain.) According to the report, the survey takers were also told that our friend’s lawyer suggested an award of $20 million when the case went to court, and that the defense lawyer countered with an estimate of $3 million.

Even though 14 percent of respondents would still issue a nuclear verdict, Swiss Re reported that the average award in the scenario with the counteroffer was 40-50 percent lower than those without counteroffers. In fact, the average when a counteroffer was introduced was $3.8 million—much closer to the actual defense offer of $3 million. And 40 percent of respondents put the expected award at less than $3 million.

Learn More

The Swiss Re survey went beyond the scenarios to gauge general sentiments about the overall levels of lawsuits and damage awards, breaking down results by age, political affiliation and income categories of the respondents.

Related article: “Swiss Re Takes a Look at Hidden Behavioral Forces Behind Skyrocketing Jury Awards“

Offering some takeaways on the scenario questions, Swiss Re noted that counteroffers aren’t the silver bullet, but added that its research validates “the strategic importance of early counter-anchoring.”

“Jurors are responsive to reasonable, fact-based suggestions, especially when presented to them before plaintiff narratives take hold. Equipping trial teams with empirically grounded anchor points could reduce loss severity by millions in high-stakes cases,” the report states. Counter-anchoring “clearly helps temper expectations and compress the range of outcomes,” the report states.

Anchoring and counter-anchoring also have an impact on settlement negotiations. “Cognitive science confirms that first offers shape the range of discussion—even if unreasonable,” writes Taylor Smith, founder and president of Suite 200 Solutions.

Smith is the guest editor of a series of articles that Carrier Management has started to publish, “Negotiation Reclaimed.”

The first article in the series, “Negotiation Is the Job: Reframing Defense Work in an AI-Enhanced Era” by Great American Insurance Group’s Ron Morrison, set the foundation for the series late last month. Importantly, the series will also include an article devoted to the science of anchoring, tentatively titled, “The Power of the First Offer.”

The first article in the series, “Negotiation Is the Job: Reframing Defense Work in an AI-Enhanced Era” by Great American Insurance Group’s Ron Morrison, set the foundation for the series late last month. Importantly, the series will also include an article devoted to the science of anchoring, tentatively titled, “The Power of the First Offer.”

“Anchoring works across cultures, domains, and claim types—even when both sides know it’s a tactic,” Smith advises. The upcoming article will also explain why written offers are powerful and gives a step-by-step guide on how offers should be structured.

“A strategic offer package doesn’t just move numbers. It changes minds,” he writes.

***

- Read more about the series: “Sharpening the Industry’s Most Overlooked Skill“

- Read the first article in the series: Negotiation Is the Job: Reframing Defense Work in an AI-Enhanced Era

- Read the results of a survey of insurance claims and litigation executives: Taking Back Negotiation: Why Claim Professionals Must Lead the Next Chapter

AI Generated images were used for this article (Adobe/Firefly)

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage  Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly  From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation  Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers