Weren’t there some days at the end of last year when you just felt like—I don’t know—blowing up a Tesla?

If you are like me, you felt gloomy as the days of 2021 wound down. After a midyear glimpse of normalcy faded from memory, and more days of virus seclusion seemed imminent, it was hard to find anything to jolt my attention.

But like more than 5 million other Internet surfers, I spent more than eight minutes early last week viewing a YouTube video titled “Insane Tesla Model S EXPLOSION!! 30kg of dynamite!” Now, that was a blast.

For those who haven’t seen it, the video depicts the explosion of a 2013 Tesla in an isolated part of a snowy Northern European landscape, arranged by a Finnish man who teamed up with a group that makes explosive high-quality videos (pun intended). The Tesla owner sought out the detonation/videography squad after being told that the cost to replace the battery on his car would be more than $22,000. Better to just blow it up, he thought.

At just over five minutes into the video comes the first image of the blast, replayed from multiple camera angles for the next two minutes for maximum impact. Then we see a cloud of smoke as the source of the Tesla owner’s frustration disappears. “There’s nothing left,” he says, according to an English translation, picking up one of the scraps. Smiling as he tosses it on a pile of scarred aluminum remnants, he adds that driving the Tesla wasn’t nearly as much fun.

Those viewers who got a temporary antidote from despair by watching that scene last week were also comforted to know that no one was put at risk by the carefully executed made-for-video moment. In fact, a companion video titled “Behind the Scenes of Exploding Model S Tesla Viral Video” is probably even more satisfying for insurance and risk management professionals. There, a narrator details the selection of the location against the backdrop of a rock wall, the positioning of lighting equipment and cameras encased in steel that can withstand military explosions, the removal of the battery to avoid a toxic nightmare, the cleanup of the trash pile to protect the environment, and the construction of a safety hut that protected videographers and the Tesla owner who remotely triggered the blast, among other precautions.

That second video is a reminder that risk is all around—some man-made, some natural—and that careful preparation and a host of mitigation activities can minimize unanticipated damage to people, property and businesses.

Through all the trials and tribulations of 2021, the reality of the year’s events reminded insurance professionals that we have the power to protect one another and to change our organizations in less explosive ways—by speaking up against bad practices, embracing new technologies and skills, seeking out new ways of working and thinking, investigating the potential risks of any emerging technologies we utilize—in short, finding new ways to make the world better and safer.

With that in mind, I selected some of my favorite articles of 2021, starting off with the unique content written by industry professionals advising their peers about strategies for dealing with the risks and challenges on their immediate agendas and into the future. Below my choices are summarized in slideshow format. (Editor’s Note: Hovering your cursor over the slideshow slows the movement of the slides.)

Link to the articles referenced in the slideshow here:

#1—Racism in Insurance. How Things Can Change

#2—Why Auto Insurance Companies Should Drop Credit Score

#3—Partner vs. Vendor. A Distinction That Matters When Working With Startups

#4—Breaking The Silence. A Black InsurTech Founder’s Story

#5—VC Viewpoint. The Insurance Carrier Is Back in Fashion

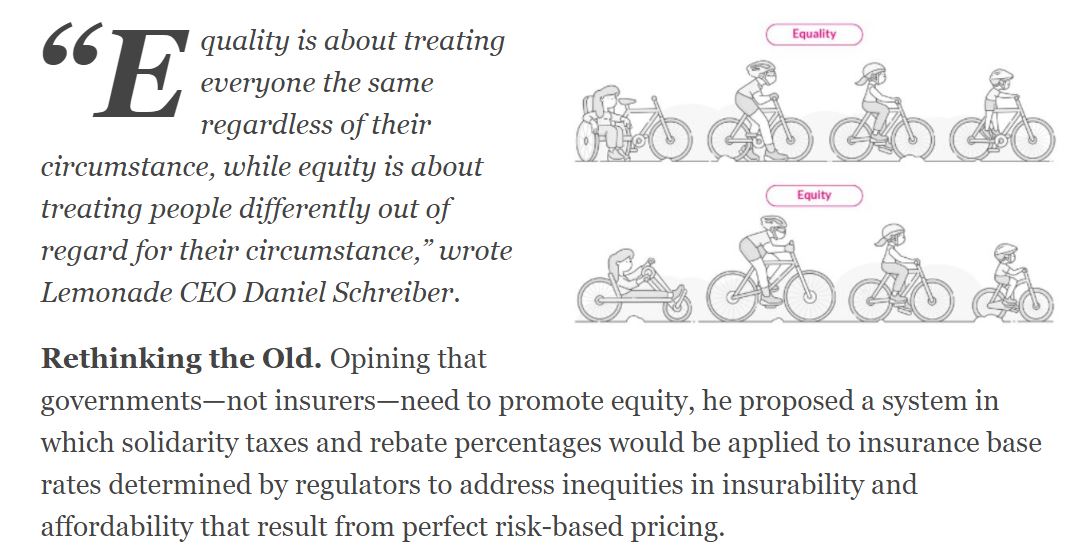

#6—Lemonade CEO on Why Regulators Need to Engineer Equity in Insurance Prices

#7—How Carriers Can Fix Their Hiring Processes

#8—Opioids Are the Next Tobacco. Are Antibiotics the Next Opioids?

#9—Crash Alert: Why It’s Time for More Auto Insurance Rebates

#10—Is Hybrid Working the Real Challenge for the Insurance Industry This Year?

As insurers prepared for hybrid working environments described in the last article at midyear, they also made their risk predictions and delivered information about their responses to emerging risks at virtual conferences. Even the Berkshire Hathaway annual meeting was virtual, and CM gave a rundown for those readers who didn’t have four hours to spend watching it on a Saturday in early May, as well as several other virtual events. Event slideshow and article links below.

Progressive ‘Crushing It’ on Profit: Berkshire’s Jain and Buffett

‘Katy, Bar the Door’: More Risks Loom for Insurers Post-COVID

Cyber Underwriting Changes: Is It Too Little, Too Late?

Social Inflation or Science: What Is Fueling Climate Litigation?

Writing Cyber Is Key To Survival, Munich Re Exec Says

Finally, I’ll end our year-in-review with another look at the “From the Editor” installments I offered to introduce our print and digital magazines in 2021 (linked below and available on today’s newsletter), and a final thank you to our guest editors—David Bradford, Matteo Carbone and Mike Fitzgerald. Bradford, Carbone and Fitzgerald delivered our special features on embedded insurance (#4), applications of the Internet of Things to insurance (#5) and geospatial information systems (#8).

#1—Be Purposeful. Be Bold. Be Human.

#2—Systemic Risk: What It Feels Like

#3—Do Reinsurers Rule the Industry?

#4—Traveling the Far Reaches of the World of Embedded Insurance

#6—Who Do You Trust? When Behavioral Science Fails

#7—Beyond the Hype: How to Value InsurTechs

#8—When Will the ‘Climate’ Change?

From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best