The prospect of property/casualty insurers and reinsurers adding information from geospatial imagery to their toolkits for underwriting, product development and claims handling isn’t an entirely new idea. But it’s one that is getting a lot more attention in 2021.

Executive Summary

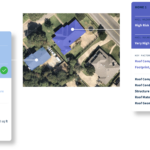

CM Guest Editor and CB Insights Analyst Mike Fitzgerald hosted a Roundtable bringing together participants in the world of geospatial information systems, seeking to understand reasons behind the increased interest in applying imagery data to existing and emerging insurance problems. In Roundtable highlights here, representatives of a commercial insurer, a global reinsurer, a flood mapping specialist and an MGA creating specialty parametric insurance products describe a confluence of technology developments that are making satellite imagery more accessible to insurers of all sizes, and broader environmental concerns that are fueling demand, as well as some remaining obstacles to broad-based acceptance by insurance underwriters. Watch the entire Virtual Roundtable—"Seeing Through the Clouds: Satellites in Insurance," on the Carrier Management channel of InsuranceJournal.TV (Editor's Note: At the time this article was first published in late 2021, Fitzgerald was a principal insurance analyst for CB Insights. In 2022, he joined SAS as an advisory insurance consultant.)Industry giants including AXA XL and Swiss Re have been using geospatial information systems (GIS) for property risk modeling and pricing, post-catastrophe loss adjusting, parametric insurance product innovations, and climate sustainability models for a number of years. But now the rest of the industry is starting to get on board, including insurers serving small business customers and homeowners, a panel of participants in the GIS space told Carrier Management recently. (See related article for GIS definition.)

“Why now?” asked Mike Fitzgerald, principal insurance analyst for CB Insights, kicking off a Carrier Management Roundtable event on geospatial information systems titled “Seeing Through the Clouds: Satellites in Insurance,” in mid-October.

Bessie Schwarz, the co-founder and chief executive officer of Cloud to Street, a team of scientists that harness the power of satellites for flood mapping, agreed that “this love affair [has] only really now started to take off and go deeper into the market”—some 10 years after the start of what she referred to as a “massive revolution” in micro-satellites. Offering her take on why this moment in time is different, Schwarz said the development of technologies outside of space tech has made data insights from satellite imagery more accessible. And beyond that, an appreciation of risk is a key factor driving demand for insurance products leveraging information from satellite imagery—and from insurers and consumers.