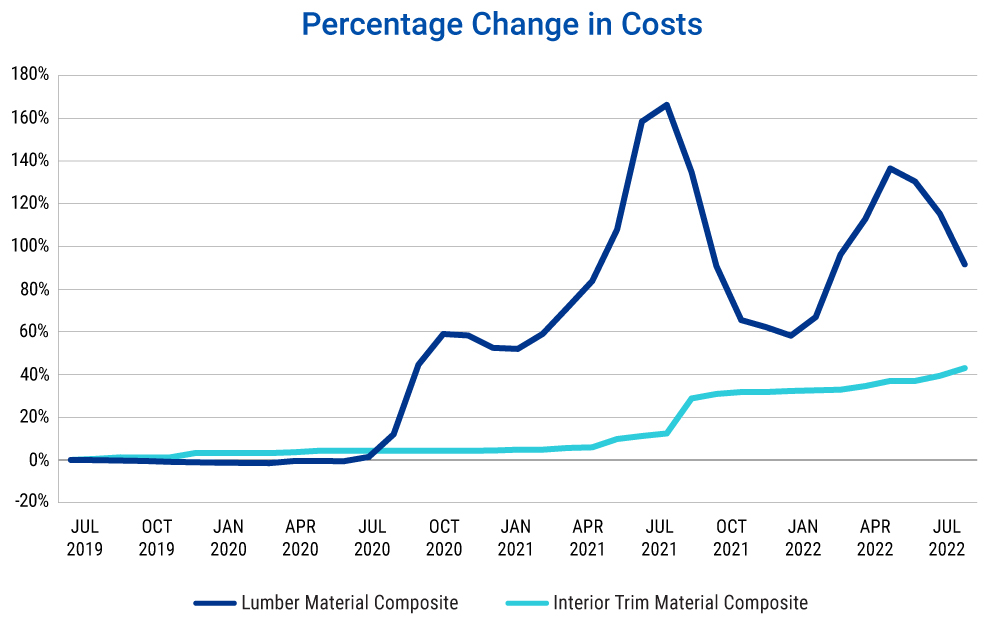

Reconstruction costs, including materials and retail labor, slowed their rate of increase entering the second half of the year as lumber prices fell from peak levels reached during the pandemic, but the degree of relief may be less than it seems given the extreme upswings of recent years.

Updated Verisk research shows national reconstruction costs in the United States were up 3% from July 2021 to July 2022, compared with a 13.5% jump recorded from April 2021 to April 2022. But costs in July 2021 were at one of multiple peaks seen during the pandemic, and costs still show the effects of continuing inflation and elevated fuel prices on production and transportation expenses. Lumber, a recurring source of cost increases in recent years, dropped 28.1% year-over-year in July—but again, from historic highs.

Paint and trim makers struggle with oil, supply chains and wages

As average gasoline prices exceeded $5 a gallon in mid-June, most categories of materials saw the effects of a volatile oil market. This included paint, which increased 11.4% on the surge in oil prices and broader supply chain issues squeezing availability of raw materials—all in a high-demand environment.

Meanwhile, despite the overall drop in lumber prices, interior trim costs were up 27.2%, likely reflecting general inflationary pressures and rising labor costs. The decorative aspects of interior trim demand more labor and resources for production, which may offset the effect of lower raw material prices. Still, prices remaining well-above pre-pandemic levels.

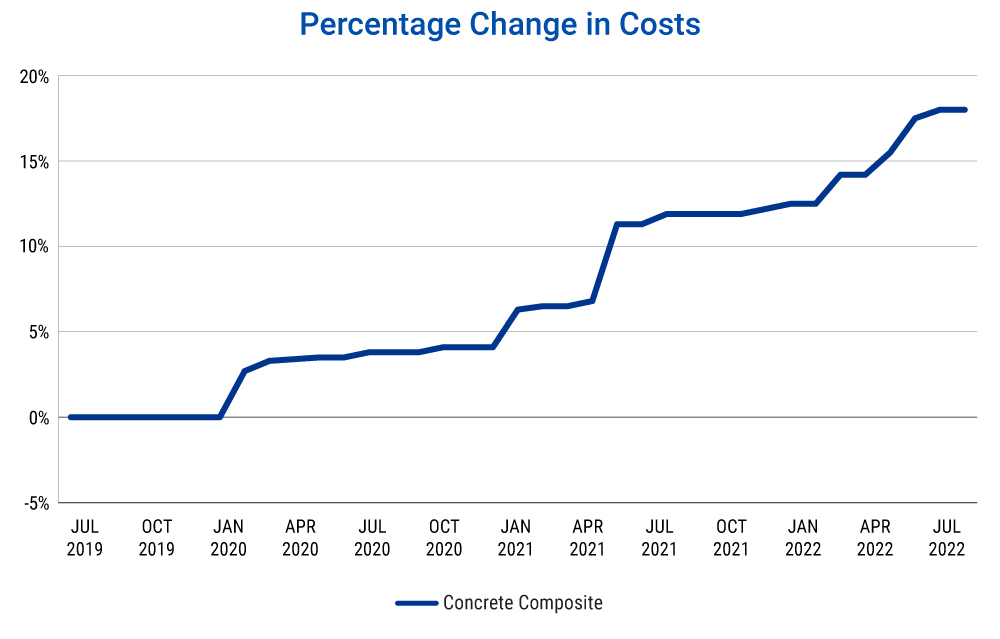

More commonly used commercial materials, such as concrete, also saw steady increases. The composite rose 6% between July 2021 to July 2022.

Labor costs keep climbing

Labor costs continue to place upward pressure on reconstruction costs. Combined hourly retail labor rates were up 9.8% from July 2021 to July 2022, a slight easing from the 10.4% increase in the April 2021 to April 2022 period. Steel worker and drywall installer/finisher costs showed the largest increases—12.1% and 11.8%, respectively—as overstretched demand for workers and high fuel costs spill over into wages.

To stay up to date on the latest in reconstruction cost trends at the state and national levels, sign up to be notified for the latest 360Value® Quarterly Reconstruction Cost Analysis.

By: Trish Hopkinson, Product Director, 360Value Personal Lines, Verisk

By: Joel Teemant, Product Director, 360Value Commercial Lines, Verisk

Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut