From Severe Convective Storms to Tornadoes and Floods, What the Data Tells Us

Each spring, particularly across the central and southeastern United States, a volatile mix of warm, moist air and cold, dry systems creates conditions that can quickly escalate into violent tornadoes, damaging hailstorms, and dangerous flooding. These seasonal perils account for a growing share of property damage and insured losses nationwide.

Spring weather events are becoming increasingly destructive. Gallagher Re notes that insured losses from Severe Convective Storms in the U.S. have grown at a 9.6% annual rate since 2000, driven by factors like suburban expansion and increased property exposure in high-risk areas.

HazardHub’s property-specific risk scores help insurers and homeowners better understand property vulnerabilities to these spring weather events – from severe convective storms and tornadoes, to hail, lightning, and floodings. Let’s take a look at the HazardHub insights on each of these extreme weather risks:

Tornadoes: The Most Destructive Spring Threat

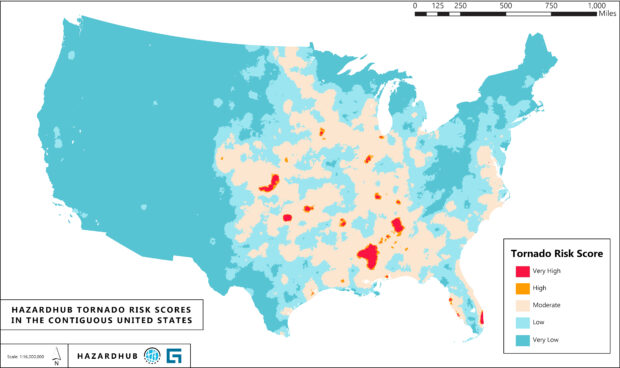

Spring is peak season for tornadoes, including the most violent events rated EF4 and EF5. According to the HazardHub Tornado Risk Score, approximately 4.8 million housing units in the U.S.—or 3.4% of all homes—are located in areas classified as high or very high risk for tornadoes.

HazardHub’s analysis of NOAA data reveals that 2024 was an exceptionally volatile year for tornado activity in the United States, with 1,796 tornadoes recorded, making it the second-most active year on record, just behind 2004. Over the past 15 years, the months of April, May, and June have consistently emerged as the core of tornado season, not only producing the highest number of storms but also the most severe. On average, May has seen 4,244 tornadoes per month, with 24 reaching EF4 or EF5 intensity. June, while slightly less active, still accounts for 2,900 tornadoes on average, including 17 of the most extreme events.

The United States experiences more violent tornadoes than any other country, with the highest concentration historically located in the central region known as Tornado Alley. Once defined primarily as northern Texas, Oklahoma, and Kansas, this high-risk zone has steadily expanded eastward in recent years, now encompassing much of the Southeast and the Ohio Valley. From 2020 to 2024, Mississippi led the nation with an average of 115 tornadoes per year, followed by Texas with 96 and Alabama with 90.

Last year alone, tornadoes caused an estimated $1.37 billion in property damage across the country, leaving behind widespread infrastructure devastation and long-lasting disruptions to the communities in their path. Tornado activity surged again this spring (2025), with over 680 tornadoes reported by mid-May, including five violent EF4s. A devastating tornado marathon from May 15–20 tore through the Midwest and Southeast, with total damages (reconstruction costs) nearing $16 billion, making it the costliest severe weather event of the year so far.

Severe Convective Storms (SCS) and Hail: Driving Billions in Damages

According to Swiss Re, a global reinsurer offering insurance and risk management for large-scale events, in 2023, Severe Convective Storm (SCS) events led to a record $65 billion in insured losses—hail was the primary culprit.

HazardHub’s Enhanced Hail Risk Score reveals that 99.72% of U.S. housing units are located in areas with at least some hail risk, though less than 1% are in high-risk zones. Wind and hail are the top causes of homeowners insurance claims, with hail alone accounting for about 20% of all P&C insurer payouts.

Flooding: America’s Most Costly Climate Risk

Flooding remains the most expensive and far-reaching natural disaster in the United States, both in terms of property damage and total economic impact. According to FEMA and the U.S. Senate Joint Economic Committee, flooding is involved in roughly 90% of all natural disasters nationwide, and three out of every four presidential disaster declarations are flood-related.

Yet despite this overwhelming exposure, only about 4% of U.S. homeowners carry flood insurance. This startling coverage gap is driven in large part by a combination of outdated FEMA flood maps and the mistaken belief that many properties lie outside of danger zones.

Texas, New Jersey, and Louisiana consistently rank among the highest in terms of total flood-related losses. HazardHub data highlights Texas, Louisiana, and California as the states with the greatest potential for riverine flood losses, while New Jersey, New York, and Virginia are most vulnerable to coastal flooding.

As some project the intensity of extreme rainfall events continue to rise, so does the urgency for better flood protection—and the private insurance market is beginning to respond. Historically, the National Flood Insurance Program (NFIP) has been the primary provider of flood insurance in the U.S. But in recent years, private insurers have started to expand their flood coverage, spurred by growing demand for higher policy limits and more comprehensive coverage, particularly in areas where the NFIP falls short.

According to the Insurance Information Institute, since 2016, the private flood insurance market saw a 24% increase in policy count, with direct written premiums rising from $3.3 billion to just over $4 billion. While private insurers still represent only about 3.5% to 4.5% of the total residential flood market, their share is slowly increasing, especially as technology enables more accurate risk assessments and custom underwriting.

A Season of Escalating Risk

Spring no longer means just warmer weather—it signals the start of the most destructive season for homeowners. Severe Convective Storms (SCS) can cause extensive property damage through wind, hail, lightning, heavy rainfall, and tornadoes. These events can also trigger secondary perils, such as mudslides, especially in wildfire burn areas, where subsequent storms pose heightened risks.

Common springtime losses include structural damage, fallen trees, shattered windows, power outages, water intrusion, and even mold or food spoilage, all of which may lead to additional living expenses. Seasonal increases in property transactions can also lead to more vacant homes, which are particularly vulnerable to undetected damage and often result in higher claims severity.

HazardHub delivers high-resolution data to help insurers evaluate these spring-related risks across multiple perils, including wind, hail, flooding, lightning, and power outages. Risk scores are accessible through Guidewire PolicyCenter, InsuranceNow, API integrations, and directly by consumers at no cost, via freehomerisk.com.

What Berkshire’s CEO Abel Said About Insurance

What Berkshire’s CEO Abel Said About Insurance  How State Farm, USAA Boost Customer Retention: Historic Dividends

How State Farm, USAA Boost Customer Retention: Historic Dividends  AmFam Reports Underwriting Profit, Top-Line Decline for 2025

AmFam Reports Underwriting Profit, Top-Line Decline for 2025  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec