While recent survey results show less conflict between actuaries and underwriters over insurance pricing this year than last, and underwriters warming up to the use of predictive analytics, issues still remain, according to Valen Analytics.

The provider of proprietary data, analytics and predictive modeling for property/casualty insurers reported results from a survey of 115 U.S. P/C insurance executives on Tuesday, finding that over half of carriers (52 percent) sense there is an internal struggle between actuaries and underwriters over price. The figure is down sharply from a similar survey last year that had more than three-quarters of the respondents (77 percent) citing a similar situation.

Even more encouraging for modelers like Valen Analytics is the nosedive in the number of respondents who said underwriters are leery of predictive models. This year, only 25 percent of respondents said underwriters have significant or high concern about predictive analytics, down an incredible 52 percent from the previous year.

Meanwhile, the actual usage of predictive analytics in underwriting is creeping up, with 65 percent of the executives saying that their companies use predictive models, up 9 percent from the prior survey last year.

Why are they incorporating predictive analytics in underwriting?

Valen Analytics reported these reasons:

- 83 percent cited better risk assessment.

- 82 percent said more accurate pricing.

- 73 percent selected protection from adverse selection.

Valen Analytics also queried P/C executives about external difficulties—conveying predictive analytics results to rating agencies—and about challenges in acquiring data and analytics talent.

- Only 21 percent said they feel effective in conveying their predictive analytics results and ROI to A.M. Best, Moody’s and Fitch.

- Just 35 percent believe their use of predictive underwriting models has a moderate or significant impact on the financial strength ratings they get.

- 78 percent said it is “very difficult” or “moderately difficult” to secure required talent.

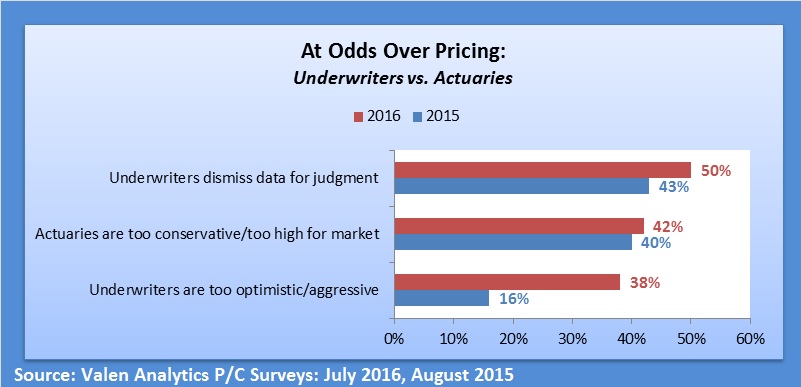

As to the actuary-underwriter conflict, below we reveal the reasons cited for the persistence of the battle in this year’s survey and last year’s report.

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk