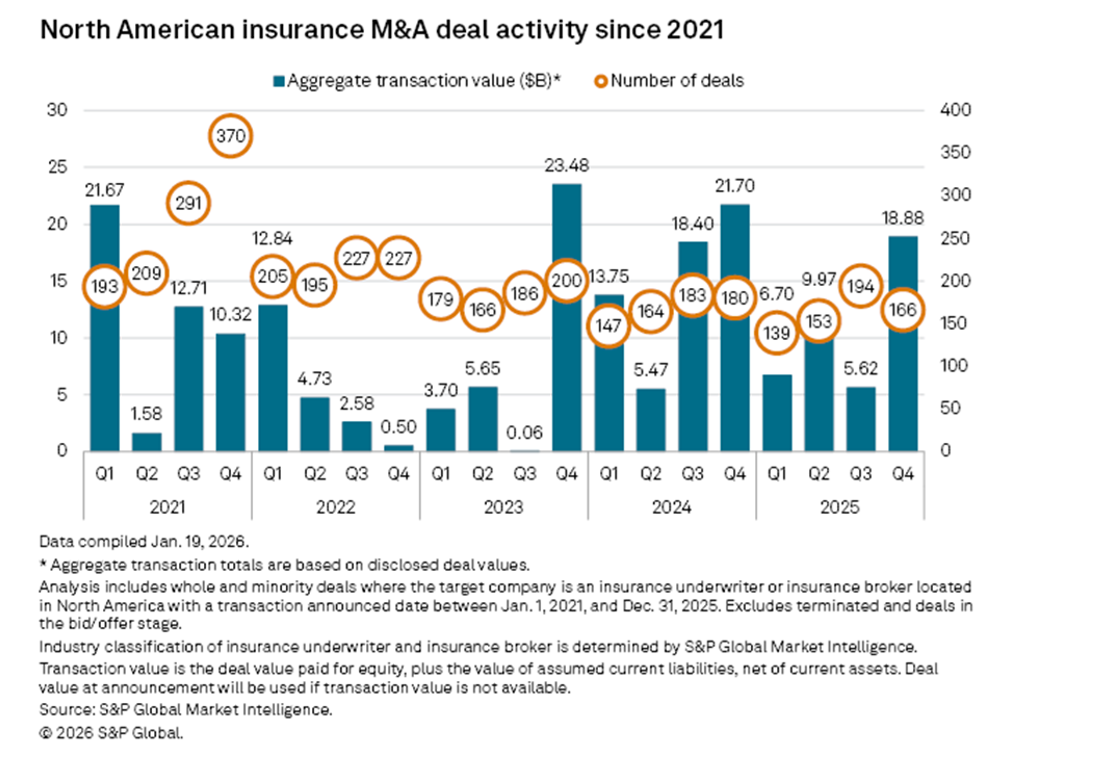

The North American insurance market experienced a decline in the total number and aggregate value of merger and acquisition deals in 2025 compared to 2024, according to S&P Global Market Intelligence.

The drop came in spite a significant surge in deal value during the fourth quarter last year, S&P GMI said, counting 166 deals totaling $18.9 billion for the final quarter of 2025.

The deal dollars compared to aggregate values under $10 billion in each of the three prior quarters but fell short of values recorded in the fourth quarters of 2024 and 2023 of $25.5 billion and $21.7 billion, according to the S&P GMI analysis.

For the full year last year, S&P GMI counted 652 deals totaling $41.2 billion, compared to 674 deals totaling $59.3 billion in 2024.

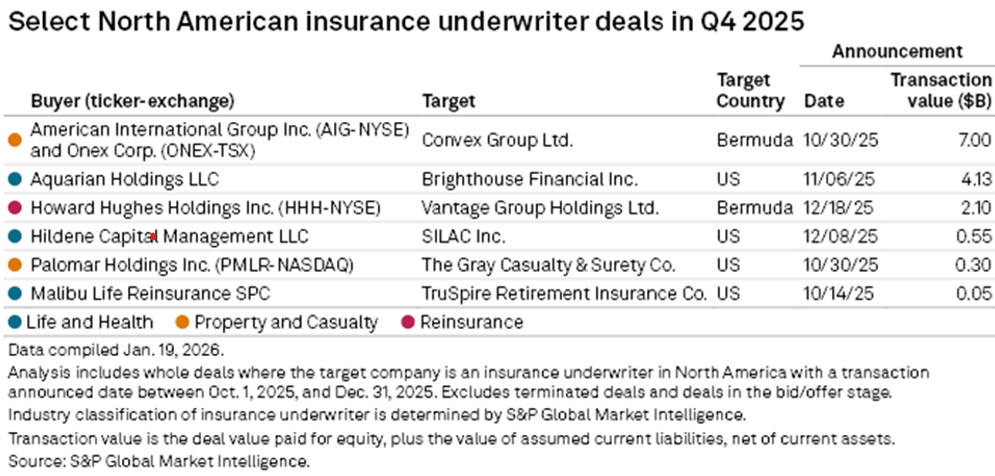

Large deals that contributed to the fourth-quarter value surge included the joint acquisition of Convex Group Ltd. by American International Group and Onex Corp., valued at $7 billion and Willis Towers Watson PLC’s acquisition of Newfront Insurance Services LLC for $1.45 billion—the largest broker-involved deal of the quarter.

S&P GMI observed that the Convex acquisition underscored “strategic interest in specialty property and casualty insurers,” and that the WTW’s deal for Newfront expanded WTW’s reach in the U.S. middle market, and also enhanced WTW’s presence in specialties such as technology, fintech, and life sciences.

The S&P GMI report also highlighted a large strategic Investment—Aquarian Holdings LLC’s acquisition of Brighthouse Financial Inc. for $4.1 billion. Aquarian Capital plans to bolster Brighthouse’s investment management capabilities through a strategic relationship with Aquarian Investments, S&P GMI noted.

From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation  What Berkshire’s CEO Abel Said About Insurance

What Berkshire’s CEO Abel Said About Insurance  Beyond Automation: The Emerging Role for Contextual AI in Insurance

Beyond Automation: The Emerging Role for Contextual AI in Insurance  Berkshire Hathaway Profit Falls; Insurance Income Lower for GEICO, Other Ops

Berkshire Hathaway Profit Falls; Insurance Income Lower for GEICO, Other Ops