Online insurance agent Insurify said it has launched a ChatGPT app to allow consumers to compare and shop for insurance.

Insurify said the app is the first insurance app in OpenAI’s directory.

“Shopping for car insurance has traditionally been time-consuming, confusing, and frustrating for many drivers,” said Snejina Zacharia, founder and CEO of Insurify, in a statement. “With our new ChatGPT app, we’re redefining the insurance shopping experience by making it feel as simple as having a conversation. Drivers can ask questions in plain language, explore personalized quotes, and review real customer feedback, all in one place.”

“Shopping for car insurance has traditionally been time-consuming, confusing, and frustrating for many drivers,” said Snejina Zacharia, founder and CEO of Insurify, in a statement. “With our new ChatGPT app, we’re redefining the insurance shopping experience by making it feel as simple as having a conversation. Drivers can ask questions in plain language, explore personalized quotes, and review real customer feedback, all in one place.”

Within ChatGPT, users can access the Insurify app to see tailored rate estimates specific to their unique driver profile, including factors such as location, vehicle, age, credit, driving history, and coverage needs. It allows shoppers to compare options from top insurance companies in their area side by side, view key information about each insurer, and weigh trade-offs across price, customer service, coverage options, discounts, policy transparency, and overall value.

When consumers are ready to purchase, they can continue the shopping experience on Insurify—a digital insurance agent licensed in all 50 states and Washington, D.C.—to finalize coverage and buy the policy.

“People are increasingly turning to AI to help them make everyday decisions,” Zacharia added. “We see this as a natural next step in our mission to make insurance shopping easier, more transparent, and more personalized.”

Insurify said its AI-powered technology has served over 196 million quotes and generated $200 billion in total coverage for auto, home, pet, and renters insurance.

Related article: Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

First? Auto? Home? Bindable?

Insurify’s media announcement on Monday states that Insurify “released the insurance industry’s first ChatGPT app, allowing users to browse, research, and compare car insurance directly through the AI platform’s new app library.”

Separately, several media outlets (including InsurTech Insights, Fintech Global and ReinsuranceNe.ws) reported that Tuio, a digital insurer in Spain, received approval from OpenAI for the first insurance provider–built AI application on ChatGPT.

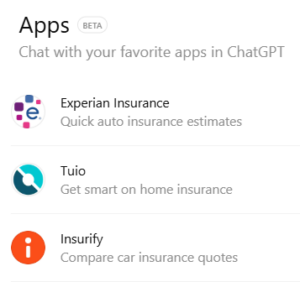

While a statement from OpenAI as to which was actually first was unavailable at press time, a Carrier Management search of ChatGPT’s available apps for insurance revealed that the Tuio app is currently for home insurance shoppers and the Insurify app is for car insurance quote comparisons. (Editor’s Note: A translated version of the Tuio Insurance website includes footers referring to a Tuio company that is an licensed insurance distributor and one that is an MGA, which has an agreement with Allianz Direct.)

There is another ChatGPT app for insurance, Experian Insurance, offering “quick auto insurance estimates.”

The app descriptions provide additional information.

- “Insurify helps you quickly discover personalized car insurance quotes based on your unique driver profile. Compare options, understand what you’re likely to pay, and browse real customer reviews of top carriers, all in one simple, intuitive experience.”

- “Experian Insurance lets users explore auto insurance pricing directly inside ChatGPT with minimal input. By entering a 5-digit U.S. ZIP code, they receive geographically based insurance estimates from Experian’s trusted carrier network. These estimates are not final prices, but localized starting points for comparison. Users can seamlessly continue to Experian to view bindable quotes and complete their purchase securely….”

- Tuio Home Insurance Explorer “provides a transparent way to view and understand Tuio home insurance options directly within ChatGPT. This tool helps you visualize how a policy could be structured for a home, focusing on clarity and customization,” the Tuio app says, listing features like a “coverage deep dive,” immediate definitions of insurance concepts and “interactive customization” of limits and included coverages.

“The [Tuio] app will generate a corresponding non-binding policy outline. You can then ask the assistant about coverage, ask to modify details or explain specific clauses to see how the coverage adapts to your needs and what options are available,” the app description continues. “If you want to go further, the app will prompt you for the necessary details and prvide [SIC] a price estimate. For an official quote or policy issuance, users are directed to Tuio’s official buying channels.”

“Use this app to design a potential policy configuration and learn about the protection details without any pressure or commitment,” the Tuio app description states. “This tool is for informational and exploration purposes only, providing estimates based on the details shared in the chat. Official policy issuance requires verification through Tuio’s site.”

Images accompanying the app descriptions suggest how ChatGPT users might interact with each of the apps.

- “What’s the estimated price for insuring my 75 square meters rental in Madrid?” asks a hypothetical Tuio app user.

- “My ZIP code is 92626. I need an auto insurance quote,” types an Experian user.

- “Insurify, is Allstate or Progressive better in Texas?” and “Insurify, find me the best car insurance in Denver.” are the sample prompts illustrated in the Insurify app description.

***A version of this article (without the discussion of ChatGPT insurance apps other than Insurify) was originally published by Insurance Journal.

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best  Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next  Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  Four Practical, Data-Backed Steps for Preventing Nuclear Verdicts®

Four Practical, Data-Backed Steps for Preventing Nuclear Verdicts®