Newly revealed data highlights a surge in criminals targeting high-value freight and new theft locations pushing losses higher, according to Verisk CargoNet analysis.

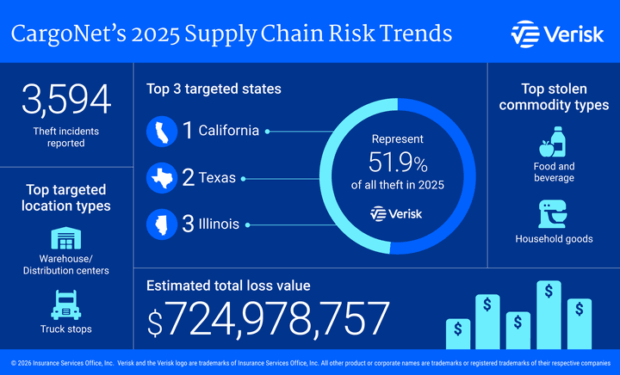

Estimated losses surged 60% from 2024 numbers to nearly $725 million, while confirmed cargo theft incidents increased 18%.

The average theft value rose to $273,990, up 36 percent from $202,364 in 2024, driven by more selective, high-value targeting by organized groups, the cargo theft monitoring company showed.

Approximately 3,594 supply chain crime events across the United States and Canada were reported in 2025, a bit lower than the 3,607 events reported in 2024.

Incidents involving confirmed cargo theft rose sharply, increasing 18 percent year-over-year from 2,243 to 2,646, the analysis showed.

California remained the most impacted state with 1,218 incidents, but activity shifted away from Los Angeles County (down 11 percent) toward historically lower-risk regions such as Kern County (up 82 percent) and San Joaquin County (up 44 percent).

Theft activity dispersed geographically, with major increases in New Jersey (+50%), Indiana (+30%), and Pennsylvania (+24%).

Food and beverage products experienced the largest increase, with 708 thefts, a 47% jump from 2024.

Meat and seafood products and tree nuts were particularly affected, with trends varying by region. Meat and seafood were heavily targeted in the Northeast, especially New Jersey, while tree nut thefts were more common on the West Coast.

Metal theft rose 77 percent, driven by ongoing demand for copper products.

Theft of consumer-grade electronics such as televisions and personal computers declined.

Vehicle-related products – including tires, auto parts, and motor oils -also remained attractive, with a notable focus on engines and components bound for domestic vehicle assembly plants.

Enterprise computing hardware and cryptocurrency mining equipment emerged as top‑tier targets for organized criminal groups.

“Criminal enterprises are becoming more selective and sophisticated, targeting extremely high value shipments rather than relying on opportunistic theft,” said Keith Lewis, vice president of operations at Verisk CargoNet. “This strategic shift explains how losses can rise 60 percent even as overall incident volume holds steady.”

Trends expected in 2026

RAM modules, storage drives, and enterprise computing equipment will continue to be high-value targets.

Theft by deception groups are expected “to increase their focus on misdirecting shipments tendered to legitimate carriers, sidestepping compliance controls that have traditionally centered on the tendering process itself,” the report stated.

In addition, non-domiciled CDL enforcement will continue to be monitored.

CargoNet warned that many complex cargo theft schemes rely on acquiring existing motor carriers with strong load histories. An increase in enforcement “may reduce available capacity and expand the pool of carriers for sale, potentially creating new opportunities for criminal enterprises to establish fraudulent operations.”

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark  The Future of HR Is AI

The Future of HR Is AI  Is Risk the Main Ingredient in Ultra-Processed Food?

Is Risk the Main Ingredient in Ultra-Processed Food?  High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best