A new spring weather hazards report indicates the central and southeastern regions of the U.S. are expected to see destructive tornadoes, with nearly 4.8 million homes at high or very high risk, according to Guidewire’s HazardHub spring weather risk assessment.

In 2024, the U.S. recorded 1,796 tornadoes, the second-highest total on record, according to the report.

Severe convective storms (SCS) continue to drive insured losses, with an estimated $65 billion in SCS-related payouts in 2023, the data showed.

SCS can cause extensive property damage through wind, hail, lightning, heavy rainfall and tornadoes. The events can also trigger secondary perils, such as mudslides—especially in wildfire burn areas—where subsequent storms pose heightened risks.

Flooding remains the nation’s most costly natural disaster, yet only 4 percent of homeowners carry flood insurance.

“Spring is now the most destructive season for homeowners and insurers,” said Tammy Nichols Schwartz, senior director of Data and Analytics at Guidewire.

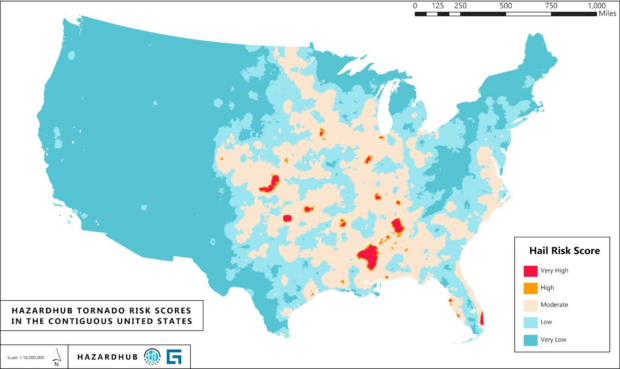

Tornadoes: The Most Destructive Spring Threat

Over the past 15 years, April, May, and June have consistently been the most active months for tornadoes, accounting for the highest total number and the most severe events (EF4 and EF5).

Monthly Averages:

April: 4,180 tornadoes (monthly average), including 30 EF4 or EF5 tornadoes

May: 4,244 tornadoes (monthly average), including 24 EF4 or EF5

June: 2,900 tornadoes (monthly average), including 17 EF4 or EF5

The U.S. typically experiences more violent tornadoes than any other country, with the greatest concentration in the central region known as Tornado Alley. Traditionally defined as northern Texas, Oklahoma, and Kansas, this high-risk zone has expanded eastward in recent years to include much of the Southeast and Ohio Valley, according to the report.

Top States for Tornadoes (5-Year Average, 2020–2024):

- Mississippi (115/year)

- Texas (96/year)

- Alabama (90/year)

Tornadoes caused $1.37 billion in property damage nationwide in 2023, data showed.

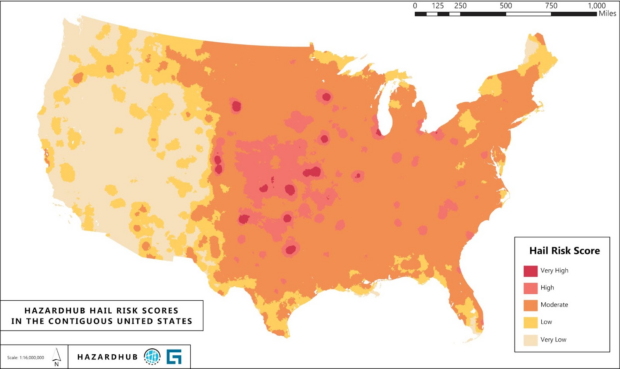

Severe Convective Storms (SCS) and Hail: Driving Billions in Damages

Nearly 100 percent (99.72) of U.S. housing units are located in areas with at least some hail risk, though less than 1 percent are in high-risk zones, according to HazardHub’s Enhanced Hail Risk Score.

Wind and hail are the top causes of homeowners insurance claims, with hail alone accounting for approximately 20 percent of all P&C insurer payouts.

Wind and hail are the top causes of homeowners insurance claims, with hail alone accounting for approximately 20 percent of all P&C insurer payouts.

Flooding: America’s Most Costly Climate Risk

According to FEMA and the U.S. Senate Joint Economic Committee, flooding remains the most costly natural disaster in the U.S. in terms of total economic impact.

According to FEMA and HazardHub:

- 90 percent of all natural disasters involve flooding.

- 75 percent of presidential disaster declarations are flood-related.

- Only four percent of U.S. homeowners carry flood insurance—despite growing risk from extreme rainfall and outdated FEMA maps.

Texas, Louisiana, and California are the states with the greatest river flood loss potential and New Jersey, New York, and Virginia as the most vulnerable to coastal flood impacts, according to the report.

In terms of total flood losses, Texas, New Jersey, and Louisiana rank the highest.

A Season of Escalating Risk

Spring weather events are becoming increasingly destructive.

“Spring no longer means just warmer weather—it signals the start of the most destructive season for homeowners,” said Schwartz.

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  The Future of HR Is AI

The Future of HR Is AI  Markel Group Announces Leadership Changes

Markel Group Announces Leadership Changes  Why Claims AI Build vs. Buy Decisions So Often Miss the Mark

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark