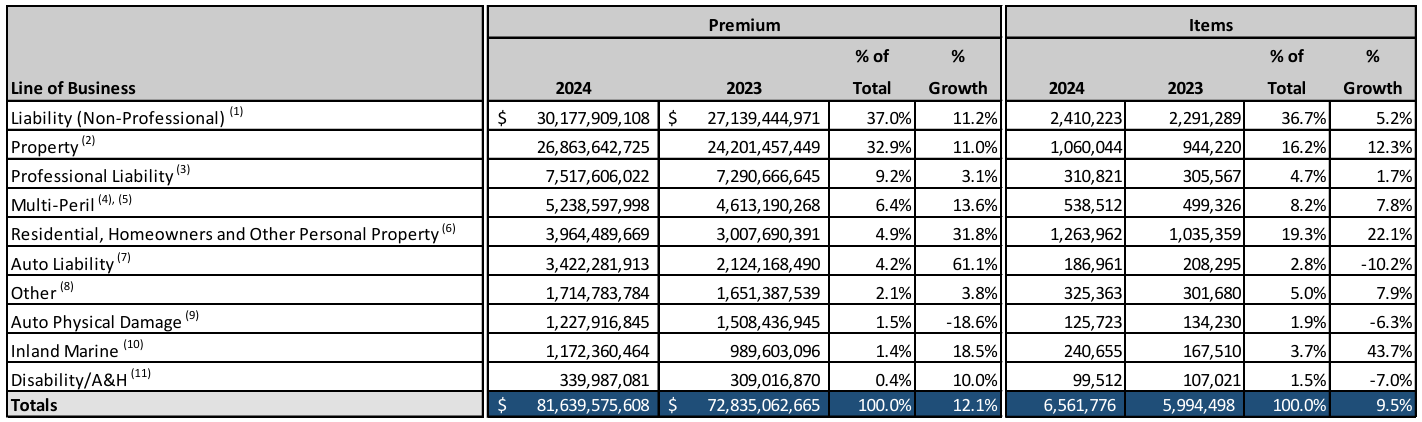

The excess and surplus lines market continued to grow in 2024, with premium reaching more than $81 billion, according to annual reports from 15 state stamping offices released by the Wholesale & Specialty Insurance Association (WSIA).

2024 premiums reflected a 12.1 percent increase over 2023, when premiums grew 14.6 percent over the prior year to about $72.7 billion. The last two years follow the record-breaking numbers of 2022 when premiums grew more than 24 percent to $63 billion.

Stamping office states accounted for 63 percent of U.S. surplus lines premium in 2024.

Transactions were up 9.5 percent to nearly 7 million in 2024. Commercial liability and commercial property remain dominant lines of business in the E&S market. Premiums in these lines each increased about 11 percent to about $30.2 billion and $26.9 billion, respectively, in 2023. The two lines of business represent about 70 percent of total surplus lines premium from the reporting offices.

Auto liability and personal property had the highest upticks in E&S premium growth – 61.1 percent and 31.8 percent, respectively. The report also breaks down data by state, revealing where risk is flowing to the E&S market. For instance, personal property transactions increased the most in Texas (63.3%) and California (60.9 percent).

Ben McKay, CEO and executive director of the Surplus Lines Association of California, said the state saw a 124 percent increase in transaction filings within the residential lines of business, “underscoring the continued dislocation in admitted markets.” Still, residential insurance policies account for less than 7 percent of the overall surplus lines market in the Golden State.

Although some states have reported increases in personal lines, these coverages represented a small portion – just 4.9 percent – of the overall E&S market.

“Liability lines, including general liability, excess, cyber, and commercial auto, remain a significant driver of our market,” McKay said. “In particular, commercial auto premiums have surged 162% year-over-year.”

In Florida, there was a slowdown in surplus lines growth as the year progressed, according to Mark Shealy, executive director of Florida Surplus Lines Service Office.

“Notably, commercial property saw a 3 percent increase in premium volume for November compared to 2023, though growth within the quarter showed signs of slowing,” Shealy added. “However, policy counts continued to rise, suggesting a stabilizing market.”

This article was previously published by Insurance Journal. Reporter Chad Hemenway is the national editor of Insurance Journal.

Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered