Global insured losses from natural catastrophes in 2023 exceeded $100 billion for the fourth consecutive year — an indication of the new norm for nat cat losses, according to Swiss Re.

Other record-breaking numbers for 2023 included the total of insured-loss-inducing catastrophes (which hit a record 142), and the insured price tag for severe convective storms (SCS), which reached $64 billion for the first time, said the report published by Swiss Re Institute, Swiss Re’s research unit. (The report is titled “Natural catastrophes in 2023: gearing up for today’s and tomorrow’s weather risks.”)

Although the earthquake in Turkey and Syria was last year’s costliest catastrophe with estimated insured losses of $6.2 billion, event frequency from severe convective storms was the main driver of 2023’s nat cat losses, said Swiss Re. (The report describes SCS as an umbrella term for a range of hazards including tornadic and straight-line winds, as well as large hailstones.)

The report said that 85 percent of total SCS insured losses originated in the U.S. and that losses are growing the fastest in Europe where they have topped $5 billion in each of the last three years.

Most of the record-breaking numbers of natural catastrophes were brought by medium-severity events, which Swiss Re defines as events with losses in the range of $1 billion–$5 billion. The number of medium-severity events, which can include SCS, has grown by an average of 7.5 percent each year since 1994, almost double the 3.9 percent increase of all catastrophes.

“After tropical cyclones, SCS have become the second largest loss-making peril. As with other perils, rising exposures due to economic and population growth, and urbanization are the main forces driving SCS losses higher,” the report continued.

Hailstorms are the main contributor to insured losses from SCS, responsible for 50-80 percent annually of all SCS-driven insured losses, Swiss Re said, pointing to the example of northern Italy where storms with giant hail stones brought insured damages of $5.5 billion in 2023.

Global Protection Gap

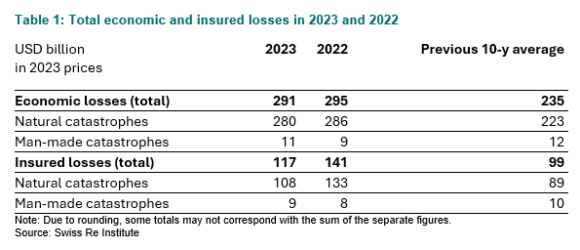

Last year, economic losses from natural catastrophes reached $280 billion, meaning that 62 percent of the global losses were uninsured, amounting to a global protection gap of $172 billion in 2023, up from $153 billion in 2022 and the previous 10-year average of $134 billion. (Economic losses include all damage, both insured and uninsured.)

Swiss Re said global insured losses from natural disasters outpaced global economic growth over the past 30 years. “From 1994 to 2023, inflation-adjusted insured losses from natural catastrophes averaged 5.9 percent per year, while global GDP grew by 2.7 percent. In other words, over the last 30 years, the relative loss burden compared to GDP has doubled,” said a press release accompanying the report.

Swiss Re forecasts that annual insured losses will grow by 5-7 percent over the long term, which is in line with actual loss increases over the last 30 years.

“Several factors suggest losses will continue to rise: property exposures continue to grow, especially in areas of already high-value concentrations. Exposure growth also tends to be focused in areas of higher catastrophe risk such as flood plains or on coastlines,” the report said. “So far, the impact of changing climates has been small. However, we expect that the contribution from severe weather and other events will likely rise. By extrapolating the aforementioned long-term growth trend, we estimate that today’s insured losses could double in 10 years.”

Accumulation of Assets in Vulnerable Regions

“Even without a historic storm on the scale of Hurricane Ian, which hit Florida the year before, global natural catastrophe losses in 2023 were severe,” commented Jérôme Jean Haegeli, Swiss Re’s group chief economist, in a statement.

“This reconfirms the 30-year loss trend that’s been driven by the accumulation of assets in regions vulnerable to natural catastrophes. In the future, however, we must consider something more: climate-related hazard intensification,” he added. “Fiercer storms and bigger floods fueled by a warming planet are due to contribute more to losses. This demonstrates how urgent the need for action is, especially when taking into account structurally higher inflation that has caused post-disaster costs to soar.”

In its conclusion, the Swiss Re report said: “To better deal with the losses of today and prepare for the weather of tomorrow, loss potential needs to be reduced so that insurance is more affordable, protection gaps are narrowed and the business of insurance remains sustainable. Lowering loss potential requires climate change mitigation, loss reduction, and prevention and adaptation actions to minimize exposure and vulnerability to hazards.”

Other findings from the report include:

- Total insured losses, which include natural catastrophes ($108 billion) and man-made losses ($9 billion) were $117 billion for 2023.

- Total economic losses for the year were $291 billion, which comprised natural catastrophes costing $280 billion and man-made events costing $11 billion.

- The costliest industry event, the earthquake in Turkey and Syria, had insured losses of $6.2 billion, but given the region’s low insurance penetration, 90 percent of all property damage was uninsured.

- The Turkey and Syria earthquake was the biggest humanitarian disaster of the year, claiming close to 58,000 lives.

Source: Swiss Re

How Modern Is ‘Modern Enough’ for Insurance Applications?

How Modern Is ‘Modern Enough’ for Insurance Applications?  AmFam Reports Underwriting Profit, Top-Line Decline for 2025

AmFam Reports Underwriting Profit, Top-Line Decline for 2025  How State Farm, USAA Boost Customer Retention: Historic Dividends

How State Farm, USAA Boost Customer Retention: Historic Dividends  As SCS Losses Grow, Demex Offers Modeled-Loss Reinsurance

As SCS Losses Grow, Demex Offers Modeled-Loss Reinsurance