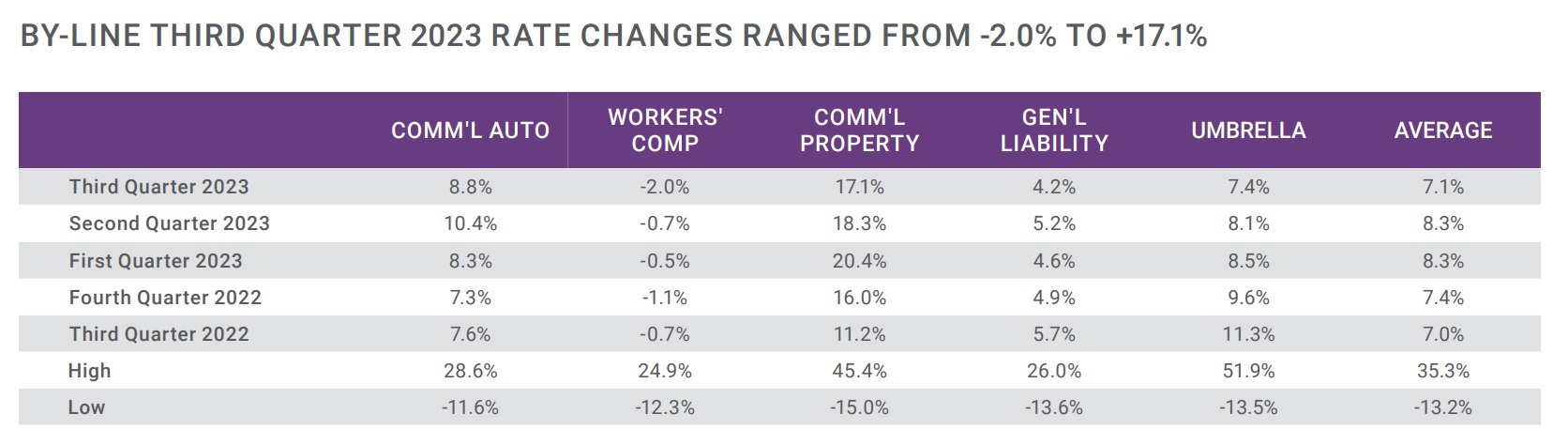

Overall commercial property/casualty premiums increased slightly more than 8 percent on average in the third quarter, marking six full years of steady increases.

According to The Council of Insurance Agents and Brokers’ Q3 Market Survey, the 8.1 percent average increase in Q3 compared to 8.9 percent in Q2, is the 24th straight quarter with increases—seen across most lines of business except for workers compensation and directors & officers.

For the first time since the first three months of 2017, D&O premiums decreased, albeit slightly, at an average of -0.3 percent. This continued a trend of moderation in D&O since its peak average increase of 16.8 percent in Q2 2020. And for the seventh consecutive quarter, workers compensation saw premium decreases, at -2 percent.

At the other end of the spectrum, commercial property maintained the distinction of having the highest average premiums increases at 17.1 percent as reinsurance pricing, a lack of capacity, and upticks in the frequency and severity of events continued to affect the line.

Of note, the report this quarter showed clients’ ” rate fatigue” and possible developing distrust in the industry. Of those surveyed, 70 percent said clients described a level of rate fatigue and 48% said clients felt burdened by information requested by carriers on applications.

Of note, the report this quarter showed clients’ ” rate fatigue” and possible developing distrust in the industry. Of those surveyed, 70 percent said clients described a level of rate fatigue and 48% said clients felt burdened by information requested by carriers on applications.

“More concerning,” said The Council, “was that 42 percent of respondents also mentioned that their client displayed a level of mistrust towards the industry, provoked by the persistent increases across most lines and cuts to coverage in key lines like commercial auto and commercial property.”

This article was originally published by Insurance Journal. Reporter Chad Hemenway is the National Editor of Insurance Journal

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  Is Risk the Main Ingredient in Ultra-Processed Food?

Is Risk the Main Ingredient in Ultra-Processed Food?  New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage