Companies are trimming their budgets for merit raises next year, a sign of belt-tightening that could surprise some employees who had enjoyed two straight years of increases.

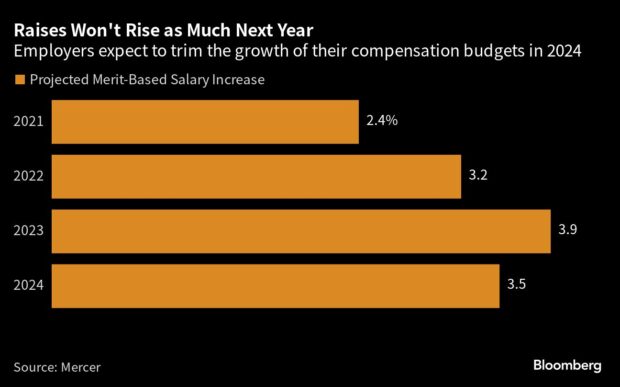

U.S. employers surveyed by Aon Plc, which compiles compensation data on more than 5,500 employers, said merit raises will average about 3.7 percent across all industries next year, down from 3.9 percent this year, as companies rein in labor budgets and inflation eases from last year’s highs. A separate survey from workplace consultant Mercer found a similar trend, with merit-based salaries seen rising 3.5 percent next year, down from 3.9 percent in 2023.

“People are not going to spend what they spent last year,” said Tim Brown, a partner at Aon. “Also, inflation has come down since last year. So, there’s more pressure on salaries.”

Workforce leaders echoed the findings. Bob Toohey, chief human resources officer at Allstate Insurance Co., said compensation budgets in the US “will be lower than last year — all company budgets will be lower than last year.”

The pay gains projected by Aon and Mercer are still well above pre-pandemic levels, when raises were stuck around 3 percent annually. That’s due to the continued resilience of the labor market and historically low unemployment, Mercer Senior Principal Lauren Mason said. Initial jobless claims in the week ending Sept. 16 fell within striking distance of the lowest level in more than five decades, according to Labor Department data. U.S. inflation, which topped 9 percent last summer, is less than half that now. Mason said that further reductions in compensation budgets are possible next year as companies adapt to the changing economic landscape.

Workers in technology have been particularly hard hit, with only 5 percent of firms in the industry saying they’re now hiring aggressively, according to Aon. That’s down from 22 percent last year. Tech firms usually top other areas when it comes to projected salary increases, but in the wake of layoffs and cost-cutting drives they’re due to deliver merit raises of just 3.3 percent next year, Mercer found — below sectors such as energy and consumer goods.

A separate survey from technology job site Hired found that tech salaries are now at a five-year low, adjusted for inflation. But jobs that require specialized skills, like machine learning engineers and data scientists, are still in high demand.

Salary increases tied to promotions will also decelerate next year, Mercer found, for the simple reason that companies plan to promote fewer people. During the hiring boom of 2021 and 2022, many companies handed out raises and promotions to white-collar workers, even in the middle of the year, to hold onto their best people. Seven out of ten companies spent more than they had planned on pay adjustments during that period, a survey from workplace consultant Willis Towers Watson (WTW) found.

A separate report from WTW found that organizations are budgeting for overall salary increases of about 4 percent next year, down from the 4.4 percent boost they paid out this year. While raises are not as large as they were in recent years, companies are getting more generous with perks and benefits such as flexible-work schedules and paid parental leave, according to a recent survey from staffing firm Robert Half Inc.

Photograph: Office workers cross London Bridge into The City of London, UK, on Monday, Aug. 14, 2023. Photo credit: Jason Alden/Bloomberg

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next  Four Practical, Data-Backed Steps for Preventing Nuclear Verdicts®

Four Practical, Data-Backed Steps for Preventing Nuclear Verdicts®  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  Beyond Automation: The Emerging Role for Contextual AI in Insurance

Beyond Automation: The Emerging Role for Contextual AI in Insurance