Despite efforts to reduce vulnerability to catastrophic weather events such as Hurricane Ian, rapid population growth and increased storm frequency have driven loss expectations even higher, according to a newly released report by Swiss Re in conjunction with the one-year anniversary of the storm.

According to the report, “Ian revisited: Disentangling the drivers of U.S. hurricane losses,” had storms like Ian struck Florida just 50 years ago, there would have been far fewer losses than in the current environment where insured losses for the storm are estimated at $65 billion.

Ian was the third mostly costly hurricane ever in the U.S.

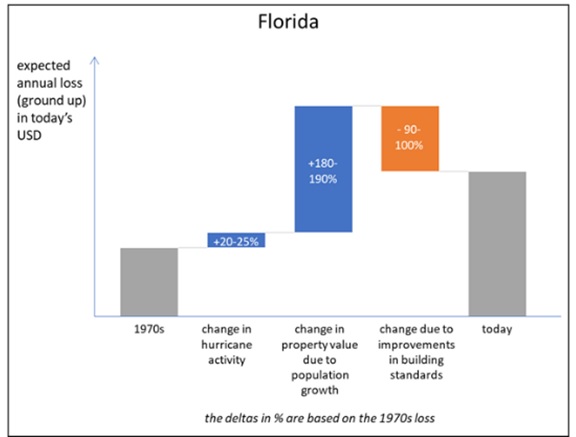

“Even adjusting for inflation, the September 2022 Category 4 storm, one of history’s most-destructive natural catastrophes, would have been half or even a third as expensive in the 1970s, data shows,” state the authors, Erdem Karaca, head of Cat Perils Americas, and Elisabeth Viktor, senior NatCat Specialist.

The report highlights the importance of “adapting our built environment to a future of volatile weather.”

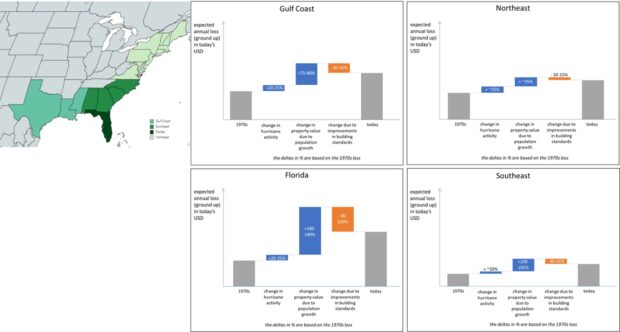

While the report found that building standards and code improvements in Florida since the 1970s have reduced the magnitude of annual losses resulting from hurricanes by 90-100 percent, the gains have been “dwarfed by higher modeled loss expectations resulting from the state’s population growth which has tripled to more than 22 million since the 1970s and the accompanying accumulation of valuable assets.”

Fort Myers, in particular, highlighted how skyrocketing population growth combined with Hurricane Ian’s landfall created a costly catastrophe.

According to Swiss Re’s models, annual expected losses in Fort Myers due to population growth have risen 340-350 percent from 1970s levels, surpassing the building standards-driven gains in Swiss Re models of 150 percent.

Florida isn’t the only state to see fast-growing metropolitan areas; the U.S. Southeast and Gulf States are experiencing significant growth in their metropolitan and coastal regions as well. For example, Houston’s modeled expected loss from population growth has risen by a factor of 200-210 percent.

Even cities that have grown more slowly, like New York in the U.S. Northeast, are still seeing rising loss risks “due to less storm-resistant construction given generally weaker and less-frequent hurricanes, as well as lower risk awareness,” the authors stated.

Swiss Re analysis found that building improvements mitigate expected loss development by just 20-30 percent. This data takes into account the older buildings that still exist that may not have retrofits to protect them from damage during more frequent and powerful hurricane events.

The increasing frequency of storms and hurricanes is likely connected to greenhouse gases contributing to climate change.

The authors indicate that in order to mitigate future losses resulting from hurricanes, there is a “a real-world need for adaptation efforts to accelerate, especially in high-growth areas but also in areas where growth has been more modest. Moreover, vulnerability-reduction measures also must go beyond wind code improvements to address flood and storm surge protection.”

Swiss Re’s analysis demonstrates the top three drivers of losses: urban population growth, a concentration of valuable assets in vulnerable regions and lagging adaptation.

The average annual growth rate of 5-7 percent in insured losses from all natural catastrophes over the past three decades demonstrates how understanding loss drivers and causes through effective modeling can assist insurers in moving toward a more resilient society.

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation  Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid