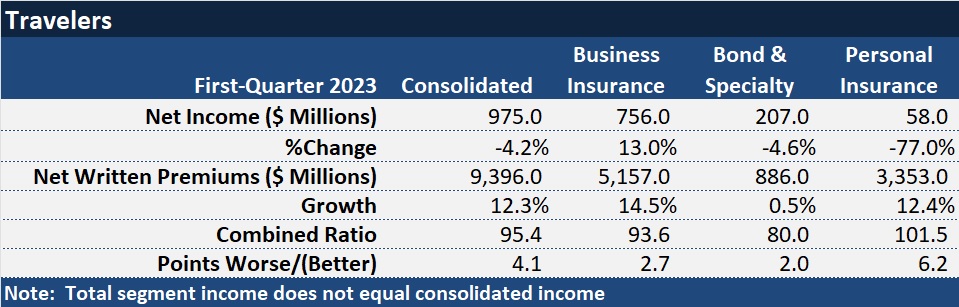

With net written premiums for the Business Insurance segment of its book rising 14.5 percent to a $5.2 billion record level for the first quarter, Travelers posted 12 percent premium growth across the company overall.

While catastrophe losses were drivers of higher combined ratios in both the Business Insurance and Personal Insurance segments, only the personal lines segment posted an underwriting loss. (A third segment, Bond & Specialty, had the best combined ratio but 3.9 points of deterioration in the underlying loss ratio for that segment came from losses related to distressed financial institutions. Related article, “No Such Thing as a ‘Run on the Bank’ in Insurance Biz: Travelers CEO“)

Added together, an underwriting profit of $367 million together with $663 million of net investment income, helped to bring bottom-line net income to $975 million after taxes, roughly 4 percent lower than last year’s first quarter.

Travelers’ executives, including Greg Toczydlowski, president of Business Insurance, highlighted the 14.5 percent jump in net written premiums for the Business Insurance segment to its record-setting level during an earnings call yesterday, saying that it was fueled by historically high renewal premium change and retention, as well as record new business levels. In addition, a quota share arrangement with Fidelis Insurance contributed roughly $160 million, or 3.5 percentage points of net written premium growth in the segment, noted Travelers CEO Alan Schnitzer.

Turning to profitability, excluding the impact of catastrophe losses, which added 4.4 points to the combined ratio, and also excluding a small amount of prior-year loss reserve development, the quarter’s underlying combined ratio of 89.6 for the Business Insurance segment was 2.2 points better than the prior-year quarter.

In personal lines, a 101.5 combined ratio booked for first-quarter 2023 included 9.4 points of catastrophe losses and less than a point (0.8 points) of favorable prior-year development. Excluding the cat losses and reserve takedowns, the underlying combined ratio for personal lines was 92.9—just about even with last year’s first-quarter combined ratio, said Michael Klein, president of the personal lines segment. Elevated losses in the auto line were largely offset by the benefit of earned pricing in both auto and homeowners, and lower non-cat winter weather losses in homeowners, he said, explaining the similar results in the two quarters.

For just the personal auto line by itself, the first-quarter booked combined ratio was 104.7, with an underlying combined ratio of 103.4. “Increased vehicle replacement and repair costs, higher bodily injury severity, and to a lesser extent higher frequency” pushed the underlying combined ratio up 4.6 points over first-quarter 2022, Klein said, noting that the increases were partially offset by the growing benefit of earned pricing as well as the lower expense ratio.

Domestic automobile renewal premium change was 13.9 percent in the quarter, up 2.5 points from fourth-quarter 2022, he said, adding that Travelers expects renewal premium change to be modestly higher than this level throughout the remainder of 2023.

“We’ve shared previously that we expect written pricing in auto to be adequate in states representing the majority of our premium by midyear. While the loss environment is incrementally more challenging, we are adjusting our pricing plan accordingly and still expect to get there or very close to it,” he said.

“We will continue to pursue rate increases necessary to deliver target returns and the benefits of this increased pricing will earn into our results over time.”

Later, he reported that the state of California approved a 19-point auto rate change last week, which will take effect on May 31. That is “one piece of the puzzle in terms of why we see renewal premium change going higher from here,” he said.

On the commercial side, executives addressed a number of questions about the commercial lines pricing environment.

“I would say the pricing environment remains very strong,” Schnitzer responded, noting that Travelers’ renewal rate figures evidenced some acceleration in property, umbrella and auto. “We’ll just have to see whether that’s the start of the trend in that direction or it’s not,” he said, also highlighting the fact that even with another quarter of very strong pricing (renewal premium changes near 10 percent for domestic business other than national accounts), Travelers’ customer retention levels remain at historical highs for the carrier.

Across all three insurance segments of its business—Business Insurance, Bond & Specialty, and Personal—Travelers posted an underwriting gain of $367 million compared to a $659 million underwriting profit in first-quarter 2022. A key driver of the lower result was $ 535 million of pre-tax catastrophe losses.

For the quarter, net investment income rose 26 percent to $663 million, and the carrier posted $5 million of realized investment gains vs. $19 million of realized losses in first-quarter 2022.

Overall, net income came in at $975 million after taxes, roughly 4 percent lower than last year’s first quarter.

Beyond Automation: The Emerging Role for Contextual AI in Insurance

Beyond Automation: The Emerging Role for Contextual AI in Insurance  The Future of HR Is AI

The Future of HR Is AI  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec  From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation