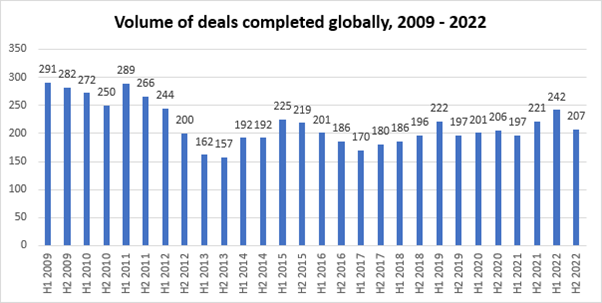

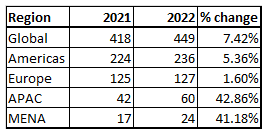

The insurance sector saw 449 completed mergers and acquisitions (M&A) worldwide during 2022, up from 418 the previous year — the highest for a decade, according to law firm Clyde & Co’s insurance growth report.

However, there was a marked downturn in the second half of the year with 207 deals completed, compared to 242 in H1, as economic and inflationary pressures began to impact investor sentiment, said the report titled “Insurance Growth Report 2023.”

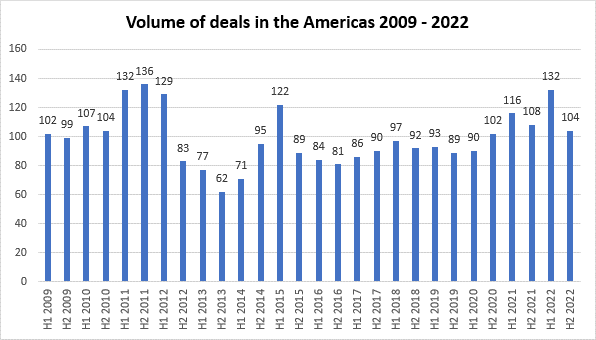

The Americas remained the most active region for M&A in 2022 with 236 deals, up 5 percent on 2021. Deal volume in H1 2022 reached its highest level since 2011 with 132 deals but dropped 21 percent in the second half of the year to 104, said the Clyde & Co. report.

Asia-Pacific saw the highest year-on-year increase in percentage terms with 60 transactions in 2022, up from 42 in 2021. It also saw an 22 percent increase in the second half of the year, the only region not to experience a dip in that period.

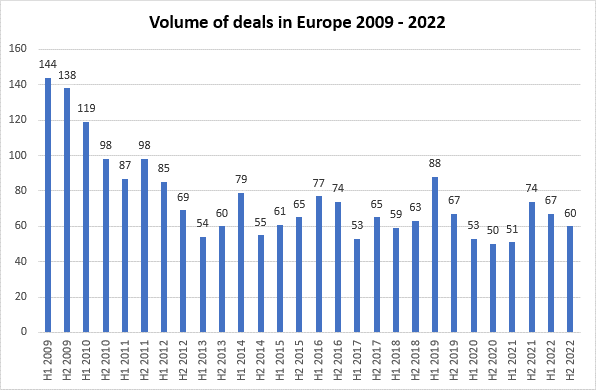

Activity in the Middle East and Africa was up 41 percent year-on-year, propelled by a strong first half (16 deals) followed by just eight in H2 2022. Europe saw the smallest annual increase with 127 transactions in 2022, up from 125 previous year, while H2 2022 marked the second consecutive period of declining activity in the region.

“Despite the return of inflation, and measures from central banks to restrict liquidity, deals that were put on hold during the pandemic continued to come to market in 2022, maintaining the upswing in deal-making that began the previous year,” commented Eva-Maria Barbosa, chair of Clyde & Co’s Corporate & Advisory Group, in a statement.

“However, looking ahead, underlying trends point to mixed investor sentiment. Deal-makers in the Americas and Europe are displaying a heightened sense of caution as they switch to wait-and-see mode in the face of market uncertainty, which will likely result in a lag in overall transaction volume,” she added.

“In contrast, investors in Asia-Pacific were generally slower to regain confidence post-pandemic but have put that reticence behind them with a consistent and increasing trend of rising deal numbers. The re-opening of China’s borders following lockdown restrictions will only serve to bolster confidence in the region further,” Barbosa said.

Two-Speed Market

Last year, the number of “mega-deals” in the insurance M&A market — or those valued in excess of $1 billion — dropped to 19 from 25 the previous year, but there is an expectation that 2023 could see the return of big M&A transactions, Clyde & Co. said.

“We are expecting a two-speed 2023. Small to medium-sized enterprises will continue to be wary of transactions as they wait for the current market uncertainty to subside,” Barbosa said.

“In contrast, large global insurance businesses seem undeterred by market conditions. With limitations on the amount of organic growth that can be generated through new distribution networks or broader lines of business, those firms that want to leap forward and grow quickly are actively seeking merger and acquisition opportunities,” she added.

“Private equity funds have largely been absent from the insurance market over the past year but have maintained their focus on larger M&A targets in anticipation of potential opportunities.”

MGAs Remain Viable Option

As insurers continue to look beyond M&A for growth opportunities, MGAs remain a viable option for insurers who want to penetrate further into markets where they lack the appropriate depth or breadth of underwriting expertise.

“In the U.S., reinsurers are exercising heightened caution with respect to what’s being written under producer agreements between insurers and MGAs/MGUs,” commented Marc Voses, partner for Clyde & Co. in New York.

“In particular, there’s a focus on exactly how the pen is being monitored for compliance with underwriting guidelines. How exactly are insurers making sure that the risks being reinsured fall within the loss profile intended to be covered by the underlying insurance contract?” Voses said.

“Meanwhile, in Europe, as rates continue to harden, an MGA arrangement is a popular route to increase market share,” he noted. “Some MGAs are entering a new growth stage, either through bringing original products to market, or looking to transition into becoming a full-stack risk carrier.”

Impact of Regulatory Action

Heavy regulatory activity is proving a double-edged sword for insurance carriers. In some jurisdictions it is affecting their capacity for organic growth, while in others it is acting as a spur for consolidation or the opening of new sections of the market.

“There is a definite push to develop a private pensions infrastructure in China, with commercial banks, wealth management firms and insurance companies being encouraged to develop the pensions business on the mainland,” according to Joyce Chan, partner for Clyde & Co. in Hong Kong. “Considering the size of the working population, this could be huge, and could mean many new opportunities for international insurers/pension players.”

By contrast, regulation is acting as a brake on growth in other jurisdictions, she said. “In certain areas the increasing demands of compliance are acting as a drain on insurers’ resources. For example, consumer protection laws are making it harder to do the same volumes of business across multiple markets, with data protection laws a common area of focus across the world.”

Mixed Outlook Ahead

Market sentiment indicates that the worst of the economic downturn is past in most parts of the world and that deal-making will come back on the agenda. Clyde & Co expects M&A volume to drop from the highs of 2022 but start to rebound in the second half of 2023, with larger deals especially in focus.

“Uncertainty continues to provide barriers to growth for the insurance sector, with significant headwinds coming out of the events of the last year,” Barbosa said.

“The war in Ukraine continues to complicate global trade and drive up costs, while some eye-opening weather events in 2022 that exceeded all loss expectations have confounded the property catastrophe re/insurance market,” she added.

“However, there is optimism that the economy is set to emerge from this difficult period as inflation stabilizes. When it does there remains plenty of capital to be deployed and likely no shortage of M&A targets,” she added. “As investor sentiment improves, ambitious insurers, particularly at the top end of the market – as well as private equity houses – will move to seize these opportunities.”

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next  New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec