U.S. property/casualty insurance net income dropped by more than a fourth in the first nine months of 2020 as the industry was hammered by COVID-19 and an historic catastrophe season, according to a new repot from data firm Verisk and the American Property Casualty Insurance Association.

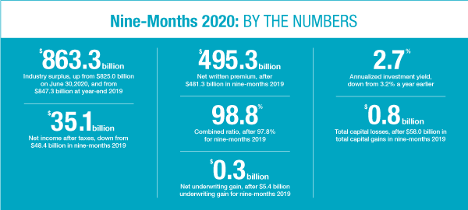

In the first nine months of 2020, net income in the sector dropped 27.5 percent to $35.1 billion and net underwriting gains declined to $0.3 billion, from $5.4 billion a year earlier, the report noted.

Verisk/APCIA blamed the deterioration in underwriting results, in part, on the losses and loss adjustment expenses from catastrophes, which more than doubled to $47.1 billion for nine-months 2020 from $21.5 billion in the same nine-month period a year earlier.

Verisk’s PCS reported that 2020 set a record for the number of U.S. catastrophic events. The 2020 catastrophes included 19 events with at least $1 billion in direct insured losses in the United States (17 in the first nine months), including the first riot and civil disorder event to exceed that threshold.

The U.S. also recorded one of the largest deteriorations on the Verisk Maplecroft Civil Unrest Index over the past year—increasing from the 91st riskiest jurisdiction by the second quarter of 2020 to the 34th. The index assesses the risk of disruption to business caused by civil unrest and includes a spectrum of incidents, from protests to violent mass demonstrations and rioting.

Auto Insurers

There were some bright spots. Auto insurers, for example, benefited from the reduced driving activity due to the pandemic during the first nine months of 2020, with the pure loss ratio for auto insurance improving to 56.6 from 65 compared to the same period in the previous year. Many auto insurers provided partial premium refunds to current policyholders and adjusted their rates. Verisk’s ISO estimates that insurers provided approximately $11 billion in direct premium refunds and renewal credits to policyholders.

According to Verisk, the effect of prospective rate changes driven in part by COVID-19 can’t be reliably estimated.

Policyholders’ surplus rose $16 billion to $863.3 billion as of Sept. 30, 2020, from $847.3 billion as of Dec. 31, 2019, driven by growth in the stock market.

The report said that while it might take time before the insured losses directly attributable to pandemic can be reliably estimated, the impact on premiums was immediate. Due to the economic disruption, consumers and businesses deferred and canceled large purchases and capital investments, which led to reduced premium activity. The written direct premium growth slowed to 2.3 percent for the first nine months of 2020 compared to 4.8 percent in the same time period in 2019.

Robert Gordon, APCIA senior vice president, policy, research and international, said analysts expect commercial lines insurers to face significant reductions in premiums due to audits that reflect reduced revenues and payrolls.

“The industry continues to face the strong headwinds of unknown but potentially severe future COVID-19 related losses and long-term claims,” Gordon said.

The COVID-19 vaccines should help the economic recovery going forward but many questions remain.

“The beginning of COVID-19 vaccination efforts has provided some hope for people in the United States and across the globe,” said Neil Spector, president of ISO at Verisk. “But the U.S. economy and the insurance industry still face many challenges which will depend on our progress in ending the pandemic.”

“How long will it take to vaccinate the majority of the population? What impact will new strains of the disease have on its spread? How will businesses that require large in-person crowds continue to survive? Which of the pandemic-driven changes are here to stay? All of these questions will have a major impact on the types of insurance and service that customers expect,” Spector added.

Third-Quarter Results

After taxes, insurers’ net income fell to $10.9 billion in third-quarter 2020 from $15.4 billion in third-quarter 2019, and their combined ratio deteriorated to 101.3 in third-quarter 2020 from 98.8 in the same period a year earlier.

Net written premiums rose $5.0 billion, or 3.0 percent, to $171.3 billion in third-quarter 2020 from $166.2 billion in third-quarter 2019. Net earned premiums grew 2.3 percent to $162.9 billion in third-quarter 2020 from $159.2 billion from the third quarter a year earlier.

Source: Verisk/ APCIA

*A version of this story ran previously in our sister publication Insurance Journal.

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage  Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard