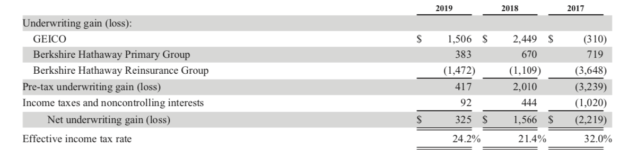

Full-year insurance results at Berkshire Hathaway disappointed in 2019, with after-tax earnings from underwriting falling to $325 million in 2019 compared to $1.6 billion in 2018.

Earnings from primary insurance operations were lower in 2019 and losses from reinsurance were higher than in 2018.

The underwriting results reflected losses from catastrophe events of approximately $800 million in 2019 (compared to $1.3 billion in 2018 and $1.95 billion in 2017).

However, after-tax earnings from insurance investment income in 2019 increased 21.4 percent over 2018, which increased 17.2 percent over 2017.

While 2019 was not as good as 2018, Berkshire Hathaway property/casualty insurance companies have been on a good run, achieving an underwriting profit for 16 of the last 17 years, the exception being 2017, when the loss was a huge $3.2 billion. For the entire 17-year span, the pre-tax gain totaled $27.5 billion, of which $400 million was recorded in 2019.

“That record is no accident: Disciplined risk evaluation is the daily focus of our insurance managers, who know that the rewards of float can be drowned by poor underwriting results. All insurers give that message lip service. At Berkshire it is a religion, Old Testament style,” CEO Warren Buffett wrote.

The fourth quarter of 2019 generated an underwriting loss of $857 million compared to a loss in the fourth quarter of 2018 of $225 million.

At Dec. 31, 2019, insurance float was approximately $129 billion, an increase of $6 billion since year-end 2018.

2019 Insurance Full-Year Results

Berkshire Hathaway’s insurance and reinsurance businesses are GEICO, Berkshire Hathaway Primary Group and Berkshire Hathaway Reinsurance Group. Underwriting results are summarized below (dollars in millions).

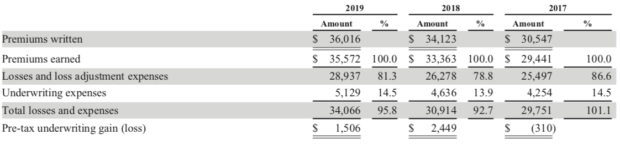

GEICO

Private passenger automobile insurer GEICO’s premiums written and earned in 2019 increased 5.5 percent and 6.6 percent, respectively, compared to 2018. The loss ratio increase in 2019 reflected continuing increases in loss severities, slightly offset by lower storm-related losses.

Claims frequencies in 2019 declined compared to 2018 for property damage and collision coverages (2-4 percent range) and personal injury protection coverage (1-2 percent range) and were relatively unchanged for bodily injury coverage. Average claims severities in 2019 were higher versus 2018 for property damage and collision coverages (4-6 percent range) and bodily injury coverage (7-9 percent range).

The underwriting expense increase was primarily attributable to increases in advertising expenses and employee-related costs, which reflected wage and staffing increases. GEICO’s underwriting results are summarized below (dollars in millions).

GEICO Results 2019

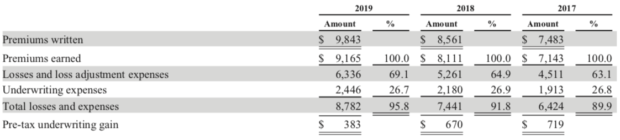

Berkshire Hathaway Primary Group

The Berkshire Hathaway Primary Group sells commercial insurance including healthcare malpractice, workers compensation, automobile, general liability, property and various specialty coverages for small, medium and large clients. The companies include Berkshire Hathaway Specialty Insurance, Homestate Cos., MedPro Group, GUARD Insurance Cos. and National Indemnity. Other BH Primary insurers include U.S. Liability Insurance Co., Applied Underwriters (sold in October 2019), Central States Indemnity Co. and MLMIC Insurance Co., acquired Oct. 1, 2018.

An increase in written premiums in 2019 was primarily attributable to volume increases from BH Specialty (30 percent), GUARD (28 percent) and MedPro Group (14 percent) and from the effects of the MLMIC acquisition, partially offset by the effects of the divestiture of Applied Underwriters and lower volume at BHHC. There were no losses from significant catastrophe events in 2019 that affected BH Primary. Underwriting results in 2018 included estimated losses from Hurricanes Florence and Michael and the wildfires in California of approximately $190 million. Underwriting results are summarized below (dollars in millions).

Berkshire Hathaway Primary Group 2019 Results

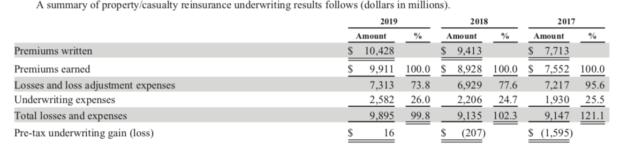

Berkshire Hathaway Property/Casualty Reinsurance

Property/casualty reinsurance premiums written in 2019 of $10.4 billion represented an increase of 10.8 percent compared to 2018. Premiums earned in 2019 increased $983 million (11.0 percent) versus 2018. The increase in premiums written reflected overall growth in U.S. and international markets. The growth was primarily attributable to new business, net of non-renewals, and increased participations for renewal business, partly offset by the unfavorable foreign currency translation effects of a stronger U.S. dollar.

Losses and loss adjustment expenses were $7.3 billion in 2019, $6.9 billion in 2018 and $7.2 billion in 2017, and losses and loss adjustment expense ratios were 73.8 percent in 2019, 77.6 percent in 2018 and 95.6 percent in 2017. Losses and loss adjustment expenses included incurred losses from significant catastrophe events occurring each year, including approximately $1.0 billion in 2019 ($700 million in the fourth quarter), $1.3 billion in 2018 ($1.1 billion in the fourth quarter) and $2.4 billion in 2017. Losses in 2019 derived from Typhoons Faxia and Hagibis and wildfires in California and Australia. Losses in 2018 derived from Hurricanes Florence and Michael, Typhoon Jebi and wildfires in California. Losses in 2017 derived from Hurricanes Harvey, Irma and Maria, an earthquake in Mexico, a cyclone in Australia and wildfires in California. Underwriting results are summarized below (dollars in millions).

Berkshire Hathaway Property/Casualty Reinsurance Group Results 2019

On Guard

In his annual letter to Berkshire Hathaway shareholders about 2019 annual report, CEO Warren Buffett gave a shout-out to one of his insurance companies in particular, suggesting big things may be ahead:

“Close your eyes for a moment and try to envision a locale that might spawn a dynamic P/C insurer. New York? London? Silicon Valley? How about Wilkes-Barre?

“Late in 2012, Ajit Jain, the invaluable manager of our insurance operations, called to tell me that he was buying a tiny company – GUARD Insurance Group – in that small Pennsylvania city for $221 million (roughly its net worth at the time). He added that Sy Foguel, GUARD’s CEO, was going to be a star at Berkshire. Both GUARD and Sy were new names to me. Bingo and bingo: In 2019, GUARD had premium volume of $1.9 billion, up 379% since 2012, and also delivered a satisfactory underwriting profit. Since joining Berkshire, Sy has led the company into both new products and new regions of the country and has increased GUARD’s float by 265%. In 1967, Omaha seemed an unlikely launching pad for a P/C giant. Wilkes-Barre may well deliver a similar surprise.”

Berkshire Hathaway Corp.

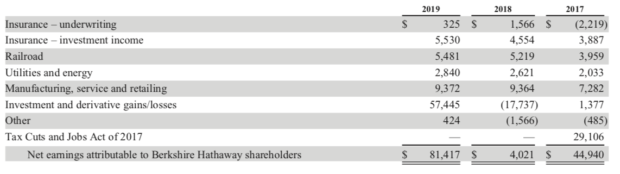

For all of Berkshire Hathaway in 2019, net income totaled $81.42 billion, which beat the 2017 record of $44.94 billion. Berkshire Hathaway Corp. full-year 2019 results are summarized below (dollars in millions). For the fourth quarter, net earnings for the full corporation were $29.1 billion compared to a $25.4 billion loss in 2018 fourth quarter. Results are summarized below (dollars in millions).

Berkshire Hathaway Corp. 2019 Results

*This story ran previously in our sister publication Insurance Journal.

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best  New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies  Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers