InsurTech startup Avinew has raised $5 million in seed financing from American Family Insurance and others, with an eye on helping auto insurers reward drivers that use autonomous and semi-autonomous driving tech.

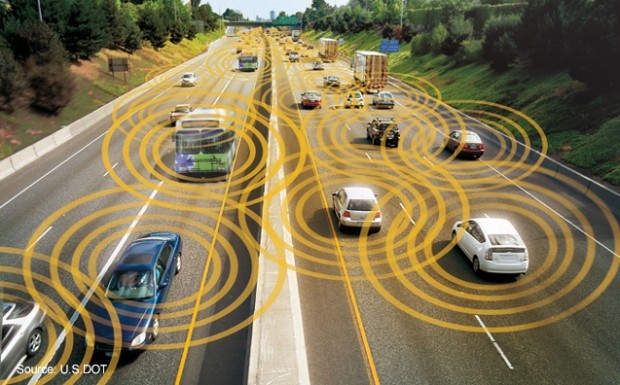

Plans call for using the money to advance Avinew’s technology, which uses artificial intelligence and telematics to gather driving data to determine when a car is in autopilot and/or using advanced safety features. That data is designed to shape coverage that rewards customers for using their vehicles’ autonomous/other safety features. Avinew bills itself as a technology company working with insurers but someday hopes to be an insurer itself, a spokesperson said

To date, Tesla, Mercedes, Ford, GM, Nissan, Audi and Volvo vehicles will be eligible, the California startup said.

To date, Tesla, Mercedes, Ford, GM, Nissan, Audi and Volvo vehicles will be eligible, the California startup said.

Crosscut led the financing round. American Family’s venture arm, American Family Ventures, also participated, along with Draper Frontier and RPM Ventures.

“The cars we drive are changing, and there’s a huge opportunity for auto insurance to change as technology helps our cars and roads become safer,” Avinew founder and CEO Dan Peate said in prepared remarks. “Our goal is to enable the safety, savings and freedom that come with autonomous driving.”

Peate explained that his company sees its technology as enabling insurance coverage that encourages consumers to use “features like Autopilot, Super Cruise, Co-Pilot 360 and ProPILOT Assist.” By doing so, this “will make the roads safer for all of us,” he said.

Plans call for launching Avinew’s insurance programs later this year “in select states,” and they’re slated to be autonomous/usage-based.

The company said it has so far finished proof-of-concept pilot programs with two unnamed insurers.

In a related move, Avinew announced that Jeremy Snyder, a 10-year Tesla veteran who served as its head of Global Business Development and Special Projects, will become Avinew’s chief operating officer.

Source: Avinew

Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered  10 Do’s and Don’ts of a Smart ORSA Report

10 Do’s and Don’ts of a Smart ORSA Report  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers