Two-thirds of insurers surveyed say they’re planning to hire more in 2016, but whether they will actually go through with those plans remains a question.

In fact, 14 percent of insurers decreased their staffs in 2015, even though less than 5 percent thought they would do so at the start of last year.

Jeff Rieder, a partner of Aon Hewitt and head of Ward Group, and Gregory Jacobson, chief executive officer of The Jacobson Group, revealed the results from the Semi-Annual U.S. Insurance Labor Study conducted by the two firms during a webinar last month.

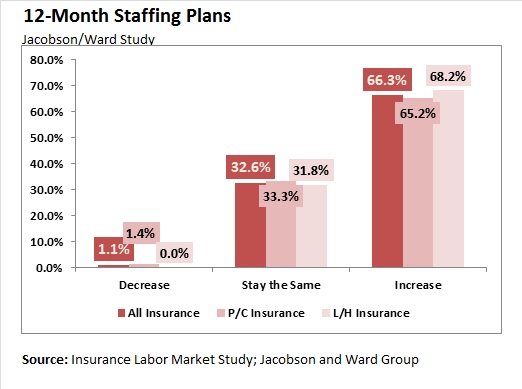

According to the latest iteration of the study, 66.3 percent of insurers polled in December and January said they intend to increase staff size in 2016—”the highest anticipated rate in the seven-year history of our survey,” according to Jacobson. “It is clear that the insurance industry is focused on building staff, resulting in an increasingly competitive labor market,” he said.

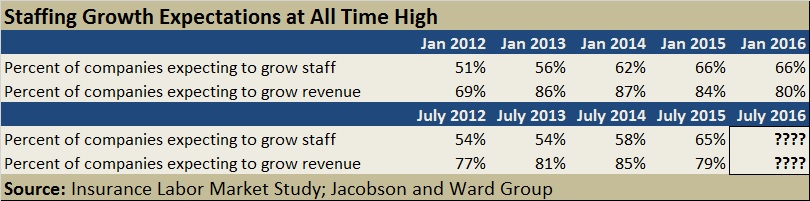

But later, comparing the latest results to staffing expectations indicated by the January 2015 and June 2015 surveys, Rieder noted that carriers are typically more optimistic at the beginning of the year than at midyear.

And comparing last year’s initial January 2015 expectations to the employment changes that actually played out in 2015 (as reported by the survey participants in January 2016), Jacobson noted two diverging trends:

- There were more decreases in staffing than anticipated—driven mainly by a handful of large insurers. Even though less than 5 percent of all respondents (property/casualty and life/health) expected to decrease employee count going into the year, nearly 8 percent wound up shrinking staff size by more than 5 percent, with 2.2 percent reducing staff by more than 20 percent.

- On the other end of the spectrum, a higher percentage of companies reported double-digit jumps in employee counts than anticipated.

According to slides presented during the webinar, 18.5 percent of carriers increased staff by 10 percent or more last year. That was 10 percent more than the 8.5 percent who thought they would have double-digit workforce increases going into 2015 at the start of last year.

Addressing the workforce cuts, Jacobson noted that on the P/C side, 10 percent of carriers surveyed reduced staff last year. “The majority of those companies were not reducing a lot of staff. There were between three and five large company outliers that announced plans to lay off people. That had a bigger impact than anything else because we’re not talking about huge numbers here in terms of total employment,” he said, noting that employment totals roughly 500,000 for P/C carriers in the United States.

But “we were seeing almost a knee-jerk reaction on the part of larger companies where they weren’t hitting their [revenue] growth targets,” Jacobson said, adding that almost 20 percent of the largest companies in the study reduced staff last year. “So, they’re making decisions based on what the [revenue] projections are. If they don’t hit their projections, they’re making adjustments very, very quickly,” Jacobson said.

As in past years, the study asked carriers about both expected revenue growth and employment growth plans. Rieder noted that carrier staffing plans tend to be correlated highly with revenue expectations for companies that are growing over time. (See chart above.) But while 80 percent of carriers are anticipating top-line growth this year—among the highest percentages recorded in the history of the survey—Rieder is skeptical that they’ll achieve those targets.

“It’s surprising to see only 2 percent anticipating decreased revenue. Going into this softening market cycle that we are in right now, I think that might be ambitious for many companies. We would expect there to be a greater percentage of companies decreasing revenue here in 2016.”

He continued, “Given the fact that we’re in a sharply declining investment market with a lot of instability there, my expectation is that both these numbers [expected revenue and staffing] will be less than what they currently are.” Noting that the surveys were filled out largely in the December-January time frame, he suggested that stock market activity in the last six months is likely to temper revenue growth plans and may also have an impact on carriers’ staffing expectations.

“We do always see this in the January cycle—that companies are a bit more optimistic about what the future holds, and as typical we expect to see some deterioration in these numbers in July,” he added.

Referring to the gap between the level of carriers expecting to decrease staff in January 2015 (4.7 percent) and the percentage that actually had workforce declines (14.2 percent), Jacobson offered similar observations. “Eighty percent of these companies are planning on growing, but they’re not all growing. So, they’re ratcheting down on their hiring plans,” he said.

Breaking down the actual staffing declines in 2015, Rieder noted that while 14 percent of carriers overall had workforce reductions, the comparable figure for P/C carriers was just 10 percent. “It did appear that some of the knee-jerk reaction was a bit more influenced by the life/health companies,” Rieder said, reporting that 27 percent of L/H carriers said they had staff reductions in 2015.

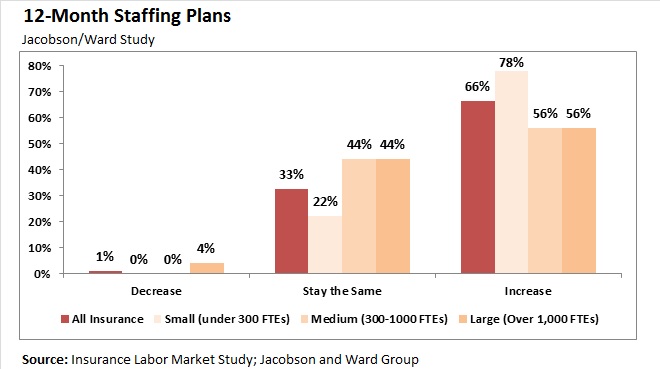

The graphs below summarize the survey results related to staffing expectations going forward, revealing differences by carrier type and size. Seventy-eight percent of small companies are expecting to increase staff in the next 12 months, compared to 56 percent of larger companies, for example.

Overall, the Jacobson/Ward survey for 2016 encompassed roughly 10 percent of the U.S insurance carrier employment market, weighted toward the P/C industry (at 74 percent of respondents) and toward regional carriers (at 56 percent), with the average number of employees per respondent coming in at 1,776. Almost half (49 percent) of the companies surveyed are small companies, defined as those with less than 300 FTEs; almost one-third (30 percent) are large companies with over 1,000 FTEs.

PwC CEO Survey: A Different View

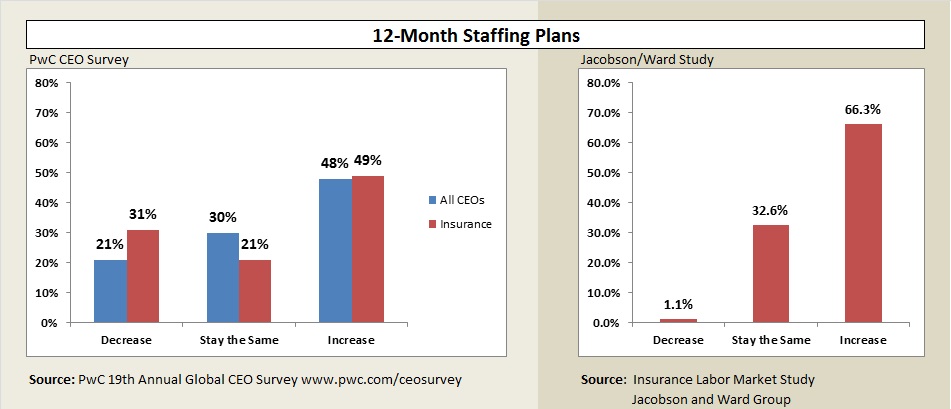

A separate study from PwC—the 19th Annual Global CEO Survey—offers a slightly different view of insurer staffing expectations, perhaps reflecting a different slice of the insurance market. The PwC study, which includes the viewpoints of 101 insurance CEOs in 43 countries, reveals that less than half expect to increase staff this year—on par with CEOs from other industries (left-hand side of graphic below; click to expand).

Where the insurance industry respondents to the PwC survey break away from their counterparts in other industries—and with carrier respondents to the Jacobson/ Ward study—is in their expectations about staffing cuts. The PwC report shows 31 percent of insurance industry respondents anticipating staff declines compared to 21 percent for all industries and to only 1.1 percent of insurance respondents to the Jacobson/Ward survey.

Size and geography may explain some of the differences. While the PwC report does not give details about the 101 insurance industry respondents beyond the fact that they are from 43 countries, it does say that across all industries included in the survey, only 10 percent of more than 1,400 CEOs were from the United States and that all companies included had more than 500 employees and revenues of more than $50 million.

Talent Competition Still Rages

Still, the majority of carriers participating in both surveys anticipate either hiring more talent in 2016 or maintaining the same level of employment.

Unemployment in the industry is near an all-time low of roughly 2.0 percent, Jacobson said, as he showed a graph of unemployment rates dating back to the year 2000 from the U.S. Bureau of Labor Statistics.

He noted that in spite of last year’s workforce cuts from a handful of outliers (a loss of about 600 jobs in total), insurance companies have increased employment by 5.2 percent since the economy recovery from the Great Recession began in April 2011. “There were a lot more companies growing than shrinking,” he said.

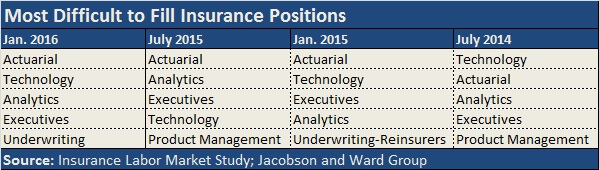

The war for talent continues, he and Rieder said, highlighting the hot areas of actuarial talent, analytics and underwriting.

Among 12 disciplines that the Jacobson/Ward Survey tracks, nine saw the level of recruiting difficulty ease up slightly last year, according to survey respondents. Respondents score the degree of difficulty in recruiting for various types of positions on a 1-10 scale, with higher numbers indicating more staffing problems.

Most jobs, however, are still considered difficult to fill—achieving a difficulty score of 5 or more. Only operations and accounting jobs were viewed by respondents as relatively easy to fill.

Rieder said that, in general, larger companies are finding recruiting more difficult than smaller ones overall. “Smaller companies are relying more on relationships than larger companies are able to as a percentage of total hiring,” he suggested.

In addition, he said, personal lines companies are having a significantly more difficult time recruiting project management people, highlighting that as an area of “constant churn.”

On the flip side of that, Jacobson said, underwriters in personal lines were easier to recruit than for commercial lines companies. “It shows up the emphasis on the account-based underwriting in commercial lines vs. the portfolio, project management approach that you’d see in personal lines.”

More generally, Jacobson reported anecdotally that “there were a significant number of companies that were not able to achieve [planned] initiatives last year…because of not being able to attract the type of talent they were looking for to move forward on those initiatives.”

For more suggestions on strategies for filling the ranks of P/C carriers, see these related articles:

Who’s Hiring? For What Jobs?

Despite the fact that the insurance pricing environment is more favorable in personal lines than commercial, “we’re actually seeing that some of the growth in headcount is coming just a bit more from the commercial lines market,” Rieder said, also noting that companies anticipating workforce decreases are all on the personal lines side.

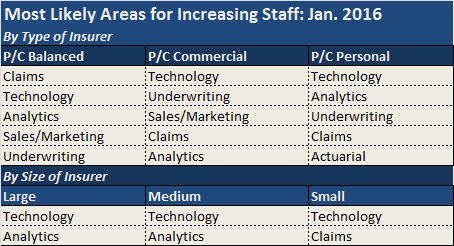

In terms of what positions carriers are looking to fill in 2016, the technology function leads the way for P/C commercial insurers and P/C personal lines insurers, while claims is a top area to fill for companies that described themselves as more balanced (with an even mix of personal and commercial lines).

While technology remains the greatest area of demand overall, there’s a sharp difference between commercial lines companies and any other type of company, Rieder said. Scoring the likelihood of hiring in each discipline on a scale of 1 to 8, commercial lines carriers came in at 7.9 for technology spots; balanced, personal and life companies put the likelihood score in the 5.5-6.0 range, he reported. Many of the commercial lines insurers are in the process of replacing policy administration and claims systems, he said, suggesting that the core systems projects are probable drivers of the greater demand.

The survey also asked carriers to select reasons for increasing or decreasing staffing overall. Those expecting to expand their workforces said they anticipated increases in business volume (57 percent) or that they expect to move into new business lines or markets (54 percent).

As for those anticipating workforce reductions, 21 percent of companies report that automation will be the primary reason.

Reporting on trends beyond full-time employment, the survey revealed that 88 percent of carriers expect to maintain current levels of temporary employment, with just about 5 percent expecting to increase their temporary hires.

Jacobson, who noted that temporary employment across all industries is at the highest rate in the history of the temporary staffing business, said that his firm actually places 70-80 actuaries to insurance companies on a temporary basis.

While business-process outsourcing is not something that is tracked in the survey, Rieder responded to a webinar participant’s question with some anecdotal information as well.

“We are seeing more companies evaluate the utilization of BPO, he said. “In the past, it had been focused more on billing and customer-service type functions. Now, companies are seeing if they can do that for their financial functions—accounts receivable, accounts payable and other noncore financial functions”—in addition to IT areas where companies have been outsourcing for some time. “If they are investigating [this] for the first time, they tend to be a company in a distressed expense situation—meaning they have a higher headcount or they have too many people located in high-cost geographical areas…Alternatively, companies located in the Midwest and rural areas don’t have as much stress to do that. Despite the recruiting challenges, they are still able to meet the core customer-service needs,” he said.

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  The Future of HR Is AI

The Future of HR Is AI  High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best