In spite of fading carrier optimism about revenue growth and increasing activity on the M&A front, unemployment in the insurance industry remains near an all-time low.

For carriers, that means more struggles in hiring talent—especially in the hot areas of actuarial and analytics talent on the personal lines side of the business, according to Greg Jacobson, chief executive officer of The Jacobson Group.

Reporting results of their Semi-Annual U.S. Insurance Labor Outlook Study on a webinar last week, Jacobson and Jeff Rieder, partner and leader of Ward Group, representing the firms that conducted the midyear survey of insurers—mostly from the property/casualty space—said that slots for actuaries and analytics gurus surpassed technology professionals and executives as the most difficult to fill based on survey responses. Comparative survey results showing difficulty rankings from the latest survey in July 2015 and two prior surveys are set forth below.

For personal lines actuaries, the average score was 8.2, and for positions in analytics for personal lines the score was 8.0, Jacobson reported. “Just to give you comparison to what I would have expected to be the most difficult position that we typically have to fill—commercial lines underwriting roles—that’s 6.6. So we see an intensity that’s coming up in personal lines,” Jacobson said.

In terms of relative difficulty, technology dropped to the fourth-ranked function overall (for personal and commercial lines together), Rieder said, adding that technology had reigned as the No. 1 most difficult function for recruiting purposes over a number of years. A second-place ranking was the previous low for tech jobs in the industry.

“By no means do we want to say that it’s easy to recruit for technology,” Rieder said. Instead, the latest numbers really just emphasize the growth in the analytical and the actuarial expertise that companies are trying to put on, he said.

Ten of the 12 disciplines are now considered at least “moderately difficult” to fill—with scores of 5 or greater. Falling just below that midrange score are positions in accounting and operations, according to a graph included in the study.

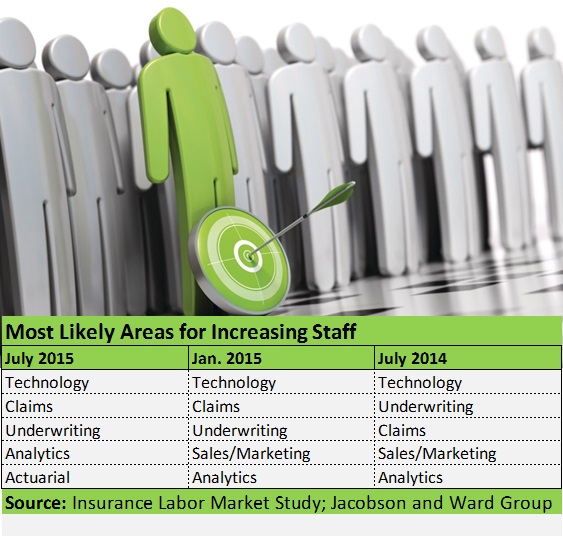

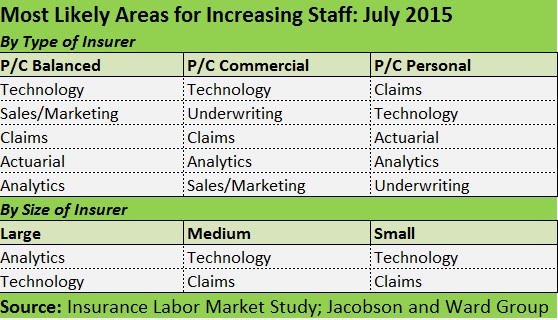

In addition, tech and claims remain the No. 1 and No. 2 areas where companies anticipate growing staff over the next 12 months. Those are followed by underwriting and analytics.

The report also shows differences in hiring expectations for three different segments of the P/C market: personal lines companies, commercial lines companies and balanced companies (split between personal and commercial lines). While IT is the No. 1 area that P/C insurers expect to staff up across the board, in commercial lines, the tech and underwriting functions are “neck and neck” for the top spots for anticipated hires, Rieder said. On the personal lines side, claims is the area where companies are most eager to beef up staffing.

Overall, “while executives were the third hardest to recruit for, it’s actually the least likely function that companies will be growing,” Rieder said. “We have seen over the last three years that many of our clients are taking corrective actions to increase the span of control within the organization and essentially try[ing] to take out some redundant layers in their executive and supervisory ranks as well,” he said.

Expectations for Staff and Revenue Growth Overall

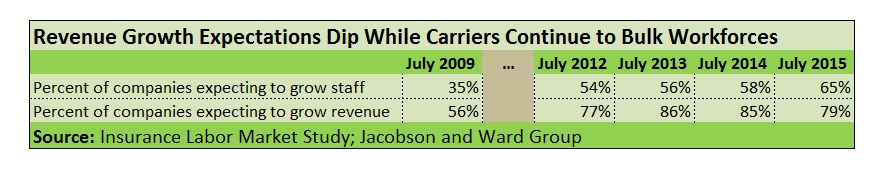

Across all positions and company sizes, 65 percent of insurance companies polled said they intend to increase staff in 2015. This is the second highest rate in the history of the survey. While it’s down slightly from a 66 percent figure in the prior (January 2015) survey, the latest figure represents an increase of seven points over the July 2014 survey response tally of 58 percent.

What intrigues Rieder and Jacobson most about the near-record high for staffing expectations is that it comes at the same time that the survey is capturing the lowest level of expected revenue growth since July 2012. The survey records 79 percent of insurers expecting revenues to grow over the next 12 months, down nearly 6 points from 85 percent in July 2014.

This was the first year-over-year decrease in revenue expectations for the midyear survey since it began in July 2009, Rieder reported.

“It’s still very, very high, but for the last couple of periods we’re showing that companies are less aggressive in their thinking about how much revenue they’ll grow. Yet we haven’t seen that wane in their plans from a hiring standpoint. The reason is because companies have not been able to hire as many people as they really need to,” Jacobson said. “Despite the softening conditions with the market, companies are making a very aggressive posture to grow staff and try to capture market share going forward,” he said.

Rieder agreed. “Many of the regional and super-regional companies are still being very aggressive in their goals to expand market share. We’re finding many are growing their product lines, their geographic footprint, and many are trying to expand their agency appointments as well.”

Illustrating the trends with numbers beyond the survey results, Jacobson noted that the U.S. Bureau of Labor Statistics reports 240,000 job openings in finance and insurance in 2015 on a monthly basis—twice the 2008 figure of 120,000 openings. Not only are a lot more jobs being opened up, “but it’s also becoming harder to fill jobs, and jobs are staying open longer,” he said.

The BLS also reported that the unemployment rate for the insurance industry dropped to 1.6 percent in July—the third-lowest reading of the past 15 years.

“Typically, that under 2 percent range [marks] the bottoming out of the cycle for the insurance labor market,” he said, suggesting that the bottom has actually not been reached this time around. “The trend is still downward pressure in terms of the unemployment rate,” he said.

On the flip side of unemployment, insurance carrier employment hit 1.5 million people for the first time since 2004, according to BLS figures. “We have recovered all the lost jobs that happened as a result of the Great Recession, but now we’re at an employment level that’s far greater than that,” Jacobson said.

While job losses in the past were driven by efficiencies created by technology, which fueled reductions in-force in staff, “that obviously has been transplanted by growth and by different types of people coming into the market,” he added, noting that 88,000 job were added in the insurance industry since April 2011.

What About M&A?

Addressing an audience question during the webinar about the impact that industry consolidation will have on the talent pool, Rieder said that while his firm would expect some more available talent within the market, “those tend to be more at the senior-level type positions rather than in the more day-to-day, customer-facing type activities.”

Jacobson added: “You have to look at the reasons why some of these deals have been put together. In the case of say XL and Catlin, there’s not really a lot of overlap in the types of people, the distribution systems and the products they’re writing. In the case of ACE and Chubb, there probably is, but it’s not going to result in mass layoffs,” he predicted.

More generally, in the case of any M&A transaction, “we do see significant stabilization of employees until the deal is actually signed, and then a significant number of defections once the deal is signed,” he said.

About the Survey

Overall, the Jacobson/Ward survey for 2015 encompassed roughly 13 percent of the U.S insurance carrier employment market, weighted to the P/C industry (at 83 percent of respondents) and toward regional carriers (at 55 percent) with the average number of employees per respondent coming in at 2,500.

More than half of the companies surveyed are small companies, defined as those with less than 300 FTEs; almost one-third are large companies with over 1,000 FTEs.

Large companies tended to be the most bullish about growing staff, with 72 percent saying they expect staff increases in the next 12 months. Next were the small companies, of which 64 percent expect more hires. Fifty-seven percent of medium-sized companies also expect to grow their workforces.

“The large companies are really focusing—especially in the personal lines P/C segment—on growing their market share. You see the amounts that companies are spending on advertising.” On the other end of the size spectrum, “you have these companies that are really focusing on carving out niches—whether it be in high-net-worth or low-value dwelling. So we’re seeing a lot of hiring going on in those two sizes of companies because of those two strategies,” Jacobson explained.

Across all sizes and types of insurers, the most common percentage increase in staffing levels is 2-4 percent, selected by 22 percent of respondents; roughly 31 percent expect to maintain the current staffing level, and another 20 percent expect to increase the overall employee count by less than 2 percent.

For more highlights, download the full insurance labor market study results summary.

About The Jacobson Group

The Jacobson Group is a global provider of insurance talent. For more than 40 years, we have been connecting insurance organizations with professionals from the board room to the back room on both a permanent and temporary basis. Further information is available at jacobsononline.com.

About Ward Group

Ward Group performs benchmarking and best practices studies for insurance companies. The firm analyzes staff levels, compensation, business practices and expenses for all areas of company operations and helps insurers measure results, optimize performance and improve profitability. For more information about Ward Group, visit www.wardinc.com.

Another Perspective

Erin Hamrick, a founding partner of Sterling James, discussed hiring trends at leadership levels of the P/C insurance industry in an interview with Carrier Management at the IICF Women in Insurance Global Conference in June.

“The types of people that are getting hired are either instantly accretive or instant gratification,” she said. She explains the terms and talks about hot areas and challenges on the commercial lines side of the P/C business in the accompanying video interview.

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec  Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best  From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation