Although insurers are finding it a little easier to recruit candidates for actuarial positions than insurance technology jobs in 2018, “the actuarial arena is set to reach a breaking point in terms of mid-level talent recruitment,” an insurance staffing firm says.

The Jacobson Group tweeted the comment about the “breaking point” recently to highlight a white paper on the firm’s website describing the problem.

According to the white paper, “The Actuarial Talent Challenge: Combating the Mid-Level Gap,” insurers are reporting a widening gap of actuarial talent with eight to 15 years of experience while entry level actuarial talent is available in record numbers.

Highlighting a big drop in the number of actuaries in their mid-to-late 30s, the paper suggests that actuaries in that age group have increasingly sought positions outside the insurance industry in recent years. The paper reasons that these individuals left because they could not climb the corporate ladder. Baby Boomers who delayed their retirements during the economic downturn stood in the way, according to The Jacobson Group authors, JoJo Harris, senior vice president of human resources, Joyce Dunn, vice president and managing director of the executive search practice, and Kylee Lacson, assistant vice president and practice lead for Group’s life team.

At the same time, with a rise in data-driven business operations in others industries, these actuaries were able to find highly quantitative non-actuarial positions elsewhere.

“The result is an exodus of actuarial talent that is unlikely to be reversed,” the paper says, added that a “snowball” effect for the insurance industry is the inability to fill senior and executive level positions in the future.

Employers looking for a mix of leadership, managerial and communication skills among actuaries are coming up short, the paper says, also pointing to cutbacks in training and professional development programs during the Great Recession.

On a positive note, the paper notes that record numbers of students are taking actuarial programs—so many, in fact, that there are not enough entry level jobs to go around. The authors estimate that only 25-30 percent of graduates find actuarial employment upon completing the programs.

Broader Trends

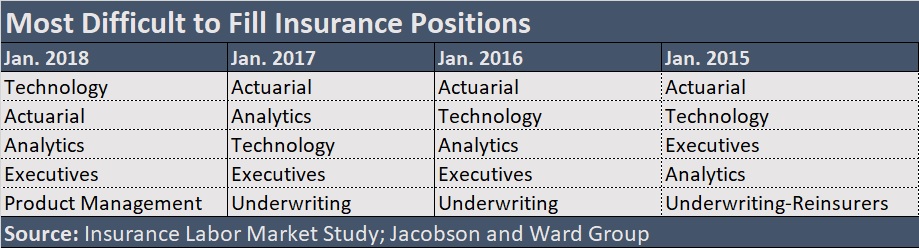

Separately, in mid-February, The Jacobson Group and Ward Group, a part of Aon plc, jointly released the latest iteration of the Semi-Annual U.S. Insurance Labor Outlook Study. Among the findings of that survey, which encompassed roughly 10 percent of the U.S. insurance carrier employment market (heavily weighted toward the P/C), carrier respondents said they found technology positions more difficult to fill than actuarial positions. Actuarial positions had previously ranked as the toughest positions to fill in prior iterations of the survey, all of which present broader findings, without reference to age or experience level.

Speaking during a webinar to present the Labor Outlook Study results, Gregory P. Jacobson, co-chief executive officer of Jacobson, noted that virtually every position with the exception of reinsurance underwriting, accounting and operations are considered moderately difficult to fill. In other words, respondents scored the difficulty at 5 or above on a 1-10 for all but those three areas. Jacobson attributed the difficulty in filling technology positions to the fact that many P/C insurance companies are going through systems integration transitions, adding that there are not enough people with experience that in specific systems that companies need to fill the available positions.

As for the subject of the white paper—the lack of mid-level actuarial talent—the white paper authors urge more focus on career development opportunities.

In addition to opening up career development for actuaries exiting the industry for non-actuarial roles, “development and training must be built into organizations’ cultures and should be incorporated as early as the onboarding process,” the paper says.

The paper offers advice about engaging experiences for actuaries all levels, as well as opportunities for development across “horizontal, vertical and diagonal paths” within organizations with the help of cross-department programs and rotational experiences, among other ideas.

To address immediate mid-level actuarial staffing problems, insurers might want to turn to contracted professionals, the paper also suggests.

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark  From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation  State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard