Most American International Group Inc. investors believe that billionaire activist Carl Icahn is right that the insurer needs a new strategy, according to a Sanford C. Bernstein & Co. analyst who polled shareholders.

In a survey of more than 100 investors, who probably represent more than a third of AIG’s shares, only 4 percent said they support the status quo, Bernstein’s Josh Stirling said Tuesday in a note.

Chief Executive Officer Peter Hancock has resisted Icahn’s call to divide AIG into three companies, one focusing on property-casualty coverage, another on life insurance and the third on backing mortgages. The CEO plans to update investors with his strategy on Jan. 26 in a webcast.

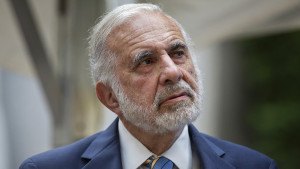

(Photo Victor J. Blue/Bloomberg )

Icahn said in November that he may reach out to shareholders and possibly seek a new director who would agree to succeed Hancock as CEO if the board asked. The billionaire said a breakup will improve returns and help AIG escape the U.S. government’s tag as a systemically important financial institution, a designation that can lead to increased regulation. About three-quarters of respondents want AIG to exit the SIFI status, and 86 percent believe the insurer should “de- conglomerate” by selling units or spinning off divisions.

“Whether it’s the strategy, or the people, it doesn’t much matter,” Stirling wrote. “It looks to us like one, if not both, might soon change.”

Icahn may have difficulty forcing out Hancock, though he may be able to add a new director, Credit Suisse Group AG analyst Tom Gallagher said in December. AIG’s stock climbed more than 10 percent last year, and the insurer bought back billions of dollars of shares after a series of asset sales.

AIG slipped 6.9 percent this year through Monday, compared with a 5.9 decline in the Standard & Poor’s 500 Index.

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  10 Do’s and Don’ts of a Smart ORSA Report

10 Do’s and Don’ts of a Smart ORSA Report  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation