Market position, capitalization, reserve adequacy and catastrophe risk management are among the factors that rating agency analysts consider when developing insurance financial strength (IFS) ratings for property/casualty insurers. But which ones influence your company’s ratings most?

Understanding the key drivers for an individual insurer’s rating from Fitch Ratings and which factors might push the rating up or down in the future became easier last month when the Chicago-based rating agency introduced a color-coded map to give users of ratings a visual picture of the ratings process.

The map, formally called “Ratings Navigator,” is intended to enhance transparency around how Fitch derives its IFS ratings by presenting an insurer’s key strengths and weaknesses in an easy-to-interpret visual format, Fitch said in a media statement, which also revealed that Navigators on 50 insurance organizations are now available, covering the Americas, EMEA and Asia-Pacific.

The map, formally called “Ratings Navigator,” is intended to enhance transparency around how Fitch derives its IFS ratings by presenting an insurer’s key strengths and weaknesses in an easy-to-interpret visual format, Fitch said in a media statement, which also revealed that Navigators on 50 insurance organizations are now available, covering the Americas, EMEA and Asia-Pacific.

The Rating Navigator also provides a summary of ratings of direct peers—listing the current IFS and previous IFS beside the analysis of the company’s rating—allowing company leaders to compare and contrast its ratings with the peer group.

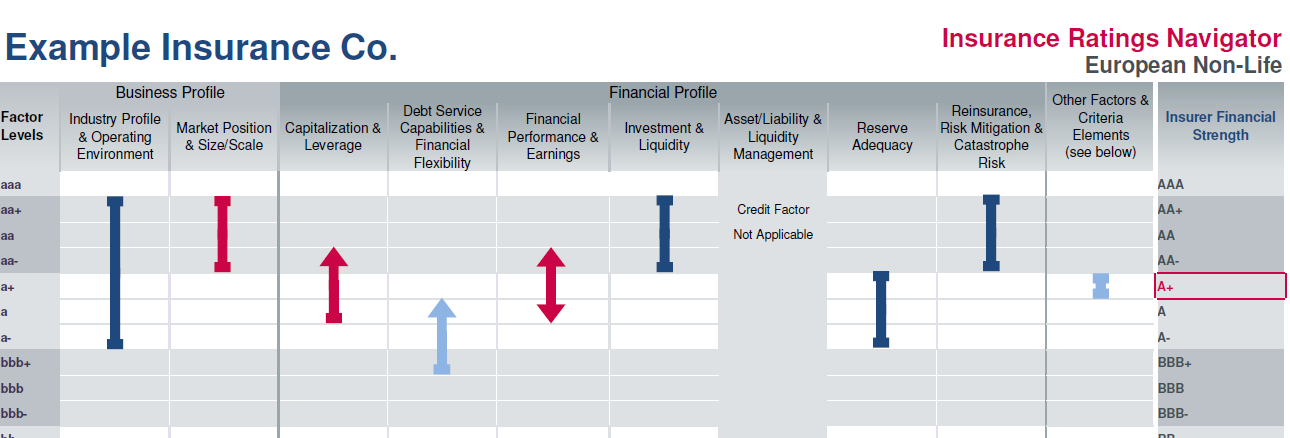

“Ratings Navigator for Insurance does not introduce new ratings methodologies or approaches to analysis. [Instead] it illustrates application of established ratings criteria,” Fitch said, referring to the central part of each Navigator diagram—the factor assessment panel (shown below).

Here, Fitch presents ranges of scores for nine of the 12 key credit factors in its ratings criteria, ranked on a scale that runs from a high of ‘aaa’ to a low of ‘c.’ Buckley notes that most factor scores cover a three-notch band. The exception is the “industry profile and operating environment,” which uses a six-notch band.

“Industry profile and operating environment” is one of two qualitative business profile factors included on the Navigator diagram—the other one being “market position and size/scale.”

Seven key quantitative financial profile factors that Fitch considers when establishing an IFS rating are also shown:

- Capitalization and leverage

- Debt service capabilities and financial flexibility

- Financial performance and earnings

- Investment and liquidity

- Asset/liability and liquidity management

- Reserve adequacy

- Reinsurance, risk mitigation and catastrophe risk

Each factor is scored by the analytical team and rating committee within the ranges of the multi-notch indicators. The analysts consider relevant quantitative and qualitative elements described in detail in a global master criteria report published last year (“Insurance Rating Methodology,” published Sept. 4, 2014)—elements like company financial ratio results relative to medians and “sector credit factors” for given sectors or regions.

For example, the red upward arrow for the “capitalization and leverage” factor for the Example Insurance Co. above indicates higher influence of this factor with positive forward trend. While the score for “reserve adequacy” has moderate influence and stable forward trend for this same example company, “financial performance and earnings” has higher influence but, directionally, future trend is unclear.

“Ultimately, the individual factor scores are weighted by an analytical team based on their relative importance and after considering their trend. They are then aggregated into an issuer’s overall rating,” Buckley said.

Beyond the nine factors, there are three additional qualitative factors Fitch analysts consider to determine ratings for insurance groups and companies: sovereign and country-related constraints; ownership; and corporate governance and management. These are captured in the column headed “Other Factors and Criteria Elements” with a single notch indicator summarizing the combined impact of these. “Typically, these factors are neutral to the final rating but sometimes can move it up or down—for example, a sovereign constraint, country ceiling or a supportive and stronger owner. If the impact is anything except neutral, the notch is indicated in red,” Buckley said during the video.

Ineffective corporate governance can pull a rating down, according to Fitch’s methodology documentation.

Notes about each of these “other factors” are provided in a summary box below the factor assessment panel.

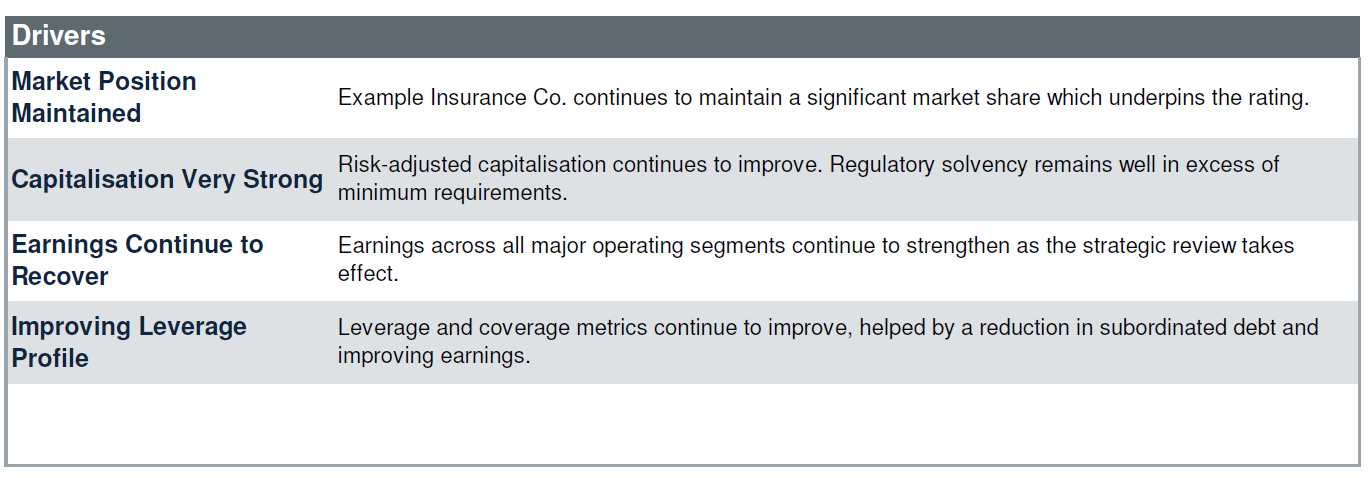

Beyond graphically highlighting how Fitch analysts’ views of key factors from the rating criteria build into a rating opinion, there is additional information captured on the single-page Ratings Navigators as well. To the left of the factor assessment panel, for example, Fitch provides as rating history for the insurer and analyst contacts. Below, the factor assessment is a peer comparison and two boxes summarizing “drivers” and “sensitivities.” These supplement the Navigator summary with information from Fitch issuer research contained in full rating reports and press releases.

Under “drivers,” for instance, the high-influence “market position” factor for Example Insurance Co. is listed with the description: “Example Insurance Co. continues to maintain a significant market share which underpins the rating.”

A box labeled “sensitivities” lists events that might prompt a future upgrade or a downgrade. For example, a downgrade might result from “increased financial leverage above 35 percent [or] weaker underwriting profitability relative to similarly rated peers” for the Example Insurance Co.

A box labeled “sensitivities” lists events that might prompt a future upgrade or a downgrade. For example, a downgrade might result from “increased financial leverage above 35 percent [or] weaker underwriting profitability relative to similarly rated peers” for the Example Insurance Co.

In Buckley’s words, the “drivers” and “sensitivities” summaries provide “additional context for the rating.”

“While the outlook for many of our insurance ratings globally remains stable, Ratings Navigator will help market participants understand the nuances behind individual ratings,” he said.

Ratings Navigator for Insurance will be published globally, with an expectation that Navigators on a vast majority of Fitch’s international IFS ratings will be published by yearend.

According to Fitch’s website, as of May 13, 2015, Ratings Navigators were available for these P/C insurance and reinsurance groups:

- Liberty Mutual Group, Inc.

- Progressive Corporation

- American International Group, Inc.

- Zurich Insurance Company Ltd.

- Travelers Companies, Inc.

- Allstate Corporation

- Assicurazioni Generali S.p.A.

- Munich Reinsurance Company

- COFACE SA

- Allianz SE

- Hannover Rueck SE

- Mapfre S.A.

- ACE Limited

- XLIT Ltd.

- Lloyd’s of London

- SCOR SE

- W. R. Berkley Corporation

- CNA Financial Corporation

- Swiss Reinsurance Company Ltd.

- AXA S.A.

Non-U.S. Insurer Rating Changes Ahead

Although Ratings Navigator does not introduce any changes to Fitch’s rating methodology, separately last month, Fitch announced a proposed criteria update related to its “notching process”—the process of setting debt ratings relative to issuer default ratings, holding company IDRs relative to operating company IDRs, etc.

Under the proposal, the IFS of the operating companies will be the initial anchor rating in the notching exercise.

In a media statement, Fitch said it is proposing changes to Insurance notching criteria in light of changes in the regulatory landscape for the global insurance industry. Specifically, the proposed criteria employs a revised approach to notching in jurisdictions migrating to Solvency II-style group regulation, while notching will remain more aligned with the rating agency’s historical approach in jurisdictions, such as the U.S., where the insurance regulatory approach has not significantly changed.

Explaining this in more detail in the exposure draft (“Exposure Draft: Insurance Notching Criteria”), Fitch distinguished between “ring-fencing” U.S.-style regulation and European “group solvency style” regulation.

“Historically, Fitch’s notching methodologies in the insurance industry have been centered on a belief that in most jurisdictions, the way regulators protect policyholder interests is to focus greater regulatory scrutiny on operating companies, and to treat holding companies as both subordinated and secondary in importance. Such a style of regulation is most evident in the U.S. via its use of formulaic restrictions on transfers from the operating company to the holding company,” the exposure draft says.

“The movement to Solvency II in Europe, and questions surrounding regulatory equivalence, spawned a global debate over the relative benefits of different styles of regulation,” the draft continues. “Accordingly, Fitch now believes it is reasonable to assume that regulatory differences will have an increasingly important impact on the relative credit quality of entities and obligations within an insurance enterprise. This, in turn, should be reflected in different approaches to notching.”

As a result, notching practices will become more varied geographically than in the past due to perceived regulatory differences.

If Fitch goes ahead with the proposed notching practice changes, then there will be “numerous rating changes, especially in jurisdictions outside of the U.S.,” Fitch said, adding, however, that the vast majority will be limited to one notch. Other information in the media statement and an exposure draft seems to indicate that directionally, changes will be upward for IFS ratings.

- At the operating company level, of approximately 300 international-scale IFS ratings of insurance groups globally, Fitch expects 4 percent will be upwardly revised by one notch, and none will be lowered.

- Of approximately 45 classes of operating company debt rated globally, Fitch expects 21 percent to be downwardly revised by one notch.

- At the holding company level, Fitch expects the 20 percent of roughly 120 IDRs globally will be revised upward by one notch, mainly in Europe (where approximately two-thirds of holding company IDRs are expected to be upwardly revised).

- Of approximately 90 classes of holding company debt rated globally, about 6 percent will be revised upward by one notch, and 5 percent downward by one notch.

Market participants may provide comments to Fitch about the exposure draft during a consultation period that ends on June 19, 2015.

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best  Is Risk the Main Ingredient in Ultra-Processed Food?

Is Risk the Main Ingredient in Ultra-Processed Food?  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly