The Reinsurance Association of America said a group of 19 U.S.-based property/casualty reinsurers reported higher net written premiums and net income for 2012 compared to 2011.

The RAA said Thursday that a survey of statutory underwriting results showed these 19 reinsurers wrote $29.5 billion of net premiums for 2012, up 11.7 percent compared to $26.4 billion for 2011.

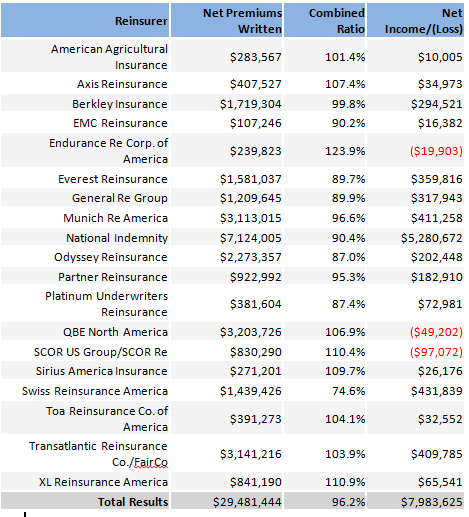

The combined ratio for the group was 96.2 for 2012, improving from a 107.2 combined ratio reported for 2011. The combined ratio was attributable to a 66.1 loss ratio and an expense ratio of 30.1. The overall net income for the reinsurers was nearly $8 billion last year, up nearly 20 percent from $6.7 billion in 2011.

The following chart shows statutory results of the 19 reinsurers for the 12 months ended on Dec. 31, 2012, from a survey by the Reinsurance Association of America. (All dollar figures are in thousands.)

This article was originally published on Insurance Journal’s website by IJ’s East Coast Editor Young Ha

Is Risk the Main Ingredient in Ultra-Processed Food?

Is Risk the Main Ingredient in Ultra-Processed Food?  State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists  Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers