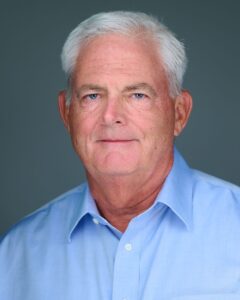

If you ask Carrier Management’s Guest Editor Michael (Fitz) Fitzgerald to describe his career path to his current role as Insurance Industry Advisor for SAS Institute, he’ll likely offer an analogy to a Swiss diplomat.

Once an insurance technologist for Royal & Sun Alliance and Zurich North America, and later an insurance technology analyst for Celent and CB Insights, Fitzgerald explains the reference: “My background is a hybrid background. I’ve worked in IT; I’ve worked in business operations. I have my CPCU as well as my PMP, the project management designation. So, I’ve actually had a foot in both the core insurance world as well as the IT automation world.”

The dual perspective, “at times, has really caused me to feel a bit like the Swiss diplomat who can speak many languages, seeing many sides to the same problem,” he told CM in a 2019 interview.

The dual perspective, “at times, has really caused me to feel a bit like the Swiss diplomat who can speak many languages, seeing many sides to the same problem,” he told CM in a 2019 interview.

Earlier in his career, Fitzgerald worked on many “change-the-business assignments” for the P/C insurers—the longest lasting four years when he was in charge of the area that revamped the legacy automobile system at RSA in the United States. Shorter carrier assignments included a stint at Zurich NA, serving as VP of Enterprise Underwriting Solutions, where he led the evaluation of technologies to support a new product development process, and earlier work at RSA to develop the first global online technical insurance learning platform, delivering claims and underwriting training. Those experiences, he believes, gave him a unique perspective to take on subsequent roles as an analyst for Celent and CB Insights, where he was involved with researching the application of technology for business value in insurance.

“I imagine a lot of people have experienced the fact that the business side of insurance speaks one language and the technical side speaks another,” Fitzgerald said during a webinar hosted to the RiskStream Collaborative of The Institutes last November, titled “Overview on AI usage in Insurance,” again explaining his career-long role as a “go-between” straddling the roles of IT and business professional.

With advanced analytics and AI taking on greater importance, Fitzgerald continues to add “go-between” value at SAS, an analytics and software solutions provider. His day-to-day work connects him to P/C insurance leaders ranging from the head of analytics at the department level all the way up to the board level, addressing questions they have about their preparedness for an AI future: “What do we have? What do we need? What should we do? What shouldn’t we do? How do we prepare ourselves personally? Professionally? How do we prepare our company?”

The idea for the featured content in this edition, “Leading the AI-Powered Insurer,” connects directly to that work, he said.

SAS has solutions for insurers grappling with concerns about AI. “On the more traditional side, we have data solutions which allows them to get control of their data.” In addition, SAS has also “been in this AI world for a long time”—with deterministic predictive models and also offering the types of non-deterministic natural language processing and machine learning tools that give rise to the trust, bias and data issues that make carrier executives fearful.

“The company understands those issues. And we have tool sets which help our customers manage them,” Fitzgerald said. He noted, for example, that he has been mapping SAS features and functions directly to items that will be requested by regulators, such as information on data lineage and bias analysis, which will be part of insurer audits in states that pass AI regulations based on the NAIC’s Model Bulletin on the Use of Algorithms, Predictive Models, and Artificial Intelligence (AI) Systems by Insurers, adopted in December.

(See related article: Regulators Run Alongside Speeding AI Train: What the NAIC Model Bulletin Means for Insurers)

Returning CM Guest Editor

Although he doesn’t officially include this on his extensive resume, Fitzgerald became an award-winning journalist when he served as guest editor for a series of Carrier Management articles and videos titled “Eyes in the Sky: Geospatial Information Systems.” The featured content, published in November 2021, was recognized by the American Society of Business Publication Editors with a National Azbee Award of Excellence for Overall Multi-Platform Package of the Year, honoring Fitzgerald along with CM‘s editors, video production team and designers.

A frequent contributor to Carrier Management, Fitzgerald also served as the guest editor for a section of CM‘s May/June 2019 magazine, titled “Innovation How-to-Guide.” In addition, in 2020, he moderated Carrier Management’s Virtual Roundtable—”Is Insurance Innovation Overrated?“

***

Guest Editor Mike (Fitz) Fitzgerald conceived of the articles in Carrier Management’s first-quarter 2024 magazine, “Leading the AI-Powered Insurer.”

Guest Editor Mike (Fitz) Fitzgerald conceived of the articles in Carrier Management’s first-quarter 2024 magazine, “Leading the AI-Powered Insurer.”

Featured articles include:

- How Underwriters Win Business With Data and ML at AXA XL

- Regulators Run Alongside Speeding AI Train

- Are Carriers Prepared to Wade Into the AI Tidal Wave?

All of the articles in the magazine are available on the magazine page of our website.

Click the “Download Magazine” button for a free PDF of the entire magazine.

To be able to read and share individual articles more easily, consider becoming a Carrier Management member to unlock everything.

The Future of HR Is AI

The Future of HR Is AI  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers  High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best