Hello, devoted COVIDigation Nation readers. This is article two in a series tracking insurance lawsuits related to COVID-19 business claims (i.e., COVIDigation). It’s kind of like a serial comic strip, except there are no cartoons—just data and graphs involving a pandemic, and legal analysis.

Onward!

This summer was a busy period for COVIDigation developments. There was a resurgence of COVID-19 infections. However, in light of the second large surge of infections, states and cities generally did not respond with the same mandatory shutdowns and shelter-in-place orders as they did in the spring. State legislation tied to retroactive business interruption coverage has languished. And, unsurprisingly, business interruption lawsuits continue to be filed at a steady rate. Most importantly, carriers are generally winning summary judgment motions seeking to dismiss business interruption claims.Did COVIDigation Filings Increase This Summer?

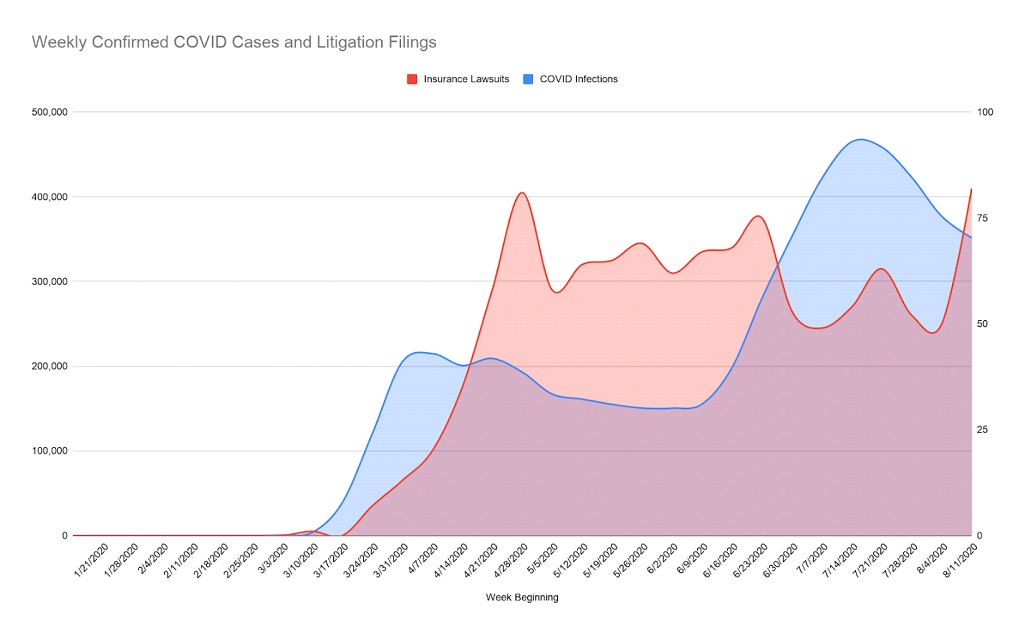

In our first article, I looked at the number of COVIDigation lawsuits compared with the number of COVID infections. I noted that after a surge in COVID-19 infections in late March and April, there was a correlated bump in COVIDigation lawsuits lagging by about a month. As we went to press with the last article in late June, infections were again increasing, and I was left wondering if a related increase in lawsuits would follow.

In an effort to start making a tool to understand some of these relationships between COVIDigation and COVID infections, Bryan Wilson (an MIT Researcher) and I compiled data from both The New York Times and the Penn Law COVID Litigation Tracker. Outputs and analysis from the Penn Law tracker (mainly graphs) have since been featured in prominent publications, including the Wall Street Journal.

Thankfully, after the mid-July surge in COVID-19 infections, numbers are declining again. However, similar to previously observed patterns, there appears to be an uptick in COVID-19 lawsuits filed in mid-August, about one month after the summer infection increase period.

It seems to be an obvious point—and the data supports the notion—that as more COVID-19 infections occur, more lawsuits are likely to be filed. However, it is still unclear whether COVID-19 lawsuits will be filed proportionately to the number of COVID-19 infections. With the sharp increase in infections in July, will we see a corresponding spike in lawsuits in August and September?

The lack of government-mandated shutdowns in the second half of 2020 may mitigate the number of business interruption lawsuits as fewer places of work choose to close.

Insurance Companies Are Winning Early Cases

When speculating about how these trends may differ from the first COVIDigation cycle, it will be important to look at the outcomes of cases to determine whether would-be litigants may be deterred from filing. For example, if there were a large number of plaintiff-friendly court rulings, there would likely be a spike in litigation. However, many of the early verdicts have been insurance carrier-friendly, suggesting that there may be a lower rate of COVID-19 business interruption lawsuits.

While lots of COVIDigation filings is not ideal for the insurance industry, the legal outcomes of these cases can be seen as a cause for hope for insurance carriers. As of Sept. 8, 2020, insurance companies successfully sought dismissal of COVID-19 business interruption lawsuits in federal and state courts in nine states (including Michigan, Washington, D.C., California, Florida and Texas). Only one court—Missouri—has moved a COVID-19 business interruption lawsuit forward.

According to Ryan Maxwell, insurance coverage attorney at Hurwitz & Fine, P.C., who responded to questions about the suits via email, “These courts have declined invitations to find loss of use or access to property due to governmental stay-at-home orders alone sufficient to trigger coverage as a ‘direct physical loss’ without at least the allegation of the physical presence of the virus on location.”

“Early decisions have largely adopted the majority position that ‘direct physical loss’ requires tangible injury to property, which has proven difficult for policyholders to overcome as many attempt to plead around the virus exclusion. Those courts that have addressed the virus exclusion in the early going have found it unambiguous in its application to the COVID-19 pandemic. The Missouri case cutting against the grain not only alleged that COVID-19 caused physical damage to property but also confronted a policy absent the virus exclusion altogether.”

What’s Next?

Moving forward, there are three issues I will be following related to COVID-19 insurance lawsuits.

First, what impact will early court rulings have on the number of new lawsuits being filed? For example, I would anticipate more cases are filed in Missouri as businesses and attorneys identify an opportunity to seize on the aforementioned ruling; conversely, insurance-friendly rulings may have a chilling effect on new filings in other states.

Second, what happens if insurer-specific filings are consolidated to one court? Michael Aylward, insurance attorney at Morrison Mahoney, describes an upcoming September hearing in his coverage newsletter that may dramatically shape COVIDigation going forward: “The issue of whether dozens of individual COVID-19 suits against five commercial property insurers should be consolidated has now been briefed to the Joint Panel on Multidistrict Litigation and awaits disposition at the JPMDL’s next hearing on September 24.”

The Panel will rule on whether COVID-19 business interruption lawsuits against five insurers should be consolidated to one court. A ruling in favor of Multidistrict Litigation would likely lead to an influx of new filings in a particular state. (Update: Panel orders published on Oct. 2 indicated that cases against The Hartford, Travelers, Cincinnati Insurance and Lloyd’s would not be consolidated but that 34 actions against Society Insurance would be transferred to the Northern District of Illinois.)

Finally, I will be following the results of non-business interruption lawsuits against insurers. As businesses attempt to navigate the pandemic, the likelihood of employees and customers getting sick at a place of work will increase. Will employees and customers revert to lawsuits?

The COVIDigation stakes are high as we enter the fall and winter periods. Early decisions favor insurance companies. We will, of course, keep you apprised as to new developments in the world of COVIDigation. Same COVIDigation time, same COVIDigation channel.

From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers  Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next  New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies