Let’s get a few things out of the way. First, I am not a data scientist or an actuary. I am an attorney interested in data. More specifically, I am interested in using data from disparate sources to understand how the insurance world is changing.

Executive Summary

This article is the first of a series from RiskGenius Co-Founder and CEO Chris Cheatham about COVID-19 insurance litigation. Here, he looks at data to investigate the correlation between infection rates and lawsuit counts by state and in aggregate across the nation.Part 1 of a series: COVIDigation Nation

The COVID-19 pandemic has been a slow-motion horror story for the United States. As I write this, COVID-19 cases and deaths are increasing. This pandemic has also served as a fascinating opportunity to study legal and regulatory decisions as they are applied to a once-in-a-lifetime (hopefully) global crisis.

Carrier Management has agreed to publish a series of articles I am writing about COVID-19 insurance litigation. I call it COVIDigation. In these articles, I will share insights gleaned from lawsuits, regulations and other data sources related to COVID-19 and insurance. Bryan Wilson is my statistical muse in this endeavor and helped me create the data visualizations and edit the text. Thank you also to the New York Times COVID-19 dataset and Penn Law’s COVID Coverage Litigation Tracker for supplying data for this initial article. (Data from The New York Times, based on reports from state and local health agencies, is also summarized on The New York Times U.S. tracking page at https://www.nytimes.com/interactive/2020/us/coronavirus-us-cases.html.)

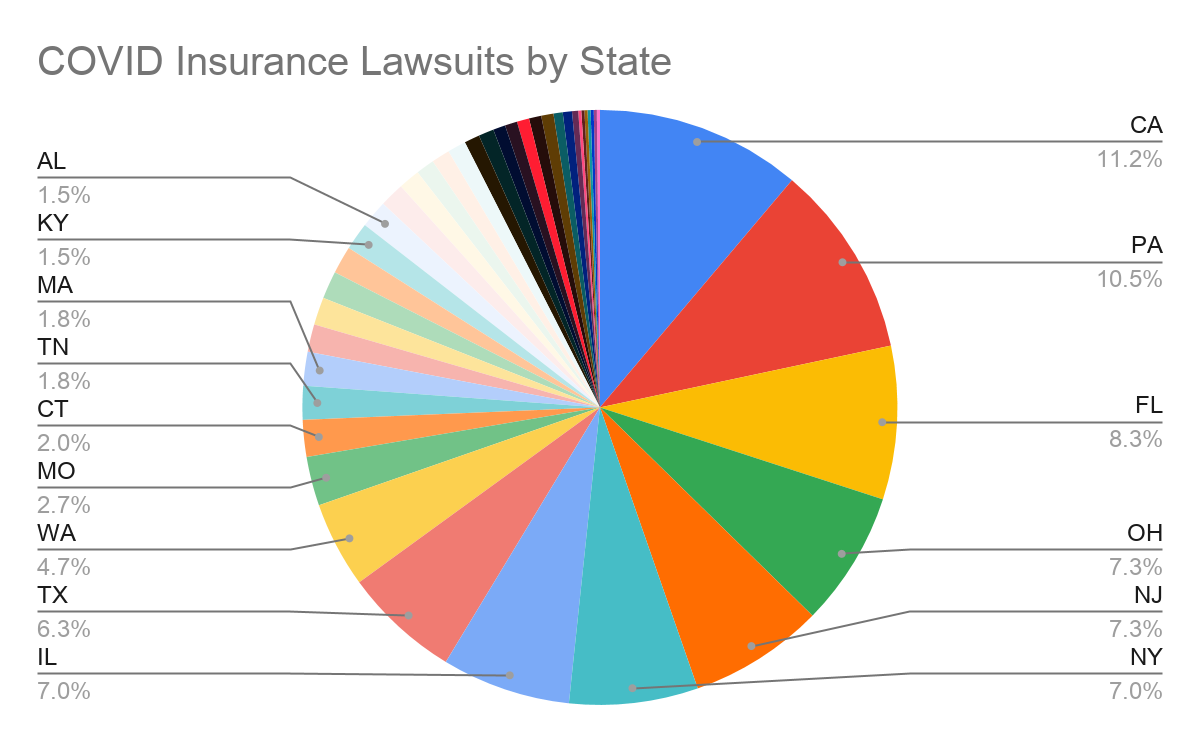

At the outset, I wanted to understand where COVID insurance lawsuits are being filed. The rationale for understanding these connections is twofold. First, this information can be used to understand COVID-19 insurance exposure by location. Claims lead to lawsuits; lawsuits lead to insurance expenses. Understanding where a pandemic is likely to lead to insurance claims, litigation and expenses can help insurance modeling. Second, there is no escaping the fact that the United States is experiencing a resurgence of COVID-19 cases, with over 75,600 cases identified on July 17, 2020. It’s possible that understanding the relationships between spikes in COVID-19 cases, time and litigation can better prepare insurers for a second wave of COVID-19-related claims and lawsuits.

The COVID Coverage Litigation Tracker includes insurance-only coverage cases related to the COVID-19 pandemic. As of July 3, 2020, 600 lawsuits had been included in the Tracker. Approximately 69 percent of these cases have been filed in nine states: California, Pennsylvania, Florida, Ohio, New Jersey, New York, Illinois, Texas, Washington.

What makes the nine states more susceptible to COVID-19 lawsuits? To put it another way, why have lawsuits been filed in greater numbers in these nine states?

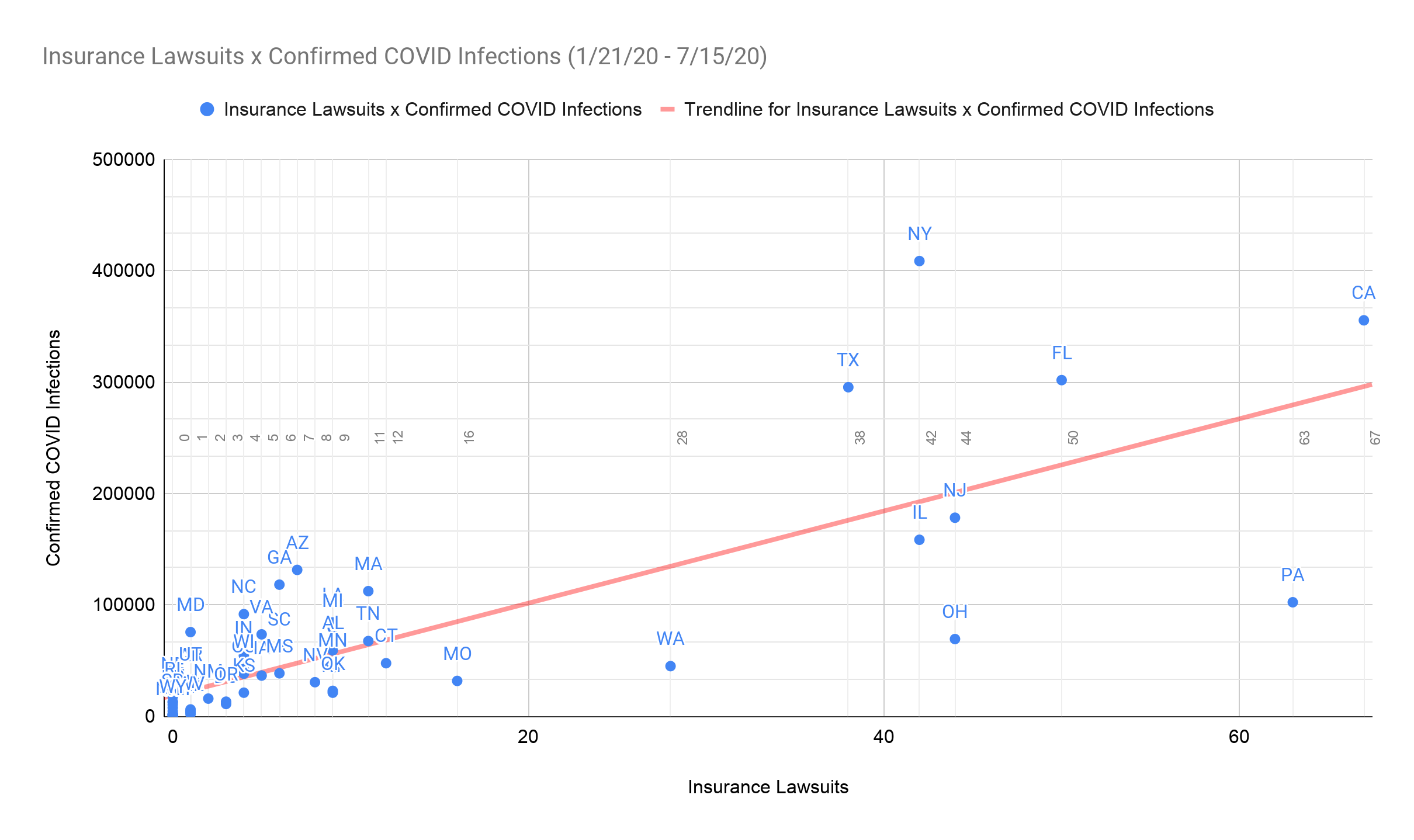

The most likely culprit, or obvious predictor, of COVID lawsuits seems to be the severity of COVID infections. (I use the word “infections” instead of “cases” in order to avoid confusion between “cases” and “lawsuits.”) When COVID-19 infections and COVID-19 lawsuits are compared by state, a correlation starts to emerge.

The trendline makes it clear: As COVID infections increase, lawsuits against insurance companies also increase.

The dynamics around COVID-19 business interruption claims and litigation is likely a key driver of this trend. As COVID-19 infections spiked in March 2020, state governments reacted by shutting down businesses. These government-enforced shutdowns are likely the culprit of many of the business interruption claims and litigation. Furthermore, insurance carriers report they are denying business interruption claims. Various parties to the insurance industry have stated that commercial property insurance policies were written to exclude coverage for virus-related business interruptions. For example, the National Association of Insurance Commissioners has stated that “(b)usiness interruption policies were generally not designed or priced to provide coverage against communicable diseases, such as COVID-19, and therefore include exclusions for that risk.”

The result is a recipe for a nationwide litigation event: COVID-19 infections caused statewide business shutdowns, which led to a surge in business insurance claims that were predominantly denied, leading to litigation.

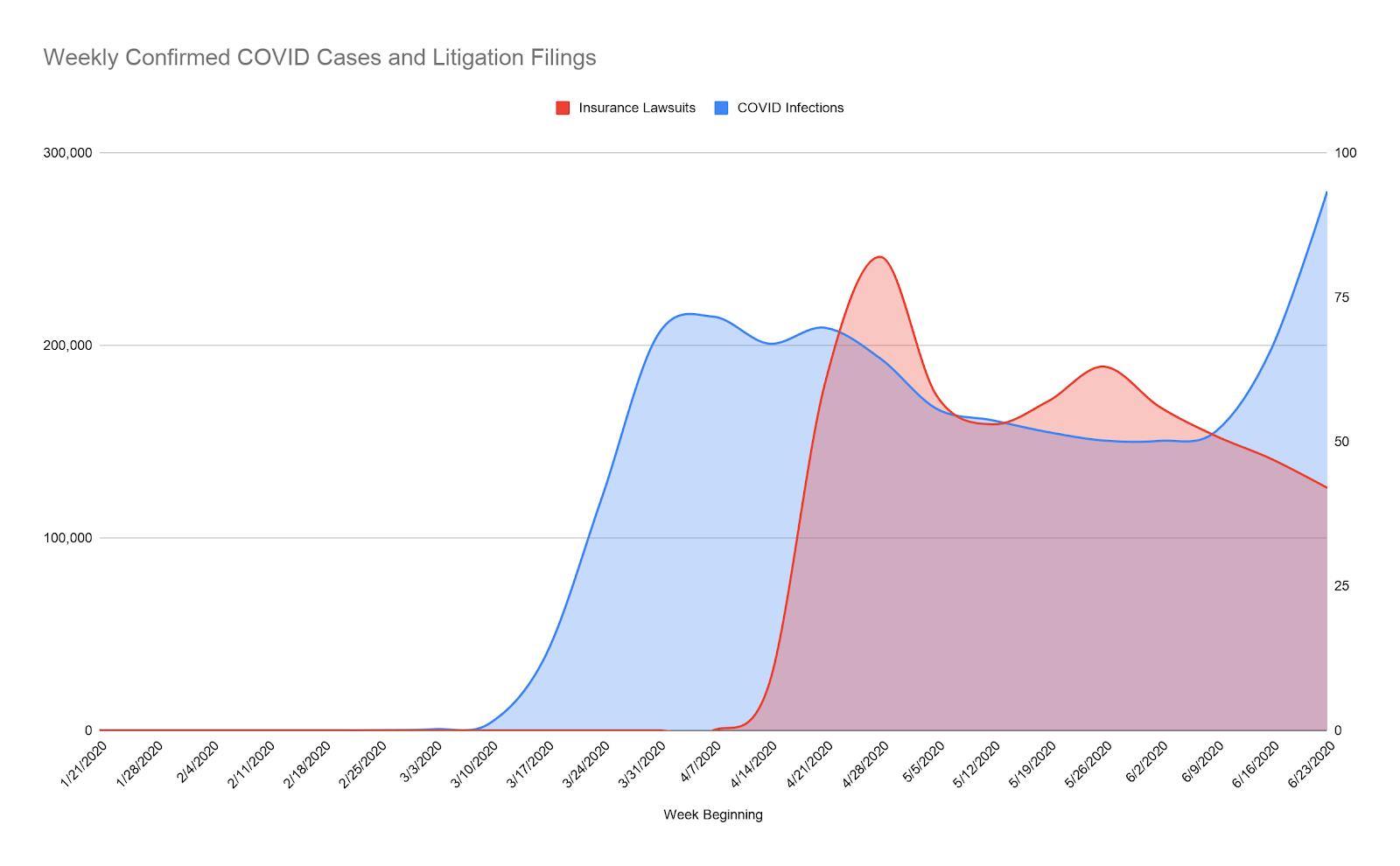

When COVID infections and lawsuits are compared over time, the two events track over a four-to-five-week period. For example, COVID infections peaked the week of March 31; COVID lawsuits peaked one month later during the week of April 28. A second COVID infection peak occurred the week of April 21; COVID lawsuits surged one month later. Because a business shutdown must proceed a business interruption claim and resulting litigation, it is not surprising to see a one-month lag between COVID infections and lawsuits.

Insurance executives may be staring at the ominous and sharp upward trend in COVID-19 infections during the week of June 23. If the trend continues, then a surge in COVID-related lawsuits against insurance companies can be expected one month later—at the end of July. However, the June-July surge in COVID-19 infections may not result in statewide shutdowns, as occurred in March, because states seem less likely to enact statewide shutdowns due to economic impacts. For example, the Texas governor has explicitly stated that “there is no shutdown coming” despite the surge in COVID infections in the state. However, it should be noted that at the time of writing, California has implemented a second statewide shutdown of restaurants and bars.

Additional questions about the exact nature of various and multifaceted relationships between COVID-19 and insurance litigation remain. What is the relationship between litigation and stay-at-home orders? How might COVID change the insurance industry in the long term? What factors carry the biggest weight when attempting to predict where litigation will take place next?

We will be digging into these in the coming weeks to help unearth some additional insight. Of course, I have never lived through a pandemic. Only time (and data) will tell; you can be sure I will be back next month to update you on these COVIDigation trends.

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit