The number of severe climate-related disasters in the United States escalated by 32 percent between 2019 and 2022, causing insured losses over the same period to rise by nearly 300 percent, according to a new report by Deloitte.

The results are widening gaps in insurance coverage.

Based on a survey of 2,000 homeowners in 21 states with high risk of climate-related disasters risk, the report offers insights into contributing factors and identifies solutions to promote resiliency in the residential insurance landscape.

Rising repair costs and more frequent claims are causing some companies to pull back from high-risk markets, making it more difficult for people in those areas to find insurance.

Nearly a quarter (23 percent) of respondents said they are struggling over shrinking insurance options.

Over half of those surveyed (53 percent) said their existing coverage options are too expensive, forcing homeowners to seek more affordable options or go without insurance.

The burden of inadequate coverage is particularly heavy on lower-income households with an annual income less than $99,000, the report found.

Homeowners are not sure how to respond to inadequate protection, the survey found, with 63 percent expressing confusion about their policies.

This has led to a number of policyholders shopping for new insurance or coverage.

Another 86 percent weren’t sure how to take advantage of state-sponsored insurance programs.

Insurers’ traditional first-line approach to maintain profitability (increasing premiums, restricting coverage) may not be sustainable, the Deloitte survey found.

The tactic tends to fuel resentment among policyholders and potentially leaves those most vulnerable exposed to risk.

Deloitte suggests a more collaborative solution to manage risks and maintain policyholder loyalty and satisfaction.

Insurers could explore loss prevention and mitigation strategies, the report suggested.

For example, partnering with public entities like state regulators could assist in educating homeowners on ways to protect their home from climate change.

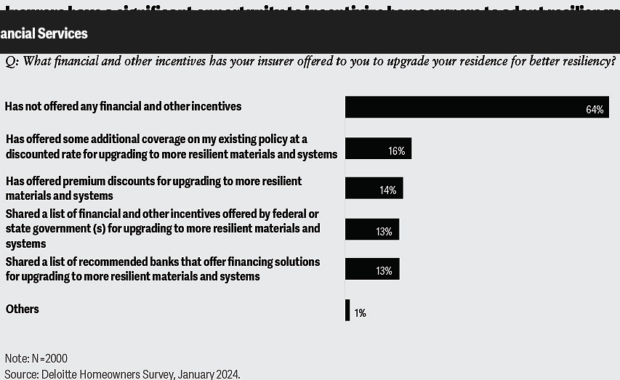

Another suggested way to educate homeowners to adopt resiliency measures is through incentives, such as a reduction in premium.

Alternatives like parametric insurance could be an answer to ensuring adequate coverage. bundling coverage is another option that may allow for more coverage at an affordable price.

Technology can assist insurers in identifying at risk properties earlier so that adequate mitigation and coverage can be procured.

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality  AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages