June 16, 2019, was a seemingly normal day on Florida’s Turnpike in Orlando. Minivans were filled with families on their way to Disney; local Floridians were going about their daily routines. But unbeknownst to motorists on the highway that day, they were partaking in a historic moment in the advancement of transportation.

Executive Summary

Widescale implementation of autonomous vehicles could be realized within the next decade, and even though there will be fewer driver-induced accidents and truck driver fatalities with autonomous technology, that doesn’t mean there won’t be a need for auto liability insurance, Milliman’s Drew Groth writes. For example, auto liability insurance may function as a gap coverage that indemnifies the insured up front and later seeks subrogation from makers of AV tech, he notes. In this article, he sets forth some steps insurers could use to investigate the feasibility of offering new products and the impact of autonomous trucking on their current books of business.That day, a nondescript, retrofit Volvo 18-wheeler was making its way along a public roadway with no human driver in the cab. The truck successfully navigated 9.4 miles, maintaining a speed of 55 mph and performing various tasks, including lane change maneuvers, a tollbooth exchange and a rest stop. All of this was performed via a combination of autonomous vehicle (AV) technology and a remote driver located 150 miles away in Jacksonville.

It was the first time such a feat had been accomplished in public at standard operating speeds, and it marked a milestone in commercial autonomous transportation solutions.

Today, trucks move 71.4 percent of freight tonnage in the United States, and annual freight volumes have continued to rise since the 2007-2010 global financial crisis. The American Trucking Associations (ATA) estimates that there is currently a sizable shortage of commercial truck drivers, tallying 60,800 in 2018 with the potential to rise to 160,000 within a decade. In addition, trucking services are becoming more of a commodity, which is pinching the margins for logistics operators. All of this is compelling companies to search for more efficient solutions to fill needed positions and increase capacity.

Time to Hit the Road

While the COVID-19 pandemic has resulted in an overall contraction in the trucking industry, the impact has been uneven by sector and is likely short-term. The overall slowdown experienced in the trucking industry has been mild compared to other parts of the economy, with early indications showing a 13 percent decrease in truck miles traveled from mid-March to mid-April.

The decrease in miles was primarily noticed in states with large fuel and manufacturing footprints, while other sectors experienced an increase in short-term demand coupled with the relaxation of regulatory requirements to help keep essential supplies moving. More recent indications in early May show that the demand for truckers is increasing again, perhaps implying the start of a turnaround in truck miles traveled as the country reopens.

While no one can predict with certainty how the economy will rebound from the current pandemic, one thing is certain: Trucking will be a key component of getting us back on our feet. Autonomous trucking technology is ready for early-stage implementation, and despite the economic slowdown, companies are still actively considering autonomous solutions to help streamline transportation logistics and meet steadily increasing demand. Meanwhile, autonomous trucks continue to carry goods for several companies on a pilot basis, further promoting the interest in this new technology. In fact, one autonomous trucking company, TuSimple, recently expanded its pilot program with UPS and has continued mail deliveries even in the midst of nationwide lockdowns.

A reasonable expectation is that early adopters could have Level 4 autonomous trucks in their fleets as soon as 2021. (According to the Society of Automotive Engineers, SAE, Levels of Autonomy, Level 4 refers to trucks that have the ability to operate fully autonomously on highway segments while a human is still needed to navigate routes off-highway.) Predicting when implementation will be fully realized is difficult given numerous roadblocks, most notably consistent AV regulations by state, which will be important for interstate trucking routes. Even in light of these challenges, experts are suggesting that widescale implementation could be realized within five to 10 years.

Meanwhile, insurance solutions for this technology are few and far between, posing yet another roadblock.

Given the momentum in autonomous trucking technology, insurance companies and reinsurers of self-insured fleets must begin formulating approaches to commercial AV tech while they still have time to contribute to the conversation. This includes quantifying which segments of their current books of business will be affected and further determining whether opportunities exist to offer policies focused on or including AV.

Decisions around whether to offer insurance products directly and how to cover liabilities related to this new exposure (e.g., traditional auto liability, product liability or specialized cyber policies, among others) already are in progress between manufacturers of the technology and those interested in utilizing it; waiting until the technology is commercially available means insurers will not be part of the conversation. Even if incumbent insurers have no intention of writing policies including these exposures, it is essential to understand the impact of AV on insurers’ commercial business already in place. With no game plan, the end result could be insurers losing significant portions of their commercial auto books or seeing unexpected impacts in other lines of business.

AV Insurance Considerations

Industry thought leaders have long discussed the possible elimination of auto liability insurance under the logic that there will be fewer driver-induced accidents with autonomous technology. When there are accidents, the technology operating the vehicle would be considered at fault instead of the human driver, likely falling into the realm of product liability.

What this argument doesn’t take into account is the length of time it takes to determine fault and to settle product liability claims. Truckers and other individuals depend on their vehicles for their livelihood and need prompt reparation when a crash occurs. With compounding medical bills and a lack of transportation, most people can’t wait for court decisions to determine whether the manufacturer of the camera or the software was more at fault. Thus, it seems more likely that auto liability insurance will continue to exist in some form, even if it primarily functions as a gap coverage that indemnifies the insured up front and later seeks subrogation from additional liable parties, namely manufacturers of the AV tech.

Insurers with auto exposure should quantify whether policies of this nature are feasible considering:

- Decreases in claim frequency as AV proves itself to be a safer alternative.

- Decreases in liability premium due to a reduction in at-fault claims by drivers.

- Increases in physical damage premium due to higher repair and replacement costs.

- Increases in staff and legal expenses to handle the product liability subrogation process.

- Inherent cash flow risk associated with the timing of recoveries.

- Possibility for mass tort against manufacturers, which could lead to bankruptcy and a reduction in expected third-party recoveries.

Based on the results of these feasibility analyses, insurers may want to propose alternative liability structures that better fit their risk appetites.

Perhaps a greater threat to insurers with commercial or personal auto exposure is the emergence of nontraditional insurance providers. A handful of AV manufacturers have already announced their intention to offer insurance along with their vehicles, most likely through a fronting arrangement. Currently, Tesla owners in California are able to buy a policy from Tesla Insurance Services that considers the vehicle’s advanced safety features, designed to reduce rates by as much as 20-30 percent. On the commercial auto side, Volvo has followed a similar approach with its autonomous mining trucks. Volvo announced that these trucks would come with a package that includes operation support, maintenance, repairs and insurance. It’s conceivable that Volvo and other producers could follow a similar approach for AV tech big rigs once they are ready to commercially deploy. Although new insurance offerings like these could eat into the market share of established commercial auto books, opportunities could exist for insurers to front or reinsure the emerging nontraditional providers.

Vehicle manufacturers benefit from insuring their own technology in two ways. First, auto tech companies are already collecting proprietary data through ongoing testing, which allows them to better quantify the impact that AV will have on accident frequency and severity. Second, currently there is a lack of options readily available to insure AV tech. These points are related, because traditional insurance companies are often unwilling to offer new products without proper data to support them.

Traditional carriers could explore the feasibility of new products for AV after first analyzing how autonomous trucks are expected to impact their current books. It is important to consider:

- Percentage of commercial accounts with long-haul trucking exposure.

- Likelihood of these accounts to adopt the new AV technology.

- States (or countries) that these accounts operate in to handle changes in limits of liability and AV-specific traffic laws, such as requiring a safety driver.

- Reassessing long-term frequency and severity trends in response to the adoption of AV.

The last piece may be difficult to quantify today without access to credible data. The National Highway Traffic Safety Administration (NHTSA) recently announced an initiative to compile data regarding ongoing AV testing to increase transparency and safety in developing AV systems. Reporting to this platform will be voluntary, and to date eight states and nine companies have agreed to participate. At this point, it is unclear whether the data that will be collected by NHTSA will include autonomous trucks or if it will contain enough information to make insurance decisions, so insurers may still want to consider ways to collect their own AV data or forge strategic partnerships with data owners that allow them to explore writing insurance policies for AV tech. Not being proactive in this space could lead to being edged out of the evolving auto and trucking market.

Going Beyond Commercial Auto

The impact of autonomous trucks goes well beyond commercial auto. While commercial auto insurance will certainly see the biggest disruption, other lines of business, including workers compensation, product liability, inland marine and cyber, will see new trends and emerging business opportunities for insurers.

For instance, consider the potential future impact of autonomous vehicles on workers compensation. Currently, one of the common causes of workers compensation claims for long-haul truckers is repetitive motion injuries from long hours spent sitting in the same position. Autonomous technology offers the potential to reduce repetitive motion injuries because drivers would be able to move around the cab while the truck is in operation. While that may sound implausible, a 2016 autonomous truck test demonstrated how a safety driver could step out of the driver’s seat and begin doing yoga on the floor of the cab while driving down the highway. A long-term goal is to completely remove drivers from highway segments, which would further decrease the likelihood of this type of injury.

But the largest impact to insurers will likely still come from a reduction in vehicle crashes that cause injury or fatality. Roughly 4,100 people died in crashes involving large trucks in the United States in 2018 alone, placing “heavy and tractor-trailer truck driver” as the deadliest occupation in the U.S. workforce. Besides the obvious emotional toll to those involved, from an insurer’s perspective driver fatalities are also some of the costliest workers compensation claims, and passenger vehicle fatalities contribute to high-severity commercial auto claims.

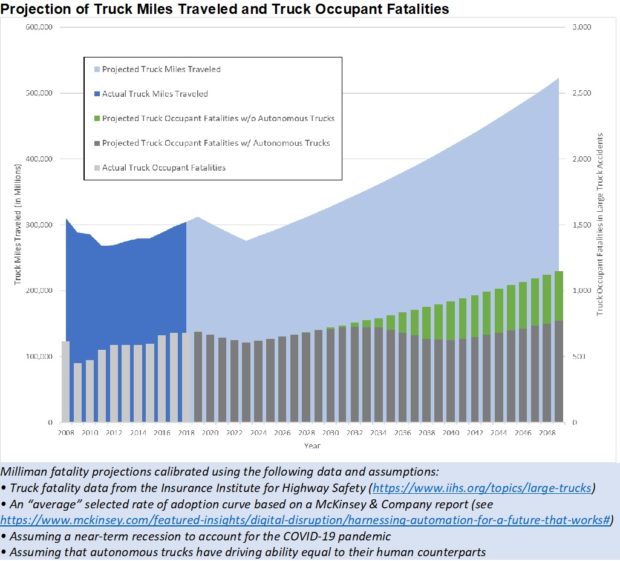

Milliman has estimated that autonomous trucks could reduce truck driver fatalities by 18.3 percent over the next 30 years by simply removing drivers from highway segments (see accompanying graph below). It’s worth noting that this reduction could be significantly higher if the rate of adoption is quicker than expected or if autonomous systems are proven to be safer operators than their human counterparts.

Plan Ahead

Autonomous trucks will begin to appear in fleets in the near future, so insurance companies need to have well-formulated plans to underwrite and price these new exposures in their commercial auto programs. Additionally, insurers that provide coverage for companies with truck-based distribution networks will need to consider the trickle-down effect of this technology on other lines of business. Autonomous technology is en route to fundamentally changing how the insurance industry will cover and price vehicle risk. Insurers should formulate their internal strategies now before these decisions are made for them.

***

Article Resources

The author relied on the following sources for some of the information contained in the article:

- For the description of June 16, 2019 autonomous truck journey on Florida highways: “Starsky Robotics begins fully unmanned public highway tests” by Stefan Seltz-Axmacher, Starsky CEO and Founder, June 26, 2019, published on Medium.com (retrieved June 12, 2020)

- For U.S. freight volumes and driver shortage statistics: “Truck Driver Shortage Analysis 2019” published by American Trucking Associations, July 2019 (retrieved June 12, 2020) citing ATA’s Freight Transportation Forecast 2019 to 2030 (www.atabusinesssolutions.com)

- COVID Impact on Freight Miles: “Freight Movement During COVID-19 Response” INRIX blog post by Mark Burfriend, April 27, 2020 (retrieved June 12, 2020); “Market Update in Response to COVID-19” by Ken Adamo, Chief of Analytics at DAT (retrieved June 12, 2020)

- TuSimple Pilot Program with UPS: “TuSimple expands autonomous trucking program with UPS” by Jerry Hirsch, Transport Topics, March 5, 2020 (Retrieved June 12, 2020) and TuSimple press release, March 5, 2020

- U.S. Department of Transportation AVEST Initiative: “U.S. Transportation Secretary Elaine L. Chao Announces First Participants in New Automated Vehicle Initiative to Improve Safety, Testing, and Public Engagement.” National Highway Transportation and Safety Administration Press release, June 15, 2020. See also, Insurance Journal/Reuters, “U.S. to Publicly Share Autonomous Vehicle Testing Data.”

- Large Truck Fatalities and Fatal Work Accidents: “Fatality Facts 2018: Large Trucks,” Insurance Institute for Highway Safety, Highway Loss Data Institute, December 2019 (retrieved June 12, 2020) based on analysis of data from the U.S. Department of Transportation’s Fatality Analysis Reporting System; “National census of fatal occupational injuries in 2018,” Bureau of Labor Statistics News Release, Dec. 17, 2019 (Retrieved June 12, 2020)

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  Why Claims AI Build vs. Buy Decisions So Often Miss the Mark

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark  10 Do’s and Don’ts of a Smart ORSA Report

10 Do’s and Don’ts of a Smart ORSA Report  New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies