A new analysis puts New York City at the center of the InsurTech universe, leading other cities around the globe on one measure of supremacy and gaining ground on another.

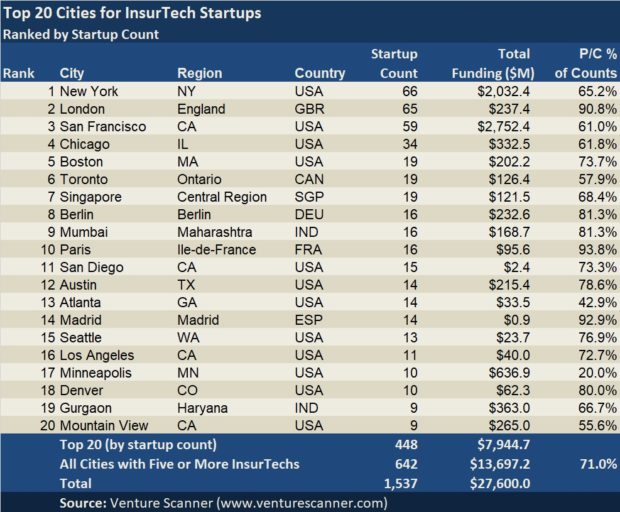

The analysis provided exclusively to Carrier Management by Venture Scanner (venturescanner.com), an analyst and technology-powered research firm, reveals that New York is in first place when cities are ranked by simply counting the number of InsurTechs that called each city home in the year ended 2018. But in the race to the top, New York City, with 66 InsurTechs, is neck-and-neck with London, which was home to 65 InsurTechs as of the end of last year based on Venture Scanner’s data.

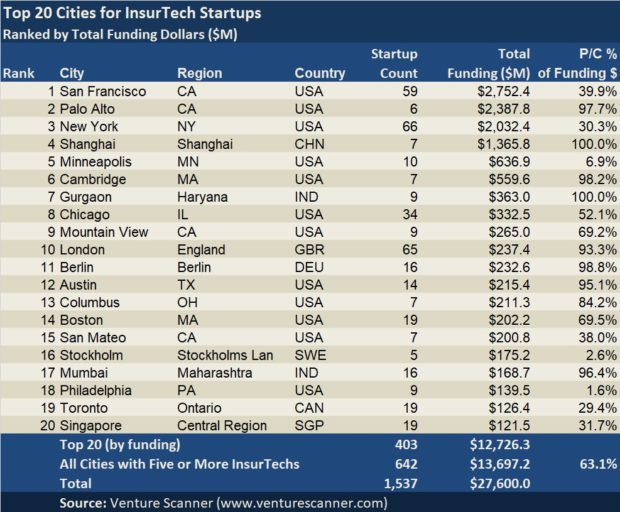

Repeating popular research that Carrier Management first published in 2018, Venture Scanner also provides information about funding dollars for the InsurTechs in each city. On that score, New York clearly leaves London in the dust. But even though New York gained ground on frontrunners in California, with total funding dollars for New York InsurTechs surging past the $2.0 billion mark, New York’s total ranks third on a funding-dollar ranking, behind San Francisco’s $2.7 billion total and Palo Alto’s $2.4 billion.

A $640 million boost in funding poured into New York’s InsurTechs in 2018 was the largest dollar increase reported for any city on Venture Scanner’s list. Other cities with significant funding changes included top-ranked San Francisco; Cambridge, Mass.; Columbus, Ohio; and Milan, Italy, which just missed the cut for the top 20 with a $120.9 million funding total.

Although Milan is the home of six InsurTechs, according to Venture Scanner data, a €100 million investment by Goldman Sachs Private Capital Investing and Blackstone Tactical Opportunities in one of them—an online distributor of auto insurance products known as Prima.it—explains almost all of the funding total.

Like Milan, the funding changes for Cambridge, which moved the city into the top 10 ranking based on funding dollars, and for Columbus, which put the Ohio city in 13th place, were each explained by investments in a single InsurTech. In Cambridge, a $500 million infusion from the Softbank Vision Fund into Cambridge Mobile Telematics was the bulk of the 1,000-plus percent funding growth spurt for the city in 2018. In Columbus, investors in Root Insurance added more than $150 million in two funding rounds, contributing to the $211 million funding total for seven InsurTechs in the city added together.

San Francisco stands apart from these cities, with more than just one of its 59 InsurTechs attracting significant dollars from investors last year. In fact, a half-dozen drew $25 million or more to support growth in their companies in 2018, including the pay-per-mile insurer Metromile raising $90 million from the likes of Tokio Marine Holdings and Intact Financial Corporation in a Series E round. On the health benefits side of the insurance business, Collective Health also netted $110 million in a Series D round.

About the Data

Venture Scanner defines InsurTechs as companies that build or utilize technology that facilitates the operational procedures of insurance companies or enhances an individual’s ability to purchase and manage their insurance. Examples of company types include insurance comparison sites, insurance infrastructure providers, employee benefits platforms and insurance data/intelligence firms.

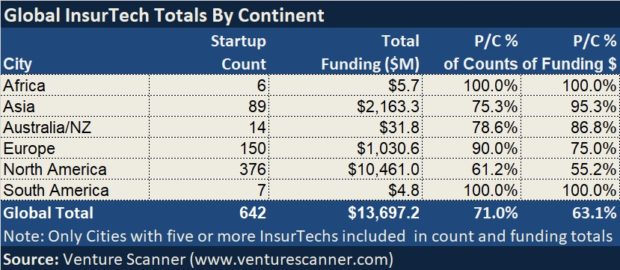

At the date of this writing in late March 2019, the firm had counted 1,537 InsurTechs in 63 countries with total funding of $27.6 billion. For the research provided to Carrier Management, Venture Scanner looked at only those cities that have five or more InsurTechs. Together, as of year-end 2018, there were 642 InsurTechs in those cities, with a total funding of $13.7 billion. That means that nearly 900 others are scattered in cities with four InsurTechs or less, underscoring the fact that insurance technology startups are a worldwide phenomenon.

To tally up funding amounts by region, Venture Scanner captures all publicly known funding events, including all sources (VCs, corporates, PE, etc.) and rounds (early stage, late stage, post IPO equity, etc.), according to Nathan Pacer, Venture Scanner’s co-founder and chief research officer. The vast majority of those funding events (more than 95 percent) occur from 2011 onward, he noted.

Cities are determined by Venture Scanner using each company’s “self-described location,” Pacer said, noting that this generally correlates to their operational headquarters.

For the second straight year, Hartford, Conn.—once widely known as the “Insurance Capital of the World”—did not make either the list of top cities ranked by the number of InsurTechs situated there or the dollars of funding for InsurTechs within each city.

Readers of both this summary of rankings based on Venture Scanner data as of Dec. 31, 2018 and the prior rankings we published in February 2018 may notice that some city count totals or funding totals have moved down slightly, rather than staying the same or increasing. Pacer explained that the unexpected moves can occur for a number of reasons.

“The first driver is that companies move locations from time to time,” he noted. “Maybe they’re growing, maybe rents are increasing (especially true in Palo Alto), maybe they want to be closer to customers.” No matter what the reason, the physical move will drive moves in the city rankings—causing both funding amounts and startup counts to shift between the locations accordingly, he said.

He also noted that there are occasional corrections in known funding amounts that can impact the dollar-based rankings. “Sometimes funding events are announced as complete when in reality only a general agreement has been made. As with any business deal, sometimes they fall apart in the final stages. As we learn about these instances, we update our information,” he said.

Finally, he said that Venture Scanner continuously reviews what it means to be an “InsurTech” company, deciding that some companies no longer meet the definition. This would cause the funding amount and count associated with those companies to go away completely.

The P/C Capitals: London and Palo Alto Reign

Carrier Management editors focused more on the cities whose counts and funding amounts rocketed up then fell down in 2018, investigating what caused the moves. Notably, for example, the $640 million funding boost coming to New York’s InsurTechs was highly concentrated in two companies, Oscar Health and Justworks, in the health and employee benefits spaces. Similarly, an increase in the number of InsurTechs identified in Minneapolis moved the city onto the top 20 list, and a comparable spurt in Boston moved Beantown into the top five ranking based on startup counts—but neither city boasts a high percentage of InsurTechs devoted to the property/casualty insurance business.

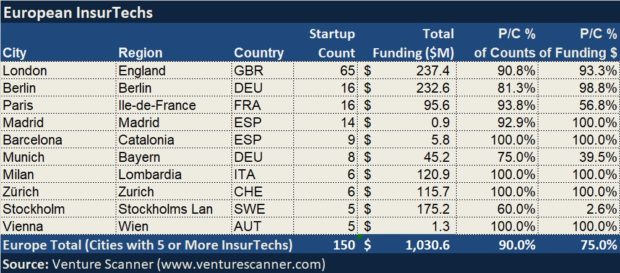

With an eye toward determining which of the cities ranked on Venture Scanner’s lists is the P/C InsurTech capital of the world, Carrier Managementanalyzed underlying data for the 642 individual InsurTechs ranked on both lists to eliminate companies devoted exclusively to life, health or benefits rather than P/C insurance. Based on counts of InsurTechs, London takes the crown in the P/C world.

Fifty-nine London startups—more than 90 percent of the total counted by Venture Scanner in London—have some ties to P/C insurance based on Carrier Management’s reading of descriptions on the individual company websites. For all locations around the world, including London, however, determining the type of insurance that each technology firm serves turned out to be a challenge. Particularly for companies delivering infrastructure and back-end services, user acquisition technology, or data and artificial intelligence, many websites fail to make any reference to insurance type—an indication perhaps that InsurTech executives see little need for line of business or even life vs. non-life policy distinctions.

In situations where distinctions are not made in company marketing materials or where a company’s technology serves insurers or customers of life, health or benefits as well as P/C, we have included the company in our P/C rankings. Even with that expansion of our definition, only about two-thirds of New York InsurTechs might classify as P/C InsurTechs, in contrast to London’s 90 percent. In Boston, the proportion is a little better than New York at about three-quarters. In Minneapolis, only 20 percent are included on the P/C InsurTech list.

What’s true for New York, Boston and Minneapolis is true for a lot of North American cities. And what’s true for London plays out in the rest of Europe. P/C InsurTechs dominate InsurTech populations in cities outside of North America. An accompanying summary of “Global InsurTechs by Continent” and a second summary of “European InsurTechs” shows the P/C percentages of counts and funding in the two right-hand columns.

More Information

A chart similar to the accompanying European InsurTechs, showing InsurTech counts, funding levels and P/C percentages for each city in North America, is available in the online version of this article.

In addition to the question of which cities rank highest among P/C InsurTechs, Carrier Management editors set out to examine several other questions in our previous analysis: Why do cities with small numbers of startups—like Shanghai and Palo Alto—have such large total funding amounts? Why does London have a low funding level compared to New York and San Francisco with similarly high startup counts? See the article titled “Where Is the InsurTech Capital of the World?” for information on these topics.

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  10 Do’s and Don’ts of a Smart ORSA Report

10 Do’s and Don’ts of a Smart ORSA Report  Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly