The world economy should brace itself for a slowing of stimulus by the Federal Reserve if history is any guide.

Any tapering in the Fed’s $85 billion-a-month asset- purchasing program will hurt economies in Europe and Asia, where the focus remains on loose monetary policy, Stephen L. Jen and Joana Freire of London-based hedge fund SLJ Macro Partners LLP wrote in a June 10 report. This decoupling would particularly strike emerging markets, which previously served as magnets for capital as the Fed kept monetary policy looser than their central banks did.

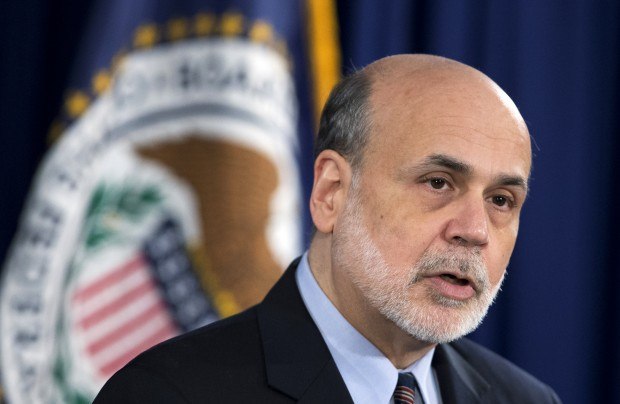

U.S. equities have outperformed those in the rest of the world since May 22, when Fed Chairman Ben S. Bernanke said the Fed “could” scale back stimulus efforts if the employment outlook shows “sustainable improvement.”

While the Standard & Poor’s 500 Index is down 1.1 percent so far this month, the Nikkei 225 Stock Average has dropped 9.7 percent and the Euro Stoxx 50 Index has fallen 5.3 percent. The MSCI Emerging Markets Index has declined 6.9 percent.

“The Fed devises policies for the sole benefit of the U.S.,” according to Freire and Jen, a former International Monetary Fund economist who also has worked at the Fed. “Just as it did not show much care about the possible negative side effects of its quantitative easing operations, when the time comes for the Fed to start tapering, it will not likely care about the negative side effects on the rest of the world.”

Premature End?

The SLJ report is one of a spate of studies in recent days from Deutsche Bank AG to Citigroup Inc. aimed at examining the potential international impact of any decision by the Fed to pull back its bond-buying. About $2.7 trillion has been wiped from the value of global equities since Bernanke’s testimony, even though he also said ending stimulus prematurely would endanger the economic recovery.

Just as the Fed’s stimulus reinforced upswings in economies such as Brazil’s and drew talk of a “currency war,” any reeling-in of it will augment their slowdowns, said Jen and Freire. They pointed to South Africa, India and Turkey as the most at risk of “sudden stops” in capital.

“If we see U.S. bond yields rising further and more and more people thinking about the Fed’s tapering, you’re going to see some further reaction in many, many emerging markets where there’s current-account deficits,” Jim O’Neill, former chairman of Goldman Sachs Asset Management, told Bloomberg Television on June 11.

Indebted Countries

The Washington-based World Bank said in a report released yesterday that the withdrawal of accommodative policies may have longer-run consequences as rates in developing nations rise more than in their industrial counterparts, slowing investment and growth. Countries with high debt levels such as Egypt and Pakistan could be in particular jeopardy.

Global stocks tumbled today following the release of the report. Emerging markets from Brazil to India and Indonesia have already acted this week to stem outflows of capital.

Not all are worried. Bank of Israel Governor Stanley Fischer told reporters in London late yesterday that he was “happy to see” higher U.S. bond yields because they helped diminish the allure of assets in emerging markets and reduce the temptation for central banks to engage in competitive devaluations.

It would not be the first time such money flows have been thrown into reverse by changes in U.S. monetary policy or a rising dollar, according to SLJ.

Latin Debt

The Latin American turmoil of the 1980s followed an increase in that region’s foreign debt to $150 billion in 1978 from $29 billion in 1970 as U.S. banks expanded internationally and higher oil prices then fueled further investment in emerging markets. A combination of a rising dollar and higher U.S. interest rates under Fed Chairman Paul Volcker then triggered a balance of payments crisis: Capital inflows fell to $1.5 billion in 1985 from $58 billion in 1981, leading 27 countries to restructure their debts.

The Fed’s rate hikes of 1994 also surprised markets and hurt Mexico, which received inflows totaling 7 percent of gross domestic product in 1993 alone. Later that decade, a surge in the dollar after 1995 hit Asian economies such as South Korea’s whose currencies were effectively pegged to the dollar.

The risk is of a ripple effect as investors decide even a slowing of monetary aid paves the way to an eventual increase in the benchmark U.S. interest rate from near zero. That is already prompting investors to re-price risk and adjust their portfolios.

Bond Yields

The effect may be greater outside the U.S. than within it. A report published yesterday by Citigroup currency strategist Steven Englander showed 10-year bond yields have gained about 83 basis points on average in emerging markets since May 1 and 29 basis points in developed economies. The interest rate on the 10-year Treasury note has risen about 30 basis points, he said.

“The paradox is that the run-up in U.S. interest rates, which is arguably the primary driver of these global rate increases, is well below the average and median globally,” said Englander in New York.

That suggests to him that while improvements in the U.S. economy may eventually justify stricter credit, about 80 percent of the world has already experienced a tightening in market interest rates that was “neither expected nor desired.”

Still, Jim Reid, head of fundamental strategy at Deutsche Bank in London, told clients yesterday that the Fed may be more of a global citizen than it was in the past.

‘Very Careful’

“The recent bout of emerging-market weakness will force the Fed to be very careful about tapering,” Reid said in a note to clients. “The Fed has assumed responsibilities beyond the U.S. economy over recent years and they will surely have to consider the impact their actions will have on the global economy and asset prices.”

Credit Suisse Group AG equity strategists led by Andrew Garthwaite in London also say there is too much pessimism over tapering. They raised their year-end target for the S&P 500 to 1,730 on June 5 from their previous estimate of 1,640 and yesterday’s 1,612.52. They predict it will climb to 1,900 by the end of next year.

Among their reasons: Even if the Fed slows its support, central banks globally will have expanded their balance sheets by 27 percent from the end of March 2012 through 2014.

Markets didn’t peak until six to seven weeks after the Fed ended its first two rounds of quantitative easing, in March 2010 and June 2011. That means a monetary policy-related correction in equities isn’t likely until the second half of 2014, the strategists said.

With assistance from Joshua Zumbrun, Jeff Kearns and Sandrine Rastello in Washington, Chris Anstey in Tokyo, Alexis Xydias, Andrew Rummer and Maria Levitov in London, Alisa Odenheimer in Jerusalem and Liz Capo McCormick in New York. Editors: Anne Swardson, Brendan Murray

Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  Preparing for an AI Native Future

Preparing for an AI Native Future