Two senior Federal Reserve officials on Tuesday played down the chances that the U.S. central bank would signal a readiness to reduce its bond buying at its meeting next month, dampening speculation the Fed’s ultra-easy monetary policy might end soon.

New York Federal Reserve Bank President William Dudley and St. Louis Fed chief James Bullard, both of whom will vote at the June 18-19 meeting, made clear further economic progress was needed before they would support curtailing bond purchases.

Wall Street stocks rallied, with both the Dow Jones industrial average and Standard & Poor’s 500 Index closing at new all-time highs after their remarks eased investor concerns that the Fed would reduce its stimulus of the economy.

“Inflation is pretty low in the U.S.,” Bullard told reporters after delivering a lecture in Frankfurt. “I can’t envision a good case to be made for tapering unless the inflation situation turns around and we are more confident than we are today that inflation is going to move back toward target,” he said.

A core inflation gauge closely monitored by the Fed slowed to just 1.1 percent per annum in March, barely half the central bank’s long-term 2.0 percent annual inflation goal. In addition, the U.S. jobless rate stood at a lofty 7.5 percent in April.

The U.S. central bank has a dual mandate for price stability and maximum sustainable employment.

MARKET MOVER

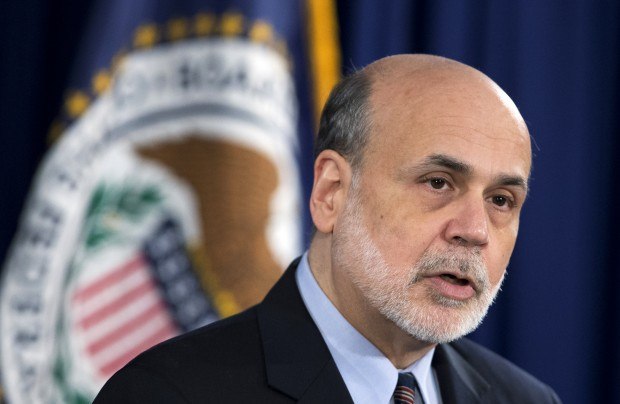

In addition to boosting stocks, the U.S. dollar softened and prices for U.S. government debt moved higher on Bullard’s remarks, and were given a further lift by Dudley, a close ally of Fed Chairman Ben Bernanke who said the central bank’s asset purchases could go up as well as down.

Furthermore, underscoring the significant communication challenge the Fed faces if they alter the bond buying program, Dudley cautioned that investors could over-react to the first adjustment in the pace of asset purchases.

Since cutting policy interest rates to almost zero in late 2008, the Fed has more than tripled the size of its balance sheet via a campaign of massive bond purchases to hold down long-term borrowing costs and spur corporate hiring.

It decided on May 1 to keep buying at an $85 billion monthly pace, and many economists say mixed economic data warrants keeping up the purchases through year-end.

But persistent warnings from more hawkish Fed officials had fanned talk that it might start to wind back soon.

Bullard, who has been a reliable centrist in his policy votes, made clear that he did not share this view.

“I do think we should be willing and ready to change the pace of purchases when the time comes but I don’t think we are there yet,” he said.

Bernanke could provide more clues on the Fed’s next step in testimony to the U.S. congressional Joint Economic Committee on Wednesday at 10 a.m. (1400 GMT). His remarks will be followed by the release at 2.00 p.m. (1800 GMT) of minutes of the last Fed meeting, which economists expect to give further details of how it will eventually manage the exit from ultra-easy policy.

BERNANKE ALLY

Dudley told the Japan Society in New York on Tuesday that he could not be sure whether policymakers would next reduce or increase the amount of purchases due to the “uncertain” economic outlook.

After its last meeting, the Fed said it was prepared to shift its bond buying in either direction as economic conditions warranted, and Dudley’s remarks signaled that the Fed was aiming to preserve its flexibility.

Echoing past comments by both himself and Bernanke, he said the Fed might adjust the pace of bond purchases as the outlooks for inflation and the labor market change “in a material way.”

While tighter fiscal policy has crimped the production, job growth, the retail sector and housing have remained surprisingly resilient.

“At some point, I expect to see sufficient evidence to make me more confident about the prospect for substantial improvement in the labor market outlook,” Dudley said. “At that time, in my view, it will be appropriate to reduce the pace at which we are adding accommodation through asset purchases.”

The Fed has said it will continue to buy bonds until the outlook for the job market has “improved substantially.”

Dudley said the Fed would monitor the impact of fiscal drag as it weighed on policy. Economists say it likely will not be possible until at least until the third quarter to determine how big a blow belt-tightening in Washington has dealt the economy.

In a possible peak at Fed thinking on how it will eventually trim back the size of its balance sheet, Dudley also said the Fed could adjust its two-year old plan for reducing the balance sheet in the years ahead, calling parts of it “stale.”

“To the extent that the committee wants to reduce the risk of disrupting market functioning during normalization, it could decide to indicate that it will avoid selling the MBS (mortgage-backed securities) portfolio during the early stages of the normalization process,” he said.

“Moreover, to the extent that the committee wants to mitigate the risk of a sharp increase in long-term rates, it could judge that it would prefer not to commit to agency MBS sales.”

(Additional reporting by Eva Kuehnen, writing by Alister Bull; Editing by Chizu Nomiyama)

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec  Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  Why Claims AI Build vs. Buy Decisions So Often Miss the Mark

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage