“Sustainable value creators” among the 100 largest property/casualty insurance carriers generated more value through underwriting than through investment activities over a 20-year study period, according to a new analysis from ACORD.

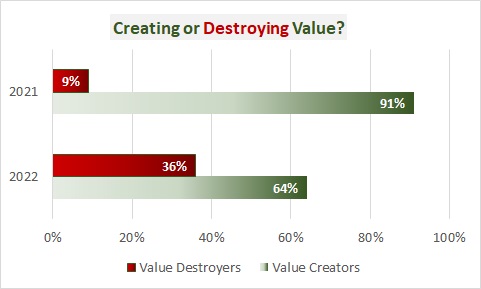

In addition, in a marked shift from a similar study published in February 2021 when ACORD found that only nine out of 100 insurers destroyed value, the 2022 study revealed that more than one-third—36 percent—were value destroyers.

As was the case in prior studies, ACORD’s “2022 U.S. Property & Casualty Value Creation Study,” released in mid-December last year, identified value creators and value destroyers by determining whether 20-year returns exceeded a prescribed benchmark. Creators exceeded the benchmark over the study period; destroyers did not. (More precisely, the study examined cash flow in excess of a 7.4 percent cost of capital as the measure of value. Related textbox, “Defining Value Creation” below)

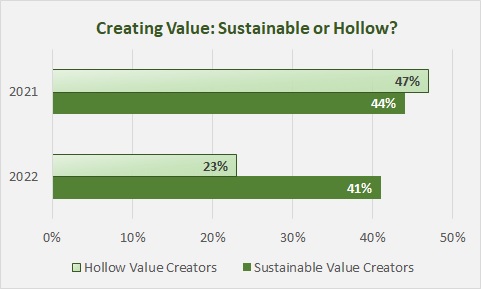

The ACORD analysis breaks the value creators into two categories: sustainable value creators that meet the required return threshold through underwriting and investment activities, and hollow value creators that do so through investment returns only while failing to generate value from underwriting.

“Lower investment returns over the past several months, compared to the average over the 20-year period studied, impacted value generation across the industry, ACORD said in a December 2022 media statement about the latest study. “In a reversal over previous years, sustainable value creators generated more value through underwriting than through investment.”

In addition, carriers that had been designated at hollow value creators in the previous study, sank into the destroyer category this time around. Given the unsustainability of a strategy of relying on investments, some of the previous hollow value creators simply failed to generate adequate value.

Tallying the numbers, while 91 percent of companies were value creators (47 percent hollow and 41 percent sustainable) in the prior study, the figure dropped to 64 percent (41 percent sustainable, 23 percent hollow) in the 2022 analysis.

“These results highlight the risk of relying on investment returns to offset underwriting losses,” said ACORD President and Chief Executive Officer Bill Pieroni in a media statement “In this year’s study, we saw the vulnerability of hollow value creators to market fluctuations. This inevitable volatility of investment returns illustrates the peril of relying solely on investment-based value creation—it is not sustainable. It is necessary to generate value through underwriting as well.”

In addition, ACORD’s research revealed:

- The largest carriers tended to generate more sustainable value in the U.S. P/C market. “This is likely the result of being able to devote resources to consistent development and renewal of digital capabilities over the long term,” ACORD said.

- Carriers with the highest levels of digital capabilities (based on another ACORD analysis, the annual ACORD Insurance Digital Maturity study) are all sustainable value creators.

- Insurers classified as sustainable value creators, on average, also had the highest levels of employee retention and satisfaction.

- Sustainable value creators achieved an 11.8 percent on capital.

- Sustainable value creators have roughly half of their insurance portfolios in personal lines and half in commercial. The business mix of hollow value creators tilts more heavily toward commercial lines (58 percent commercial vs. 42 percent personal), while value destroyers had the opposite mix (58 percent personal vs. 42 percent commercial).

- There is roughly a 5 point difference between the all lines P/C loss and loss adjustment expense ratios of sustainable value creators (70.1) as compared to either hollow value creators (75.5) or value destroyers (75.4).

- On the underwriting expense side, sustainable value creators’ expense ratios averaging 25.0 are 3-4 points better than hollow creators (28.8) and destroyers (28.0).

The ACORD report also identified three “value levers” that keep the sustainable value creators ahead of the pack. In underwriting, these carriers leverage data and analytics to target and retain the right customers, and they are heavy uses of technology and automation augmenting human tasks for claims management. In addition, they optimize customer lifetime value, with an average of two products per customers (and some averaging five or more) vs. a 1.2 product per household average across the P/C personal lines industry.

Concluding the report with a recommended path to sustainable value creation, ACORD highlights aspects of strategy, execution excellence, as well as talent and culture, in addition to suggesting that sustainable value creators leverage the benefits of ACORD’s main activity—setting global data standards for the insurance and related financial services industries.

Describing the “execution excellence” component of the value path, the report highlights the idea that the sustainable value creators are “deliberate and focused” in the lines of business they underwrite. In addition, “they overpaid their distribution partners and underpaid claims and LAE costs,” the report said.

***

Related articles:

- By the Numbers: Highlights of ACORD U.S. P&C Value Creation Study (2021)

- Digital Maturity: The Path to Sustainable Value Creation

- Truly Transformative Tech: Hype vs. Results

- How ‘Intelligent’ Insurers Grow and Create Value: ACORD Study (2019)

- ACORD Study Results: Loser Lessons (2019)

- Why E&S Carriers Aren’t Winners Over the Long Term (2019)

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation  Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market