Allianz is the only global insurance organization that ranks among the top 50 most valuable brands in the world, but even the German company failed to garner the highest brand rating of AAA+ awarded by a consultancy, according to a report published earlier this month.

Allianz is the only global insurance organization that ranks among the top 50 most valuable brands in the world, but even the German company failed to garner the highest brand rating of AAA+ awarded by a consultancy, according to a report published earlier this month.

The valuations and ratings published by Brand Finance, a London-based brand valuation and strategy consulting firm, put Allianz in 43rd place in a ranking of all types of companies, with a brand value of $20.9 billion. Sitting on top of a list of insurers ranked by Brand Finance in terms of brand value, Allianz also commands a brand rating of AA.

China Life Insurance and Ping An, ranked third and fourth in brand value among global insurers, moved closer this year to attaining Brand Finance’s top brand rating of AAA+—a rating held by the likes of Google, Coca-Cola and Walt Disney. Both Asian insurers still fall short of the highest echelon, however, coming in with AAA- ratings from Brand Finance.

Focusing just on insurers, others with property/casualty operations in the top 10 for 2016 include AXA, Generali, Allstate and Zurich. But none of these made the cut into the top 50 of all types of global companies.

The brand values for both Allianz and AXA are less than one-fifth of the value calculated by Brand Finance for the world’s most valuable brand—Apple, which has a value of over $145 billion, according to the firm’s calculations.

Brand Finance does not provide free access to the 2016 brand values it determined for any companies ranked below the top 100 global companies. Ping An, which is actually at the cutoff point of No. 100, was valued at $12.4 billion. (Editor’s Note: Brand values and ratings can be obtained directly from Brand Finance for a fee.)

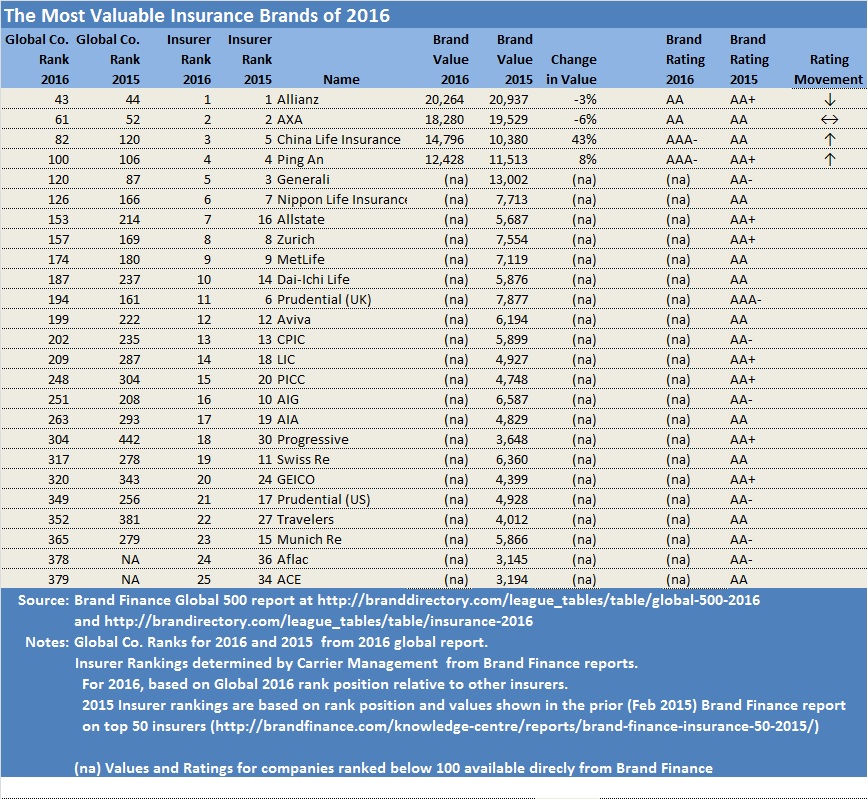

While the values and ratings are not immediately available for most insurers, Brand Finance does indicate where every one of 500 global brands sits relative to other global brands in terms of brand valuation on its website (here), including at least 30 insurers. Above, we have reproduced the 2016 and 2015 rankings of the 25 insurers with the highest 2016 rankings included on Brand Finance’s analysis. In addition to displaying their Brand Finance rank among all types of companies, we have also indicated whether they have moved up or down the charts compared to their peers in the insurance industry.

Falling in the other direction were systemically important global insurers American International Group and Prudential and global reinsurers Swiss Re and Munich Re.

How Does Brand Finance Determine These Values and Ratings?

The Brand Finance Global 500 report details a complex calculation of “brand value,” described in simple terms as the net present value of the estimated future cash flows attributable to the brand.

According to the report, the calculation uses the “Royalty Relief methodology,” determining the value a company would have to pay to license its brand if it were not already owned.”

A starting point of the calculation of a brand value (and also the determination of a brand rating) is a “Brand Strength Index” ranging from 0 to 100. According to Brand Finance, this BSI is calculated “using a balanced scorecard of a number of relevant attributes such as emotional connection, financial performance and sustainability, among others.”

“Brand strength is the part of our analysis most directly and easily influenced by those responsible for marketing and brand management,” the report says, noting that factors like “marketing investment, brand equity (the goodwill accumulated with customers, staff and other stakeholders) and finally the impact of those on business performance” are analyzed.

The brand ratings, in turn, are derived from the BSIs. Describing the ratings as conceptually similar to a credit rating, the ratings are benchmarks of the strength, risk and future potential of a brand relative to its competitors on a scale ranging from D to AAA, the report says. An AAA+ is “extremely strong,” while AA and A ratings denote “very strong” and “strong” brands.

Powerful Brands: If Only Insurers Made a Movie

While none of the four insurers listed in the top 100 had ratings lower than AA, the fact that none of them garnered a AAA+ rating means that Brand Finance doesn’t view any of them as “powerful brands.”

Less than a dozen companies, with BSIs ranging from 89.5 to 91.5, have the AAA+ ratings that put them in the “power” group. At the top of the heap this year is Disney, according to Brand Finance. Disney overtook Lego this year, and Brand Finance attributes Disney’s power, in part, to the record-breaking success of the movie “Star Wars Episode VII: The Force Awakens.”

When Brand Finance crowned Lego the most powerful brand in 2015, the consultancy also attributed the brand strength to the success of a movie—”The Lego Movie”—and, in part, to Lego Star Wars, a successful video game franchise.

But Disney’s distinction as the most powerful brand isn’t just about movies and Star Wars. More to the point, the Brand Finance report says: “Disney’s brand strength is founded on its rich history and original, classic characters of Mickey Mouse and friends…However, its now dominant position is the result of its many acquisitions and the powerful brands it has brought under its roof.”

Lucasfilm is just one of those acquisitions. Other powerful brands now under Disney’s control are ESPN, Pixar, The Muppets and Marvel, Brand Finance reports.

As for Lego, Brand Finance says that while it still has a AAA+ brand rating, “the Danish company has been beset by a series of controversies of late which threaten to affect its wholesome image. It has been fined by German regulators for attempting to prevent retailers from discounting its products. It was also accused of colluding in censorship for trying to prevent dissident Chinese artist Ai Wei Wei from using Lego in his work.”

Tech, Chinese Companies Top Value Growers

Brand strength/power is only the initial part of Brand Finance’s analysis. Using its Brand Strength Index assessment, Brand Finance determines a royalty rate for each brand, which is then applied to revenue information to calculate the brand’s value.

In terms of brand value, Apple rules, and four of the top five brands in terms of valuation are technology companies. (The fifth, online retailer Amazon.com, is also partly a technology company.)

Brand Finance also notes that Apple and Google saw their brand values grow more than $17 billion from 2015 to 2016, while Amazon.com’s brand value grew by $13 billion. Not far behind, in terms of value sprints, were four China-based companies—Agricultural Bank of China, CSCEC (China State Construction Engineering Corp.), China Construction Bank, and ICBC Industrial and Commercial Bank of China Ltd.—each seeing their Brand Finance valuations jump about $9 billion.

In percentage terms, Evergrande Real, a Chinese property developer, was the fastest-growing brand this year, soaring 112 percent by Brand Finance’s calculation.

The report also makes special note of Chinese technology companies, such as WeChat. WeChat—described in the report as a messaging app (similar to WhatsApp in the West) that also offers video-gaming and payment services—has over 650 million users, with 70 million outside China. The tech company saw its brand value vault to $6.5 billion, an 83 percent, Brand Finance reports.

Related Carrier Management Videos on Brand Building

What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford