Cyber insurance and professional liability were the only clear outliers in a picture of softening primary insurance prices that now includes casualty lines, a broker report revealed last week.

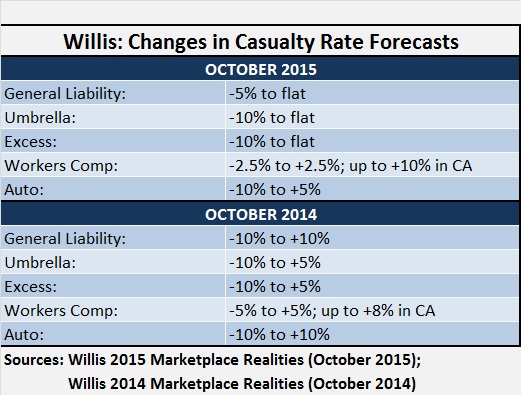

In its 2016 Marketplace Realities report published on Oct. 22, Willis Group Holdings plc said that primary casualty rates are falling for most buyers for the first time in the current soft market, predicting further dips ahead in 2016.

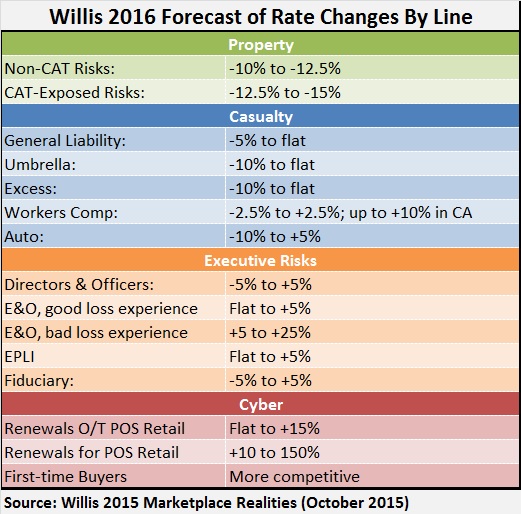

Relatively benign losses and an oversupply of capacity from traditional and nontraditional sources are fueling current marketplace conditions, the broker said, predicting drops of up to 5 percent for general liability and up to 10 percent for umbrella/excess next year. For workers compensation, Willis predicts a mix of low-single-digit increases or decreases next year.

Certain states, like California, will see workers comp rate hikes up to 10 percent. But for cyber and E&O insurance, prices may jump even more.

“The steadily growing threat of cyber intrusion and data theft is sending rates upward—as much as 150 percent for retailers with POS (point-of-sale) exposures,” Willis said, noting that the low end of a range of rate hikes for such retailers comes in at 10 percent. In contrast, in Willis’s 2015 Marketplace Realities report last year, the range of price predictions extended from flat pricing to hikes of up to just 20 percent for POS retailers.

Speaking at the Advisen Cyber Risk Insights conference last week, two days before the report was released, Willis Executive Vice President Peter Foster characterized the cyber market as a “hardening market.”

“I don’t think we’re in a hard market,” he told attendees that included risk managers, as well as broker and carrier representatives specializing in cyber.

Foster had a special message, which seemed to be specifically aimed at carriers, delivered by quoting American folk singer Bob Dylan. “The loser now will be later to win,” Foster said, borrowing a line from Dylan’s “The Times They are A-Changin.”

“You’re going to have some losses today, [but] you’re going to be able to get through this. It’s going to make you stronger,” he said, extending his remarks to others in the room. “Whether you’re a risk manager or an underwriter, you’re going to have losses. We have to help you manage them.”

Foster continued: “You’re going through this now, but over time it’s going to benefit you. The fact that you’re going to stay in this market and work in this market and continue to build this market—you will be paid back handsomely in the end.”

Noting that he has worked through hard markets before, he said, “I don’t see this as a hard market. I see things changing…We’re all running in order to figure it all out”—with carriers not wanting to put out too much limit and to price the products right while brokers want clients to have enough coverage in place.

“This will eventually cool down. We’re going to come out of this stronger [because] of our relationships,” he said, urging risk managers, brokers and carriers in the room to use the Advisen event as a networking opportunity to strengthen relationships.

“As I build towers over the last year after Home Depot,…I turn to my relationships” with carriers, he said, noting that he has brought premium to those carriers with whom he has developed relationships over many years, relying on them when it’s tough for Willis to place a risk.

The Market Realities report offers these observations about the cyber insurance line:

- Excess cyber losses have caused a few markets to stop writing large accounts; others are increase their premiums significantly in upper layers of $75 million-plus placements.

- Even with the reduction in capacity by some carriers, available limits in the marketplace are approximately $350-$400 million.

- Capital markets are reviewing cyber to determine if they can provide additional relief.

- Underwriting requirements continue to rise; requirements can include conference calls with third-party security experts.

- Insurers are also increasing retentions and exiting certain sectors.

- Despite renewal increases, carriers are still encouraging adoption of the coverage.

- First-time buyers (except for POS retailers and large health care organizations) will continue to see a marketplace with favorable terms, conditions and pricing, though not as favorable as in the past, given the shifting competitive environment and paid losses.

Consolidation: A Challenge

While most lines are softer than Willis predicted a year ago, the overall message of Willis’s announcement about the latest report was focused more on challenges—and choices—for buyers and their representatives in the broker community.

In introductory comments, Matt Keeping, Willis North America’s chief broking officer highlighted particular challenges resulting from industry consolidation.

“In the short run, consolidation shrinks the market. As two companies become one, the marketplace offers one less piece with which to solve the puzzle of an insurance program. Our carrier trading partners would like us to believe 1+1 = 2, but historically this has not borne out on either side of the equation,” he said.

Still, Keeping went on to note that “a smaller market with fewer, larger players also opens up the field to newcomers that can focus on smaller, specialized niches in areas of potential growth.”

In other words, “consolidation often yields its opposite by thinning the competition and encouraging the emergence of new puzzle pieces,” he concluded.

Other Lines

Willis offered these takeaways in predicting what’s ahead for other lines in 2016:

- Property rates will continue to fall, according to Willis experts, although drops will be slightly less steep than they have been. The reason: Since rates have fallen for several renewal cycles, they do not have much room to drop further.

- For commercial auto rates, most buyers can expect decreases of up to 10 percent, although less attractive risks may see low-single-digit increases.

- Airline insurance is now forecast to fall by 15-20 percent—an accelerated softening, as the industry has absorbed the major losses of 2014 and the sector remains attractive to insurers. Political risk insurance buyers facing small increases earlier in 2014 and the first half of 2015 are more likely to see rates fall, again a result of insurers competing for market share.

- In the executive risk lines, buyers will continue to find a mix of modest increases and decreases.

The chart below summarizes the ups and downs of the market for next year.

The Marketplace Realities publication is available on the Publications page of the Willis website, www.willis.com/What_We_Think/Publications/

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs  Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook