In a market report predicting that property insurance rates will decline further while casualty rates are sliding down too, broker Willis suggests that a mega-loss event won’t turn the market, but instead might weaken prices even more.

The 2015 Marketplace Realities Report released earlier this week has generally good news for buyers of insurance. Sellers, on the other side of each insurance transaction, will be saddled with lower-priced offerings if no big event happens—and even if one does, the report suggests.

In a cover note at the front of the report, Willis North America Chief Placement Officer Matt Keeping suggests that the conventional wisdom that says a harder market prevails after a large disaster is flawed in an environment where new capacity is “eager and steady.” This new capacity will not withdraw from the market after a big event. Anticipating a potential post-event rise in rates, “more capacity might come in,” he writes.

“This could very well counter the withdrawal of capacity by insurers paying out mega claims for the mega loss, and rates would continue to decline.”

“$100 billion isn’t what it used to be in today’s massive global insurance environment,” he wrote. The $100 billion figure is a reference to an article published by Reuters in August, quoting Zurich’s general insurance chief Michael Kerner, who said the industry can handle a $100 billion event—paying all claims, without facing any solvency issue (Reuters, Aug. 15, 2014, “Insurers can withstand $100 billion natural catastrophe: Zurich”).

Keeping notes that the $100-billion event will not change the supply and demand curves of insurance.

And with lower levels of losses—similar to those of the past two years—prices are headed straight down. “We could be at the edge of a cliff, possibly standing with one foot over the edge,” he writes.

In the current market, even terrorism coverage is experiencing downward pricing pressure, with Willis predicting terror prices coming in flat or dropping as much as 5 percent, assuming renewal of the Terrorism Risk Insurance Program Reauthorization Act. Without the renewal, terror prices could rise in the 5-15 percent range, the new Willis report says, but this is below the increases of 10-25 percent forecast in the April 2014 edition of the semiannual Willis report.

“The absence of major terrorism losses in the West and abundant capacity exerted stronger downward pressure than anticipated.

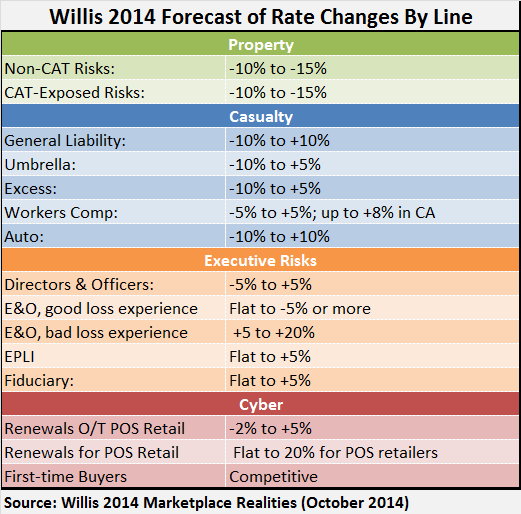

Price predictions for the next six months are set forth below for other lines:

Summarizing the predictions in a video introduction accompanying the October report on the Willis website, Keeping notes that Willis is predicting flat to negative pricing for 60 percent of the lines of business surveyed. In contrast in October 2013, the situation was reversed, with 60 percent forecast to have flat or increasing pricing.

While Keeping notes that key drivers of the downward trend are in the property and property terrorism segments, which “insurers are chasing” due to the short-tail nature of the business, changes are evident of casualty lines.

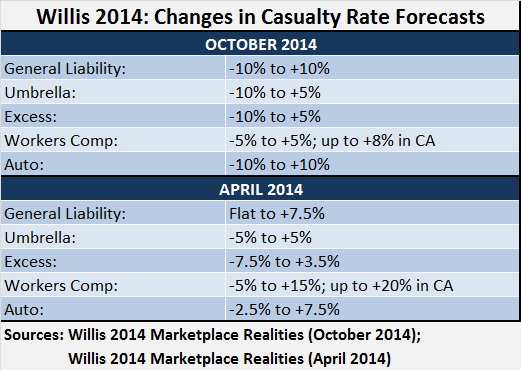

The chart below summarizes the casualty predictions in Willis April 2014 and October 2014, showing general liability, for example, formerly flat on the low end of the price range now seen a declining as much as 10 percent.

Even California workers compensation, where high-end price increases were up at 20 percent in the April forecast, the level has come down to 8 percent.

“Several states remain challenging workers compensation environments: New York, Massachusetts, Pennsylvania, Illinois and California. That said, California rate increases are at their lowest levels in years and 15 states have applied for rate reductions,” the report says, noting that carriers continue to fine tune their state-specific appetites in comp.

At the same time, the latest Willis report also suggests that hedge fund capital may be taking an interest in workers compensation.

“Despite several leading carriers moving away from the line, the hedge funds see predictability and profits, even if one of the predicable aspects of workers compensation is that 15-20 percent of the loss cases can last the life span of the injured employees.”

“Part of the hedge fund interest is in ancillary services associated with workers compensation and managing of the claims,” the report says.

From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage  The Future of HR Is AI

The Future of HR Is AI  Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits