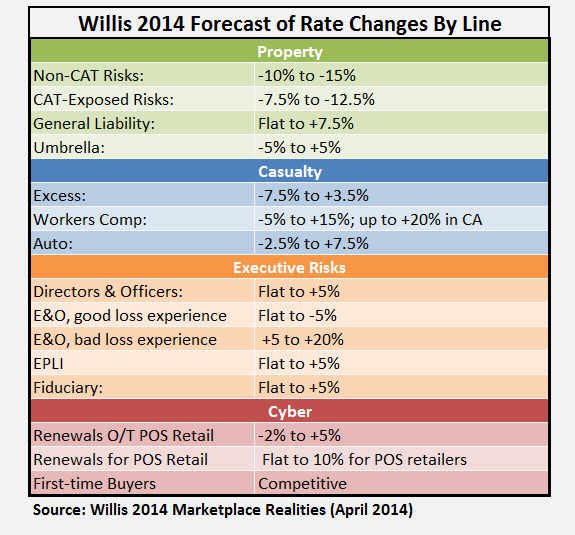

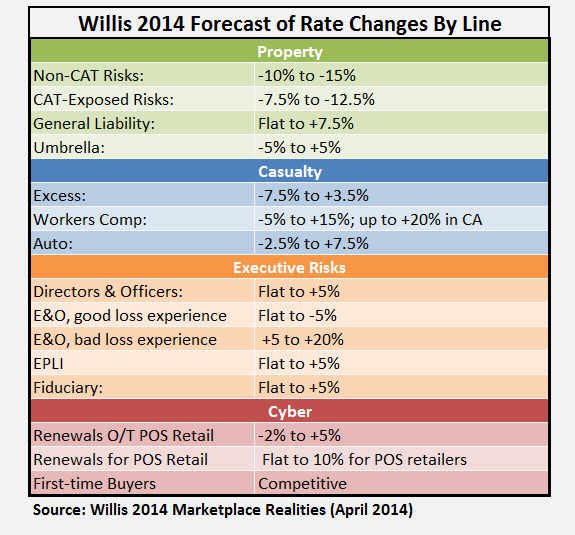

Although double-digit insurance price hikes are still possible in a handful of areas—workers compensation, poor performing professional liability accounts and terrorism coverage—broker Willis expects softer conditions throughout the rest of the commercial insurance market this year.

In the Marketplace Realities report published by Willis Group Holdings plc on Wednesday, the broker and risk advisor signals further softening in the property insurance line and an easing of upward rate pressure on many other insurance lines.

Countering the general downward trend, the report says that external factors, including ongoing uncertainty around the renewal of the federal terrorism insurance backstop, the impact of the health care reform, political instability across some regions of the globe and high profile cyber attacks, are fueling upward movement in select insurance lines.

For commercial property, Willis is predicting a steeper drop in insurance rates that it did in an early 2014 Marketplace Realities forecast in October 2013, now putting declines in the range of 7.5-12.5 percent for risks exposed to catastrophes. The prior forecast range was for 5.0-10.0 percent declines.

Willis expects commercial property rates to fall by an average of 10-15 percent for non-catastrophe-exposed business.

In addition to low levels of catastrophes and ample capacity, Willis listed revised catastrophe modeling as another driver of downward rate pressure.

RMS 13.0, released in July 2013, is now being fully implemented and in many cases is producing lower loss estimates for windstorm, generally in the range of 10-20 percent lower, the Willis report says.

The reports also says that most shared and layered commercial property programs are over-subscribed at the time of binding, giving insureds the upper hand in leveraging aggressive negotiating tactics.

According to Willis, capacity from Chinese insurers, broker facilities and capital markets continues to have an impact. Beyond that, most insurers have additional capacity, and they will make decisions about where to employ it as rates continue dropping in 2014.

For commercial casualty lines, Willis experts are currently seeing mostly single-digit rate increases but occasional decreases on umbrella and excess rates.

For casualty, capacity remains abundant and carriers are redefining appetites. Some are cutting back on workers compensation or raising umbrella attachments to improve profitability; others are aggressively underwriting to grow market share, the report reveals.

Workers compensation rates are forecast to change within a wider band than almost any other coverage reviewed in the Willis report, with potential rate declines of up to 5 percent on one end and possible rate hikes of up to 15 percent on the high end.

Greater increases will come in states such as California, the report says.

For workers comp, the Willis report highlights the impact of two area of uncertainty— the renewal of the federal terrorism insurance backstop (TRIPRA) and the impact of the Affordable Care Act.

The TRIPRA renewal question is creating challenges for some risks with employee concentration exposures in the largest U.S. cities. Some carriers are only offering short-term comp policies, which expire with TRIPRA for these locations with the highest exposures.

More broadly, many carriers are using an NCCI endorsement that sets forth an option to change premiums should TRIPRA not be renewed, the report says.

The impact of the Affordable Care Act on workers comp cannot be measured as yet, the report says, but goes on to suggest a possible micro-trend arising from related changes in hiring patterns that is pushing claim frequencies higher in certain industries—and most notably in California.

“As increased frequency will negatively impact an employer’s experience mod, this trend may increase workers comp premium,” the report says.

This workers comp section of the report, authored by Willis North America’s Casualty Practice Leader Pam Ferrandino, restates observations she made along these same lines during the Advisen Casualty Insights conference late last month.

“What we [are] hearing from some of our clients in certain industry sectors [is that], specifically to keep their cost of operations down, they are potentially cutting back on hours” of individual workers, she said. “They’re looking at bringing in more people—more bodies against the same payroll or same number of full time equivalents— and those sectors are seeing a greater increased frequency,” she reported.

In particular, this is happening in the state of California, where frequency in 8 percent higher than the rest of the country. While frequencies are falling in other states, they are moving in the opposite direction in California, she said.

“When we drill down, we actually see specific sectors such as retail, gaming, hospitality, which they have an abundance of in California, where those frequency trends are double-digits in some cases” as result of these shifts in hiring.

“Industries that are moving more jobs to part-time status and hiring more part-time employees are seeing the increases in loss frequency typical with newer employees,” Ferrandino writes in the Marketplace Realities report.

In contrast, in those sectors where clients are not shifting to the utilization of part-time employees are—”where they have decided [it is] more prudent for their business to provide for health care—they’re seeing their frequency continue to go down,” even in California, she said at the conference.

The Willis report also covers several specialty lines, including cyber insurance and management liability coverages, such as directors and officers liability and employment practices liability.

For cyber insurance buyers, Willis expects small rate increases ranging up to 5 percent. While the market is competitive first-time buyers, renewals of existing customers are coming in flat for many buyers. The exception is point-of-sale (POS) retailers, which can expect increases up to 10 percent on renewals in the wake of high-profile cyber breaches in the retail sector.

For the POS retailers, underwriters are considering increasing retentions and premiums, while reducing capacity. At least one market quotes a higher retention for class-action losses, the report says, without identifying the carrier.

For D&O, the Willis report repeats the observations of Aon’s D&O Pricing Index report last month, noting that price-firming momentum on primary D&O placements is easing in 2014 and impact of new entrants looking on primary market dynamics.

The Marketplace Realities series, which is published in the fall and updated every spring, features market snapshots of property, casualty, workers compensation, employee benefits and all executive risks lines, as well as key specialty lines: aerospace, cyber risks, construction, energy (upstream and downstream), environmental, health care professional, kidnap & ransom, marine, political risk, surety, terrorism and trade credit.

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best  Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits  Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered